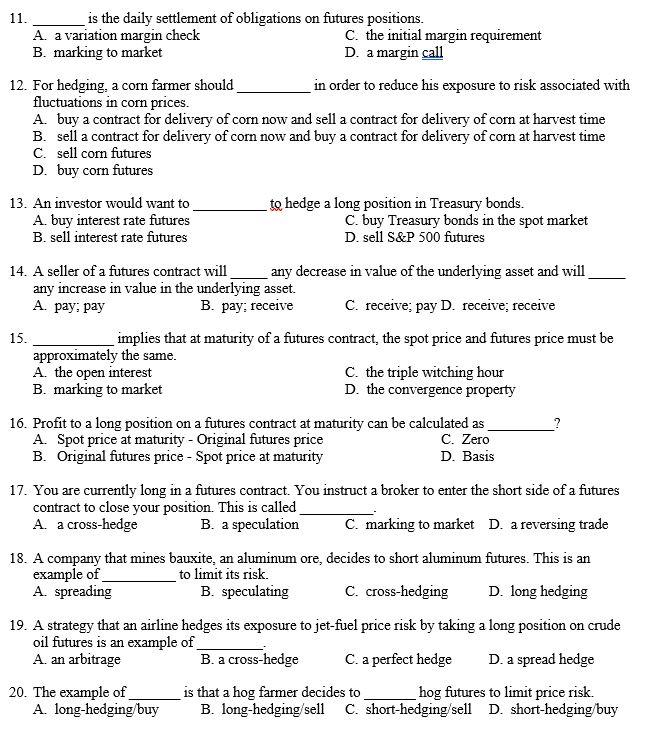

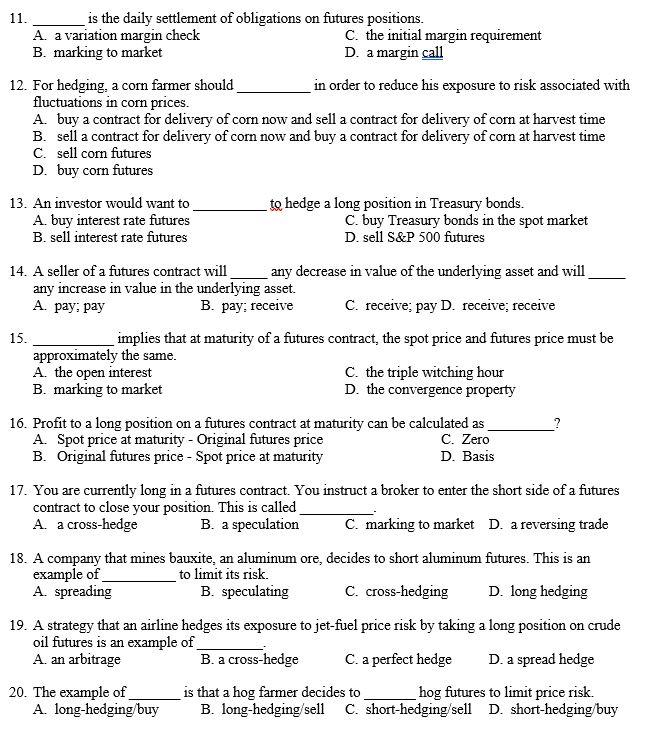

11. is the daily settlement of obligations on futures positions. A. a variation margin check C. the initial margin requirement B. marking to market D. a margin call 12. For hedging, a com farmer should in order to reduce his exposure to risk associated with fluctuations in com prices. A. buy a contract for delivery of corn now and sell a contract for delivery of corn at harvest time B. sell a contract for delivery of corn now and buy a contract for delivery of corn at harvest time C. sell corn futures D. buy corn futures 13. An investor would want to to hedge a long position in Treasury bonds. A. buy interest rate futures C. buy Treasury bonds in the spot market B. sell interest rate futures D. sell S&P 500 futures 14. A seller of a futures contract will any decrease in value of the underlying asset and will any increase in value in the underlying asset. A. pay: pay B. pay; receive C. receive; pay D. receive; receive 15. implies that at maturity of a futures contract, the spot price and futures price must be approximately the same. A. the open interest C. the triple witching hour B. marking to market D. the convergence property 16. Profit to a long position on a futures contract at maturity can be calculated as A. Spot price at maturity - Original futures price C. Zero B. Original futures price - Spot price at maturity D. Basis 17. You are currently long in a futures contract. You instruct a broker to enter the short side of a futures contract to close your position. This is called A. a cross-hedge B. a speculation C. marking to market D. a reversing trade 18. A company that mines bauxite, an aluminum ore, decides to short aluminum futures. This is an example of to limit its risk. A. spreading B. speculating C. cross-hedging D. long hedging 19. A strategy that an airline hedges its exposure to jet-fuel price risk by taking a long position on crude oil futures is an example of A. an arbitrage B. a cross-hedge C. a perfect hedge D. a spread hedge 20. The example of is that a hog farmer decides to hog futures to limit price risk. A. long-hedging/buy B. long-hedging/sell C. short-hedging/sell D. short-hedging buy