1.1

1.2

1.3

last part

please help me with all parts. i will leave a thumbs up, as well as anyone who has similar

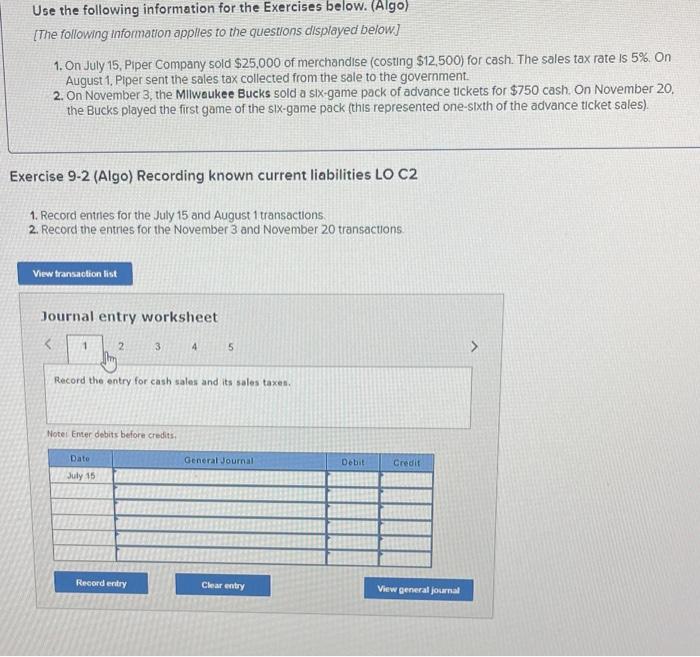

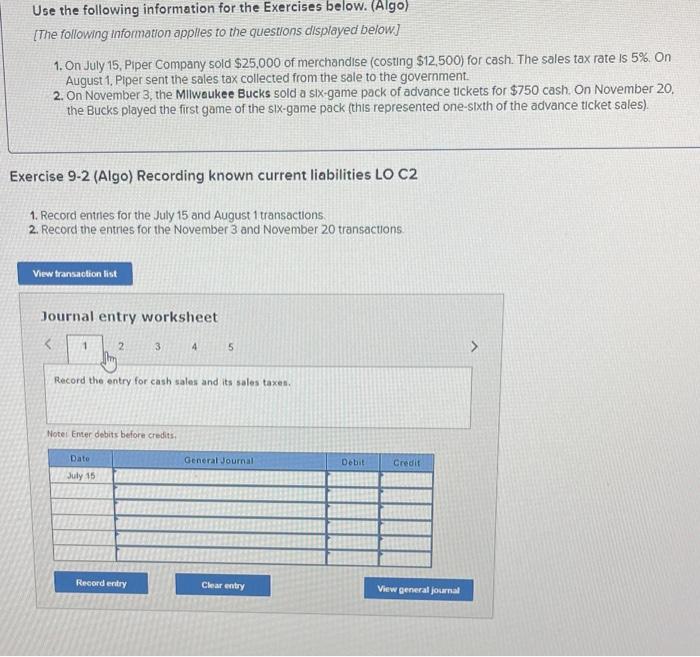

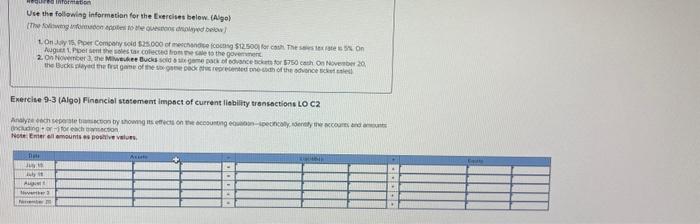

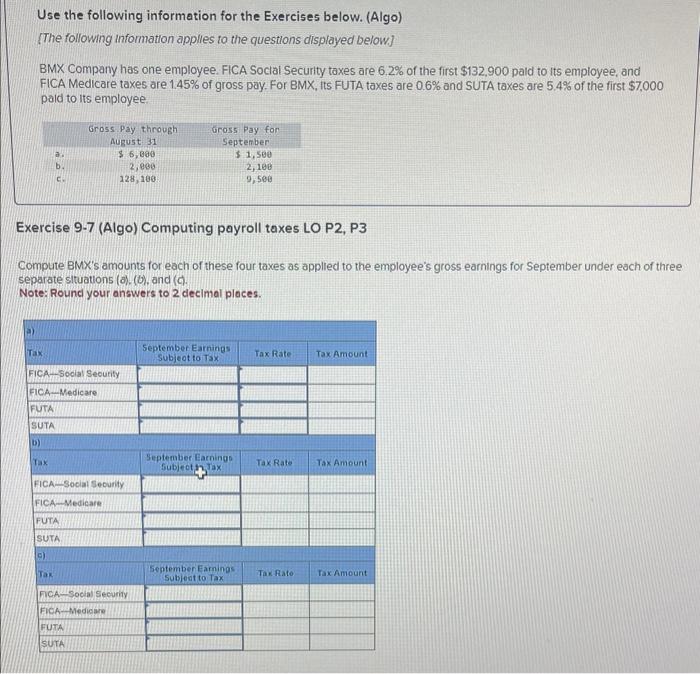

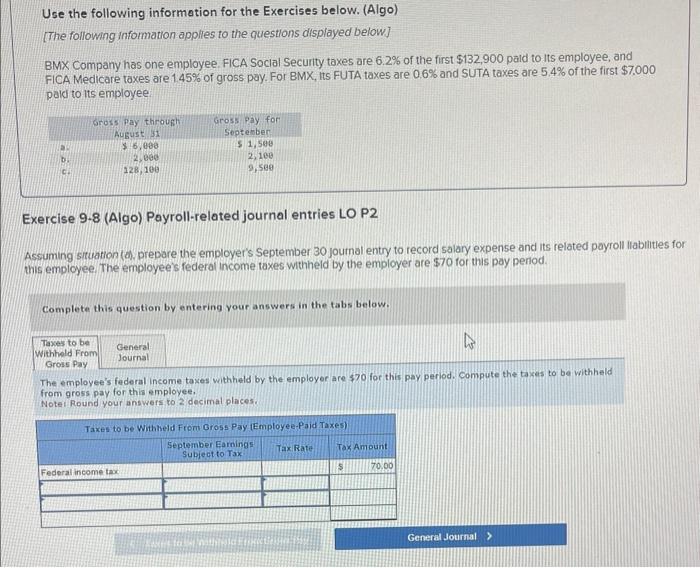

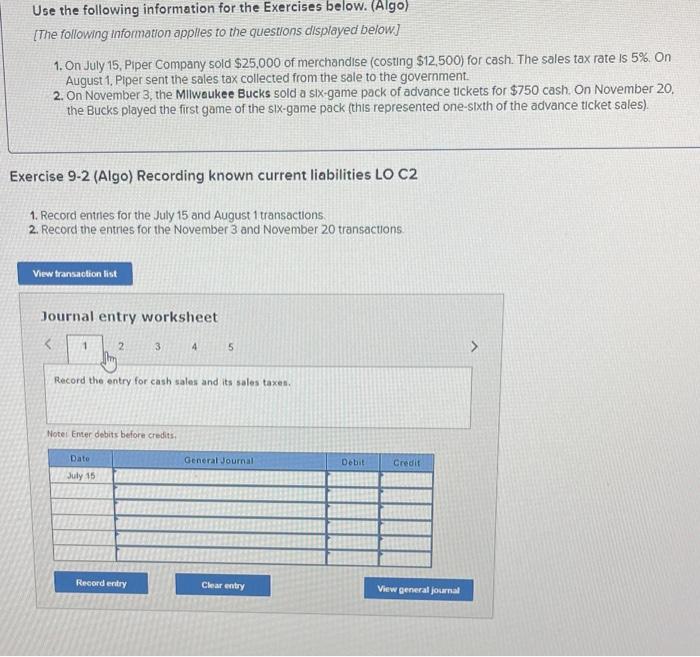

Use the following information for the Exercises below. (Algo) [The following information applles to the questions displayed below] 1. On July 15 , Piper Company sold $25,000 of merchandise (costing $12,500) for cash. The sales tax rate is 5%. On August1. Piper sent the sales tax collected from the sale to the government. 2. On November 3, the Milwoukee Bucks sold a six-game pack of advance tickets for $750 cash. On November 20 . the Bucks played the first game of the six-game pack (this represented one-sixth of the advance ticket sales). Exercise 9-2 (Algo) Recording known current liabilities LO C2 1. Record entries for the July 15 and August 1 transactions. 2. Record the entres for the November 3 and November 20 transactions. Journal entry worksheet a023445 Record the entry for cash sales and its sales taxen. Hotel Emer debits before ciedits. Use the following informetian for the Luerciset below (A)g o) Exercise 9-3 (Algo) Finencisl stotement imphet of current liebility trensections LO C2. West Enier ell emourits es poshive veluns. Use the following information for the Exercises below. (Algo) [The following information applies to the questlons displayed below] BMX Company has one employee. FICA Soctal Security taxes are 6.2% of the first $132,900 pald to lts employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7.000 pald to its employee. Exercise 9-7 (Algo) Computing payroll taxes LO P2, P3 Compute BMX's amounts for each of these four taxes as applled to the employee's gross earnings for September under each of three separate situations (o), (b), and (c). Note: Round your answers to 2 decimal places. Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below] BMX Company has one employee. FICA Soclal Security taxes are 6,2% of the first $132,900 pald to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7.000 pald to its employee: Exercise 9-8 (Algo) Payroll-related journal entries LO P2 Assuming stuation (a), prepare the employer's September 30 joumal entry to record salary expense and its related payroll ilabilities fo this employee. The employee's federal income taxes withheld by the employer are $70 for this pay period. Complete this question by entering your answers in the tabs below. The employee's federal income toxes withineld by the employer are $70 for this pay perlod. Compute the taxes to be with from gross pay for this employee. Notei Round your answers to 2 decimal places