Answered step by step

Verified Expert Solution

Question

1 Approved Answer

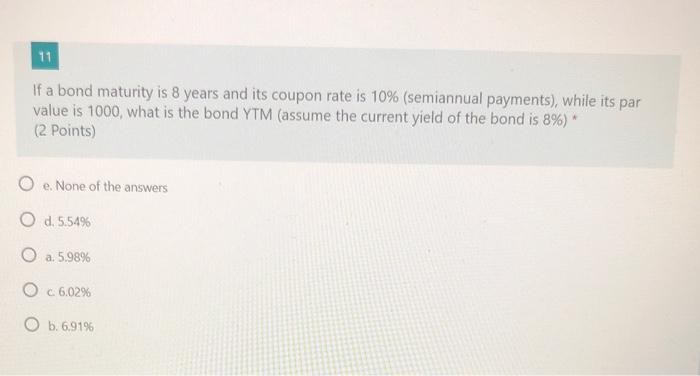

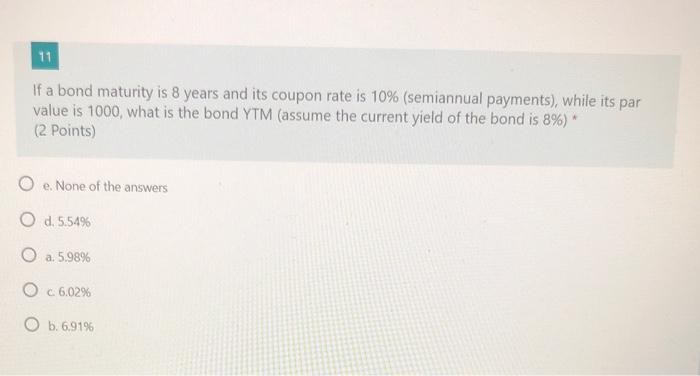

11 If a bond maturity is 8 years and its coupon rate is 10% (semiannual payments), while its par value is 1000, what is the

