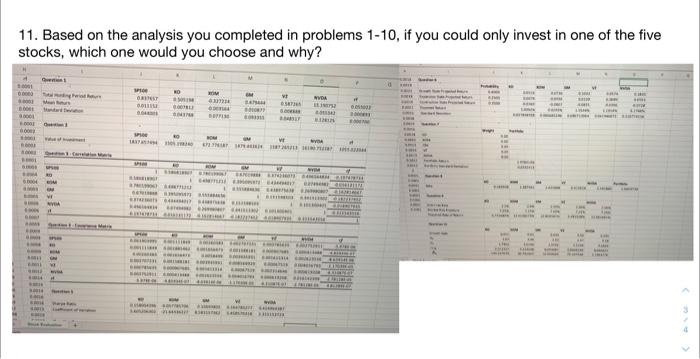

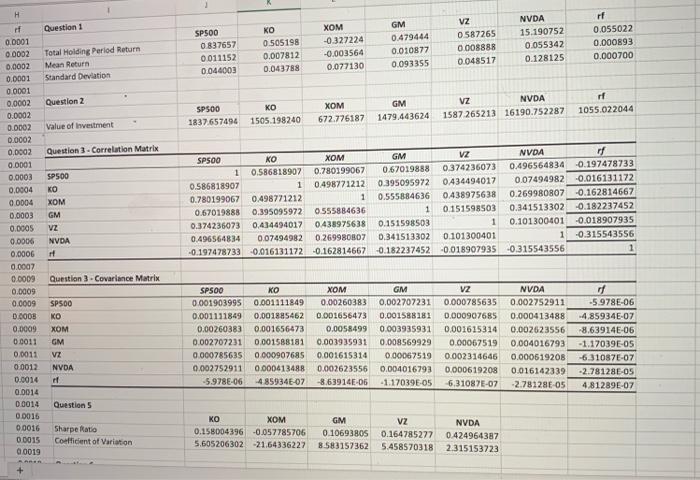

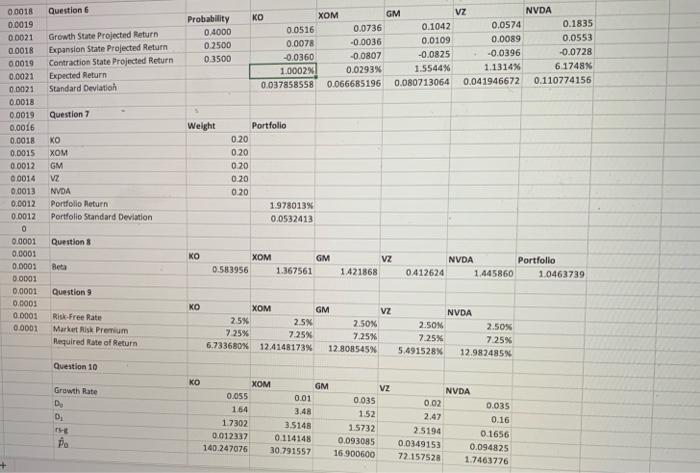

11. Based on the analysis you completed in problems 1-10, if you could only invest in one of the five stocks, which one would you choose and why? m NO WG 1 VOAN # ST WINE TE HIRT 1000 - We IA HER HINS WA HE 11 TO 60 ME HI MC HA NDA F 1 THE HH HE THE www YO is HE . SP500 0.837657 0011152 0.044003 KO 0.505198 0.007812 0.043788 XOM -0.327224 -0.003564 0.077130 GM 0.479444 0.010877 0.093355 VZ 0 587265 0.008888 0.048517 NVDA 15.190752 0.055342 0.128125 rf 0.055022 0.000893 0.000700 SP500 KO 1837.657494 1505.198240 XOM 672.776187 GM 1479.443624 rf 1055.022044 VZ NVDA 1587265213 16190.752287 GM H f Question 1 0.0001 0.0002 Total Holding Period Return 0.0002 Mean Return 0.0001 Standard Deviation 0.0001 0.0002 Question 2 0.0002 0.0002 Value of Investment 0.0002 0.0002 Question 3 - Correlation Matrix 0.0001 0.0003 SP500 0.0004 KO 0.0004 XOM 0.0003 GM 0.DOOS VZ 0.0006 NVDA 0.0006 Ht 0.0007 0.0009 Question 3. Covariance Matrix 0.0009 0.0009 SP500 0.0003 KO 0.0009 XOM 0.0011 GM 0.0011 VZ 00012 NVDA 0.0014 0.0014 0.0014 Question 5 00016 0.0016 Sharpe Ratio 00015 Confident of Variation 0.0019 SP500 KO XOM 1 0.586818907 0.780199067 0.586818907 1 0.498771212 0.780199067 0.498771212 1 0.67019888 0.395095972 0.555884636 0.374236073 0.434494017 0.438975638 0.496564834 0.07494982 0.269980807 -0.197478733 -0.016131172 0.162814667 0.67019888 0.395095972 0.555884636 1 0.151598503 0.341513302 -0.182237452 VZ NVDA of 0.374236073 0.496564834 -0.197478733 0434494017 0.07494982 -0.016131172 0.438975638 0.269980807 0.162814667 0.151598503 0.341513302 0.182237452 1 0.101300401 -0.018907935 0.101300401 1 -0.315543556 -0.018907935 -0.315543556 1 SP500 KO 0.00190399S 0.001111849 0.001131849 0.001885462 0.00260383 0.001656473 0.002707231 0.001588181 0.000785635 0.000907685 0.002752911 0.000413488 -5.978-06 -4859348-07 XOM 0.00260383 0.001656473 0.0058499 0.003935931 0.001615314 0.002623556 -8.63914E-06 GM 0.002707231 0.001588181 0.003935931 0.008569929 0.00067519 0.004016793 - 1.170396-05 VZ 0.000785635 0.000907685 0.001615314 0.00067519 0.002314646 0.000619208 6.31087E-07 NVDA 0.002752911 0.000413488 0.002623556 0.004016793 0.000619208 0.016142339 -2.78128E-05 of -5.978E-06 -4.85934E-07 -8.63914E-06 -1.17039E-05 -6.310876-07 -2.781281-05 4.81289E-07 KO XOM 0.158004396 -0.057785706 5.605206302 -21.64336227 GM 0.10693805 8.583157362 VZ 