Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.1 Briefly discuss providing a well-reasoned answer as to what you consider the difference between recording and reporting in the practice of accounting. [5

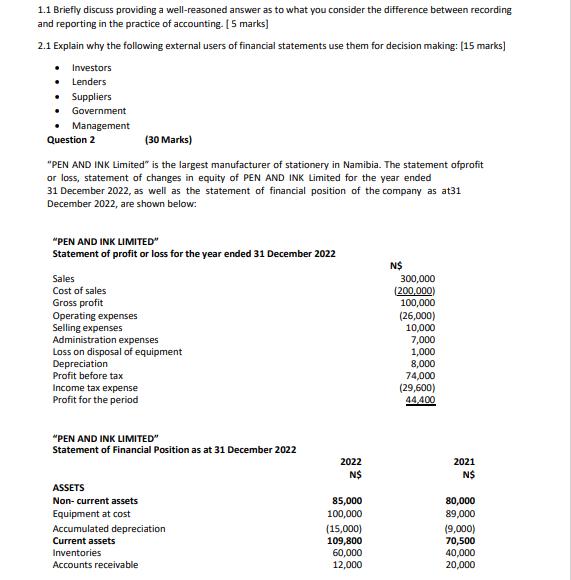

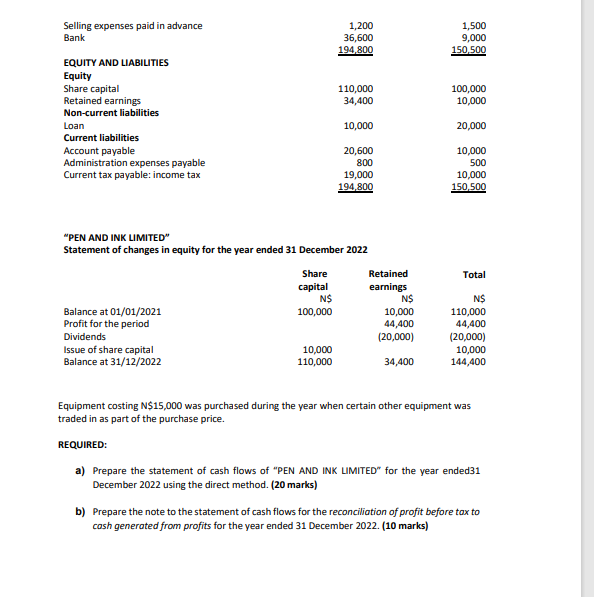

1.1 Briefly discuss providing a well-reasoned answer as to what you consider the difference between recording and reporting in the practice of accounting. [5 marks] 2.1 Explain why the following external users of financial statements use them for decision making: [15 marks] Lenders Suppliers Government Management Investors Question 2 (30 Marks) "PEN AND INK Limited" is the largest manufacturer of stationery in Namibia. The statement ofprofit or loss, statement of changes in equity of PEN AND INK Limited for the year ended 31 December 2022, as well as the statement of financial position of the company as at31 December 2022, are shown below: "PEN AND INK LIMITED" Statement of profit or loss for the year ended 31 December 2022 Sales Cost of sales Gross profit Operating expenses Selling expenses Administration expenses Loss on disposal of equipment Depreciation Profit before tax Income tax expense Profit for the period "PEN AND INK LIMITED" Statement of Financial Position as at 31 December 2022 ASSETS Non-current assets Equipment at cost Accumulated depreciation Current assets Inventories Accounts receivable 2022 N$ 85,000 100,000 (15,000) 109,800 60,000 12,000 N$ 300,000 (200,000) 100,000 (26,000) 10,000 7,000 1,000 8,000 74,000 (29,600) 44,400 2021 N$ 80,000 89,000 (9,000) 70,500 40,000 20,000 Selling expenses paid in advance Bank EQUITY AND LIABILITIES Equity Share capital Retained earnings Non-current liabilities Loan Current liabilities Account payable Administration expenses payable Current tax payable: income tax Balance at 01/01/2021 Profit for the period Dividends Issue of share capital Balance at 31/12/2022 "PEN AND INK LIMITED" Statement of changes in equity for the year ended 31 December 2022 Share capital REQUIRED: N$ 100,000 1,200 36,600 194,800 10,000 110,000 110,000 34,400 10,000 20,600 800 19,000 194,800 Retained earnings N$ 10,000 44,400 (20,000) 34,400 1,500 9,000 150,500 100,000 10,000 20,000 10,000 500 10,000 150,500 Total N$ 110,000 44,400 (20,000) 10,000 144,400 Equipment costing N$15,000 was purchased during the year when certain other equipment was traded in as part of the purchase price. a) Prepare the statement of cash flows of "PEN AND INK LIMITED" for the year ended31 December 2022 using the direct method. (20 marks) b) Prepare the note to the statement of cash flows for the reconciliation of profit before tax to cash generated from profits for the year ended 31 December 2022. (10 marks)

Step by Step Solution

★★★★★

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Difference Between Recording and Reporting in Accounting Recording and reporting are two essential aspects of accounting but they serve distinct purposes in the practice of accounting Recording This r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started