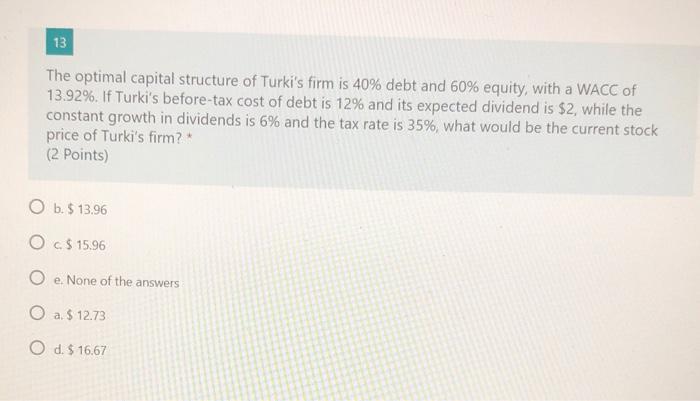

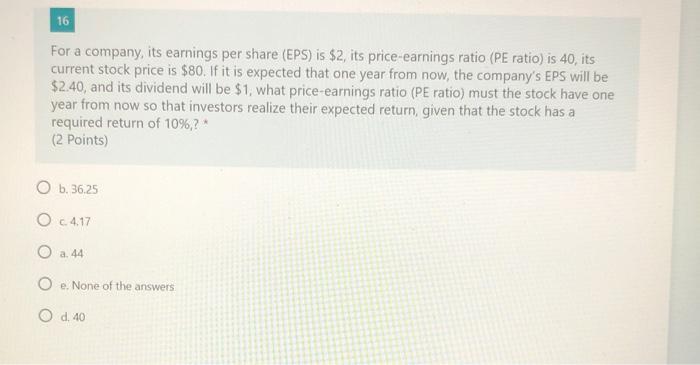

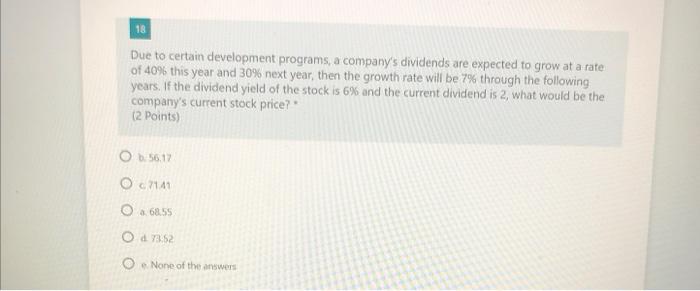

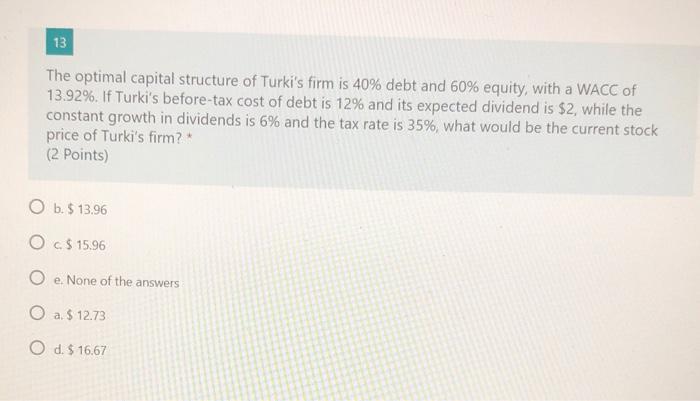

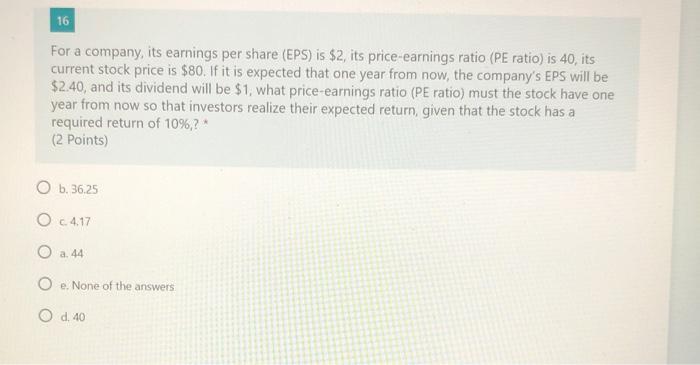

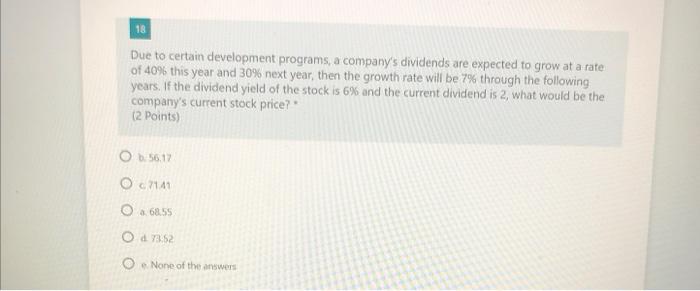

11 If a bond maturity is 8 years and its coupon rate is 10% (semiannual payments), while its par value is 1000, what is the bond YTM (assume the current yield of the bond is 8%) * (2 points) O e. None of the answers O d. 5.54% O a. 5.98% O c 6.02% O b. 6.91% 13 The optimal capital structure of Turki's firm is 40% debt and 60% equity, with a WACC of 13.92%. If Turki's before-tax cost of debt is 12% and its expected dividend is $2, while the constant growth in dividends is 6% and the tax rate is 35%, what would be the current stock price of Turki's firm? (2 Points) O b. $ 13.96 O c $15.96 O e. None of the answers O a. $ 12.73 O d. $ 16.67 16 For a company, its earnings per share (EPS) is $2, its price earnings ratio (PE ratio) is 40, its current stock price is $80. If it is expected that one year from now, the company's EPS will be $2.40, and its dividend will be $1, what price-earnings ratio (PE ratio) must the stock have one year from now so that investors realize their expected return, given that the stock has a required return of 10%,?* (2 points) O b. 36.25 O c 4.17 O a. 44 O e. None of the answers O d. 40 18 Due to certain development programs, a company's dividends are expected to grow at a rate of 40% this year and 30% next year, then the growth rate will be 7% through the following years. If the dividend yield of the stock is 6% and the current dividend is 2, what would be the company's current stock price? (2 points) O 5617 Oc7141 O 68.55 Od 7352 O None of the answers

11 If a bond maturity is 8 years and its coupon rate is 10% (semiannual payments), while its par value is 1000, what is the bond YTM (assume the current yield of the bond is 8%) * (2 points) O e. None of the answers O d. 5.54% O a. 5.98% O c 6.02% O b. 6.91% 13 The optimal capital structure of Turki's firm is 40% debt and 60% equity, with a WACC of 13.92%. If Turki's before-tax cost of debt is 12% and its expected dividend is $2, while the constant growth in dividends is 6% and the tax rate is 35%, what would be the current stock price of Turki's firm? (2 Points) O b. $ 13.96 O c $15.96 O e. None of the answers O a. $ 12.73 O d. $ 16.67 16 For a company, its earnings per share (EPS) is $2, its price earnings ratio (PE ratio) is 40, its current stock price is $80. If it is expected that one year from now, the company's EPS will be $2.40, and its dividend will be $1, what price-earnings ratio (PE ratio) must the stock have one year from now so that investors realize their expected return, given that the stock has a required return of 10%,?* (2 points) O b. 36.25 O c 4.17 O a. 44 O e. None of the answers O d. 40 18 Due to certain development programs, a company's dividends are expected to grow at a rate of 40% this year and 30% next year, then the growth rate will be 7% through the following years. If the dividend yield of the stock is 6% and the current dividend is 2, what would be the company's current stock price? (2 points) O 5617 Oc7141 O 68.55 Od 7352 O None of the answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started