0.164785277 5.458570318 NVDA 0.424964387 2.315153723 + Question Probability 0.4000 0.2500 0.3500 Growth State Projected Return Expansion State Projected Return Contraction State Projected Return Expected Return Standard Deviation KO XOM GM VZ NVDA 0.0516 0.0736 0.1042 0.0574 0.1835 0.0078 -0.0036 0.0109 0.0089 0.0553 -0.0360 -0.0807 -0.0825 -0.0396 -0.0728 1.0002% 0.0293% 1.5544% 1.1314% 6.1748% 0.037858558 0.066685196 0.080713064 0.041946672 0.110774156 Question 7 Weight 00018 0.0019 0 0021 0.0018 00019 0.0021 0.0021 0.0018 0.0019 0.0016 0.0018 0.0015 0.0012 0.0014 0.0013 0.0012 0.0012 0 0.0001 0.0001 0.0001 0.0001 0.0001 0.0003 0.0001 0.0001 KO XOM GM VZ NVDA Portfolio Return Portfolio Standard Deviation Portfolio 0.20 0.20 0.20 0.20 0.20 1.978013% 0.0532413 Question 8 KO Beta XOM 0.583956 GM 1.367561 VZ 1.421868 NVDA Portfolio 0.412624 1.445860 1.0463739 Question 9 KO Risk-Free Rate Market Risk Premium Required Rate of Return XOM GM VZ 2.5% 25% 2.50% 7.25% 7.25% 7.25% 6.733680% 12.4148173% 12.808545% NVDA 2.50% 2.50% 7.25% 7.25% 5.491528% 12.982485N Question 10 Growth Rate De 0 ro Po XOM GM 0.055 0.01 1.64 3,48 17302 3.5148 0.012337 0.114148 140.247076 30.791557 VZ 0.035 1.52 1.5732 0.093085 16 900600 NVDA 0.02 0.035 2.47 0.16 2.5194 0.1656 0.0349153 0.094825 72.157528 1.7463776 11. Based on the analysis you completed in problems 1-10, if you could only invest in one of the five stocks, which one would you choose and why? m NO WG 1 VOAN # ST WINE TE HIRT 1000 - We IA HER HINS WA HE 11 TO 60 ME HI MC HA NDA F 1 THE HH HE THE www YO is HE . SP500 0.837657 0011152 0.044003 KO 0.505198 0.007812 0.043788 XOM -0.327224 -0.003564 0.077130 GM 0.479444 0.010877 0.093355 VZ 0 587265 0.008888 0.048517 NVDA 15.190752 0.055342 0.128125 rf 0.055022 0.000893 0.000700 SP500 KO 1837.657494 1505.198240 XOM 672.776187 GM 1479.443624 rf 1055.022044 VZ NVDA 1587265213 16190.752287 GM H f Question 1 0.0001 0.0002 Total Holding Period Return 0.0002 Mean Return 0.0001 Standard Deviation 0.0001 0.0002 Question 2 0.0002 0.0002 Value of Investment 0.0002 0.0002 Question 3 - Correlation Matrix 0.0001 0.0003 SP500 0.0004 KO 0.0004 XOM 0.0003 GM 0.DOOS VZ 0.0006 NVDA 0.0006 Ht 0.0007 0.0009 Question 3. Covariance Matrix 0.0009 0.0009 SP500 0.0003 KO 0.0009 XOM 0.0011 GM 0.0011 VZ 00012 NVDA 0.0014 0.0014 0.0014 Question 5 00016 0.0016 Sharpe Ratio 00015 Confident of Variation 0.0019 SP500 KO XOM 1 0.586818907 0.780199067 0.586818907 1 0.498771212 0.780199067 