Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11. Cite the differences in the tax remedies with respect to national taxes as provided by the National Internal Revenue Code and those that

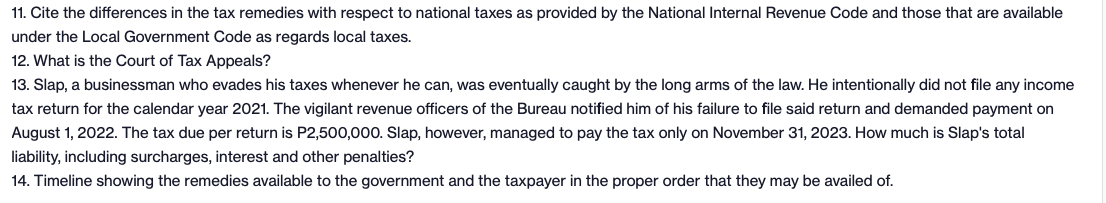

11. Cite the differences in the tax remedies with respect to national taxes as provided by the National Internal Revenue Code and those that are available under the Local Government Code as regards local taxes. 12. What is the Court of Tax Appeals? 13. Slap, a businessman who evades his taxes whenever he can, was eventually caught by the long arms of the law. He intentionally did not file any income tax return for the calendar year 2021. The vigilant revenue officers of the Bureau notified him of his failure to file said return and demanded payment on August 1, 2022. The tax due per return is P2,500,000. Slap, however, managed to pay the tax only on November 31, 2023. How much is Slap's total liability, including surcharges, interest and other penalties? 14. Timeline showing the remedies available to the government and the taxpayer in the proper order that they may be availed of.

Step by Step Solution

★★★★★

3.26 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

11 The National Internal Revenue Code NIRC and the Local Government Code LGC provide different tax remedies with respect to national and local taxes respectively Here are some key differences NIRC Nat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started