Answered step by step

Verified Expert Solution

Question

1 Approved Answer

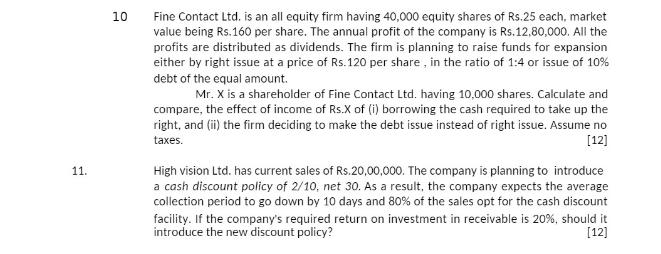

11. 10 Fine Contact Ltd. is an all equity firm having 40,000 equity shares of Rs.25 each, market value being Rs.160 per share. The

11. 10 Fine Contact Ltd. is an all equity firm having 40,000 equity shares of Rs.25 each, market value being Rs.160 per share. The annual profit of the company is Rs.12,80,000. All the profits are distributed as dividends. The firm is planning to raise funds for expansion either by right issue at a price of Rs.120 per share, in the ratio of 1:4 or issue of 10% debt of the equal amount. Mr. X is a shareholder of Fine Contact Ltd. having 10,000 shares. Calculate and compare, the effect of income of Rs.X of (i) borrowing the cash required to take up the right, and (ii) the firm deciding to make the debt issue instead of right issue. Assume no taxes. [12] High vision Ltd. has current sales of Rs.20,00,000. The company is planning to introduce a cash discount policy of 2/10, net 30. As a result, the company expects the average collection period to go down by 10 days and 80% of the sales opt for the cash discount facility. If the company's required return on investment in receivable is 20%, should it introduce the new discount policy? [12]

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

10 To calculate the effect of income for Mr X in the given scenarios lets consider the two options i Borrowing the cash required to take up the right issue Total number of equity shares 40000 Mr Xs nu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started