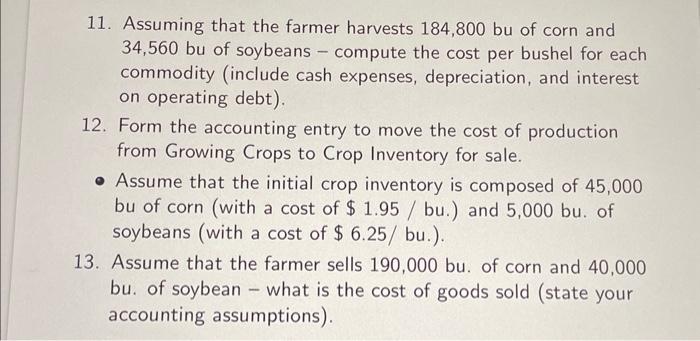

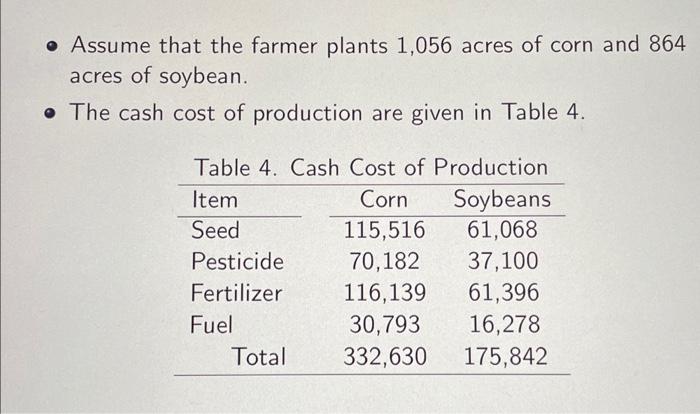

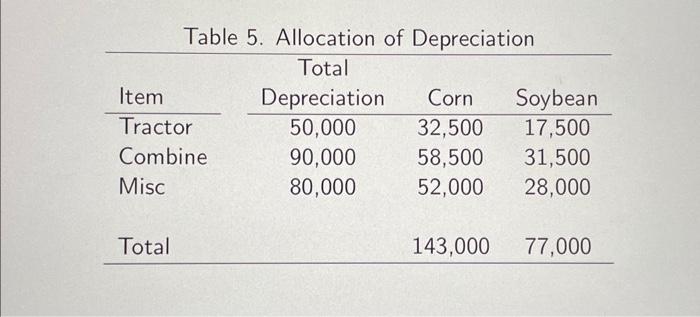

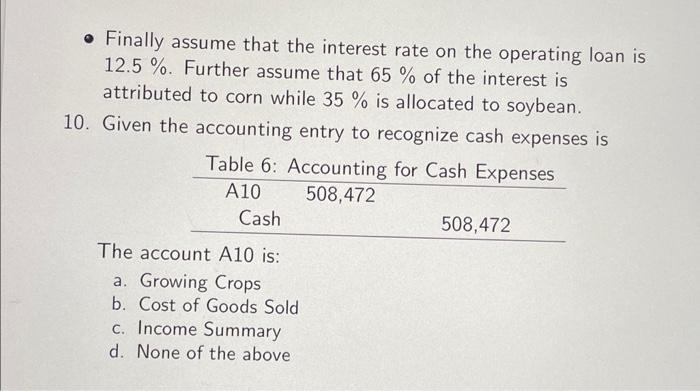

11. Assuming that the farmer harvests 184,800 bu of corn and 34,560 bu of soybeans - compute the cost per bushel for each commodity (include cash expenses, depreciation, and interest on operating debt). 12. Form the accounting entry to move the cost of production from Growing Crops to Crop Inventory for sale. - Assume that the initial crop inventory is composed of 45,000 bu of corn (with a cost of $1.95 / bu.) and 5,000 bu. of soybeans (with a cost of $6.25/ bu.). 13. Assume that the farmer sells 190,000 bu. of corn and 40,000 bu. of soybean - what is the cost of goods sold (state your accounting assumptions). - Assume that the farmer plants 1,056 acres of corn and 864 acres of soybean. - The cash cost of production are given in Table 4. Tahlo 5 Alloration of Monroriation - Finally assume that the interest rate on the operating loan is 12.5%. Further assume that 65% of the interest is attributed to corn while 35% is allocated to soybean. 10. Given the accounting entry to recognize cash expenses is The account A10 is: a. Growing Crops b. Cost of Goods Sold c. Income Summary d. None of the above 11. Assuming that the farmer harvests 184,800 bu of corn and 34,560 bu of soybeans - compute the cost per bushel for each commodity (include cash expenses, depreciation, and interest on operating debt). 12. Form the accounting entry to move the cost of production from Growing Crops to Crop Inventory for sale. - Assume that the initial crop inventory is composed of 45,000 bu of corn (with a cost of $1.95 / bu.) and 5,000 bu. of soybeans (with a cost of $6.25/ bu.). 13. Assume that the farmer sells 190,000 bu. of corn and 40,000 bu. of soybean - what is the cost of goods sold (state your accounting assumptions). - Assume that the farmer plants 1,056 acres of corn and 864 acres of soybean. - The cash cost of production are given in Table 4. Tahlo 5 Alloration of Monroriation - Finally assume that the interest rate on the operating loan is 12.5%. Further assume that 65% of the interest is attributed to corn while 35% is allocated to soybean. 10. Given the accounting entry to recognize cash expenses is The account A10 is: a. Growing Crops b. Cost of Goods Sold c. Income Summary d. None of the above