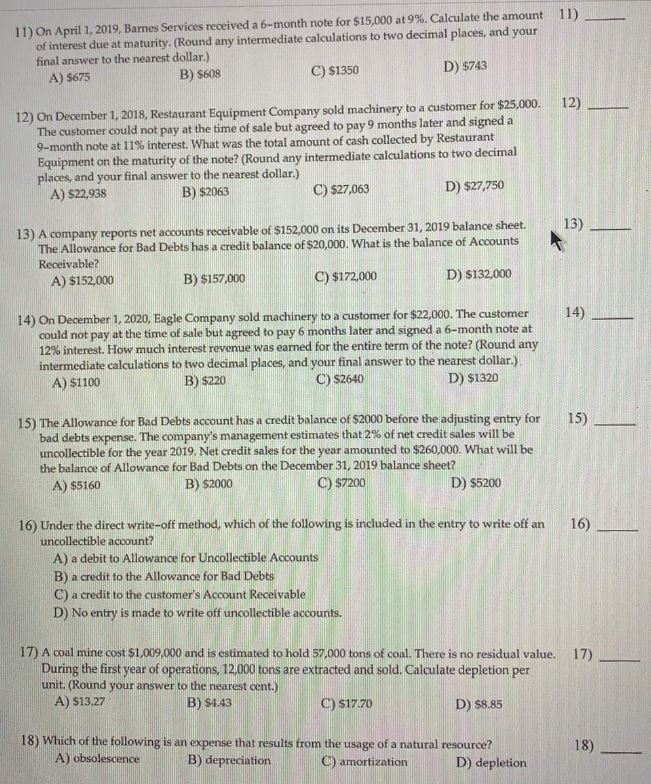

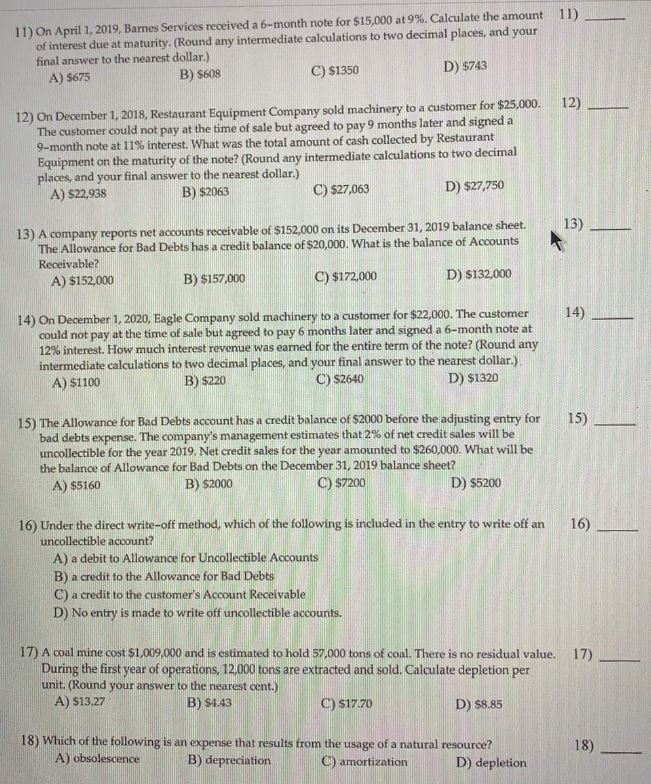

11) 11) On April 1, 2019, Bames Services received a 6-month note for $15,000 at 9%. Calculate the amount of interest due at maturity. (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.) A) $675 B) $608 C) $1350 D) $743 12) 12) On December 1, 2018, Restaurant Equipment Company sold machinery to a customer for $25,000. The customer could not pay at the time of sale but agreed to pay 9 months later and signed a 9-month note at 11% interest. What was the total amount of cash collected by Restaurant Equipment on the maturity of the note? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.) A) $22,938 B) $2063 C) $27,063 D) $27,750 1 3) cheet 13) A company reports net accounts receivable of $152,000 on its December 31, 2019 balance sheet. The Allowance for Bad Debts has a credit balance of $20,000. What is the balance of Accounts Receivable? A) $152,000 B) $157,000 C) $172,000 D) $132,000 14) 14) On December 1, 2020, Eagle Company sold machinery to a customer for $22,000. The customer could not pay at the time of sale but agreed to pay 6 months later and signed a 6-month note at 12% interest. How much interest revenue was earned for the entire term of the note? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.) A) $1100 B) $220 C) $2640 D) $1320 15) 15) The Allowance for Bad Debts account has a credit balance of $2000 before the adjusting entry for bad debts expense. The company's management estimates that 2% of net credit sales will be uncollectible for the year 2019. Net credit sales for the year amounted to $260,000. What will be the balance of Allowance for Bad Debts on the December 31, 2019 balance sheet? A) $5160 B) $2000 C) $7200 D) $5200 16) - 16) Under the direct write-off method, which of the following is included in the entry to write off an uncollectible account? A) a debit to Allowance for Uncollectible Accounts B) a credit to the Allowance for Bad Debts C) a credit to the customer's Account Receivable D) No entry is made to write off uncollectible accounts, 17) 17) A coal mine cost $1,009,000 and is estimated to hola 57.000 tons of coal. There is no residual value. During the first year of operations, 12,000 tons are extracted and sold. Calculate depletion per unit. (Round your answer to the nearest cent.) A) $13.27 B) $1.43 C) $17.70 D) $8.85 18) Which of the following is an expense that results from the usage of a natural resource? A) obsolescence B) depreciation C) amortization D) depletion 18)