Question

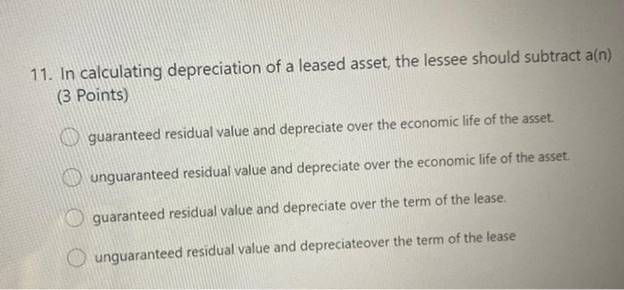

11. In calculating depreciation of a leased asset, the lessee should subtract a(n) (3 Points) guaranteed residual value and depreciate over the economic life

11. In calculating depreciation of a leased asset, the lessee should subtract a(n) (3 Points) guaranteed residual value and depreciate over the economic life of the asset. unguaranteed residual value and depreciate over the economic life of the asset. guaranteed residual value and depreciate over the term of the lease. unguaranteed residual value and depreciateover the term of the lease

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Third option is the correct option In computing depreciation of a leased asset the lessee should sub...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Using Financial Accounting Information The Alternative to Debits and Credits

Authors: Gary A. Porter, Curtis L. Norton

7th Edition

978-0-538-4527, 0-538-45274-9, 978-1133161646

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App