Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11. An investor buys $10,000 worth of a stock priced at $50 per share using 40% initial margin. The broker charges 5% on the margin

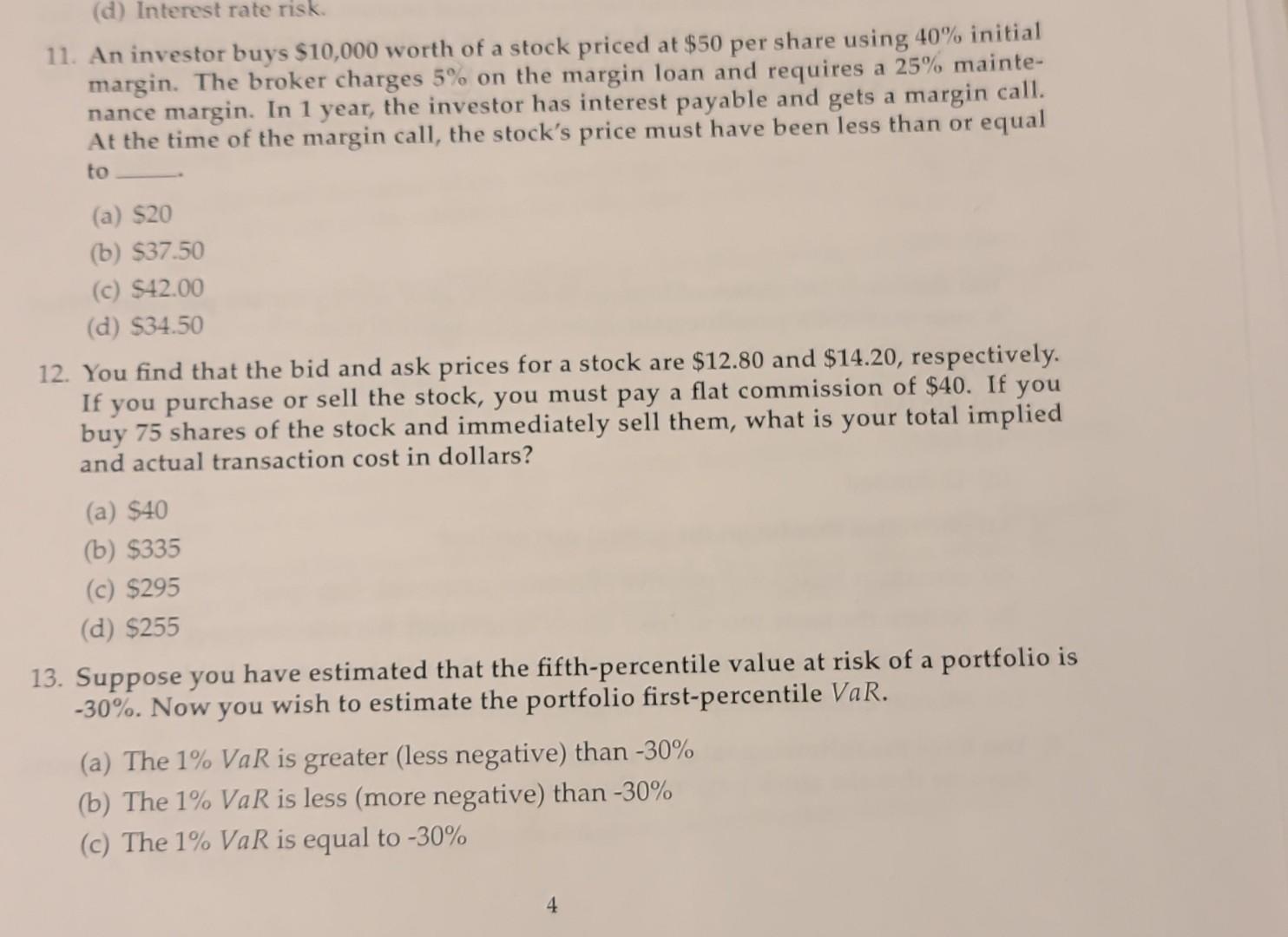

11. An investor buys $10,000 worth of a stock priced at $50 per share using 40% initial margin. The broker charges 5% on the margin loan and requires a 25% maintenance margin. In 1 year, the investor has interest payable and gets a margin call. At the time of the margin call, the stock's price must have been less than or equal to (a) $20 (b) $37.50 (c) $42.00 (d) $34.50 12. You find that the bid and ask prices for a stock are $12.80 and $14.20, respectively. If you purchase or sell the stock, you must pay a flat commission of $40. If you buy 75 shares of the stock and immediately sell them, what is your total implied and actual transaction cost in dollars? (a) $40 (b) $335 (c) $295 (d) $255 13. Suppose you have estimated that the fifth-percentile value at risk of a portfolio is 30%. Now you wish to estimate the portfolio first-percentile VaR. (a) The 1%VaR is greater (less negative) than 30% (b) The 1%VaR is less (more negative) than 30% (c) The 1%VaR is equal to 30%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started