0.498771212 1 0.67019888 0.395095972 0.555884636 0.374236073 0.434494017 0.438975638 0.496564834 0.07494982 0.269980807 -0.197478733 -0.016131172 0.162814667 0.67019888 0.395095972 0.555884636 1 0.151598503 0.341513302 -0.182237452 VZ NVDA of 0.374236073 0.496564834 -0.197478733 0434494017 0.07494982 -0.016131172 0.438975638 0.269980807 0.162814667 0.151598503 0.341513302 0.182237452 1 0.101300401 -0.018907935 0.101300401 1 -0.315543556 -0.018907935 -0.315543556 1 SP500 KO 0.00190399S 0.001111849 0.001131849 0.001885462 0.00260383 0.001656473 0.002707231 0.001588181 0.000785635 0.000907685 0.002752911 0.000413488 -5.978-06 -4859348-07 XOM 0.00260383 0.001656473 0.0058499 0.003935931 0.001615314 0.002623556 -8.63914E-06 GM 0.002707231 0.001588181 0.003935931 0.008569929 0.00067519 0.004016793 - 1.170396-05 VZ 0.000785635 0.000907685 0.001615314 0.00067519 0.002314646 0.000619208 6.31087E-07 NVDA 0.002752911 0.000413488 0.002623556 0.004016793 0.000619208 0.016142339 -2.78128E-05 of -5.978E-06 -4.85934E-07 -8.63914E-06 -1.17039E-05 -6.310876-07 -2.781281-05 4.81289E-07 KO XOM 0.158004396 -0.057785706 5.605206302 -21.64336227 GM 0.10693805 8.583157362 VZ 0.164785277 5.458570318 NVDA 0.424964387 2.315153723 + Question Probability 0.4000 0.2500 0.3500 Growth State Projected Return Expansion State Projected Return Contraction State Projected Return Expected Return Standard Deviation KO XOM GM VZ NVDA 0.0516 0.0736 0.1042 0.0574 0.1835 0.0078 -0.0036 0.0109 0.0089 0.0553 -0.0360 -0.0807 -0.0825 -0.0396 -0.0728 1.0002% 0.0293% 1.5544% 1.1314% 6.1748% 0.037858558 0.066685196 0.080713064 0.041946672 0.110774156 Question 7 Weight 00018 0.0019 0 0021 0.0018 00019 0.0021 0.0021 0.0018 0.0019 0.0016 0.0018 0.0015 0.0012 0.0014 0.0013 0.0012 0.0012 0 0.0001 0.0001 0.0001 0.0001 0.0001 0.0003 0.0001 0.0001 KO XOM GM VZ NVDA Portfolio Return Portfolio Standard Deviation Portfolio 0.20 0.20 0.20 0.20 0.20 1.978013% 0.0532413 Question 8 KO Beta XOM 0.583956 GM 1.367561 VZ 1.421868 NVDA Portfolio 0.412624 1.445860 1.0463739 Question 9 KO Risk-Free Rate Market Risk Premium Required Rate of Return XOM GM VZ 2.5% 25% 2.50% 7.25% 7.25% 7.25% 6.733680% 12.4148173% 12.808545% NVDA 2.50% 2.50% 7.25% 7.25% 5.491528% 12.982485N Question 10 Growth Rate De 0 ro Po XOM GM 0.055 0.01 1.64 3,48 17302 3.5148 0.012337 0.114148 140.247076 30.791557 VZ 0.035 1.52 1.5732 0.093085 16 900600 NVDA 0.02 0.035 2.47 0.16 2.5194 0.1656 0.0349153 0.094825 72.157528 1.7463776