Answered step by step

Verified Expert Solution

Question

1 Approved Answer

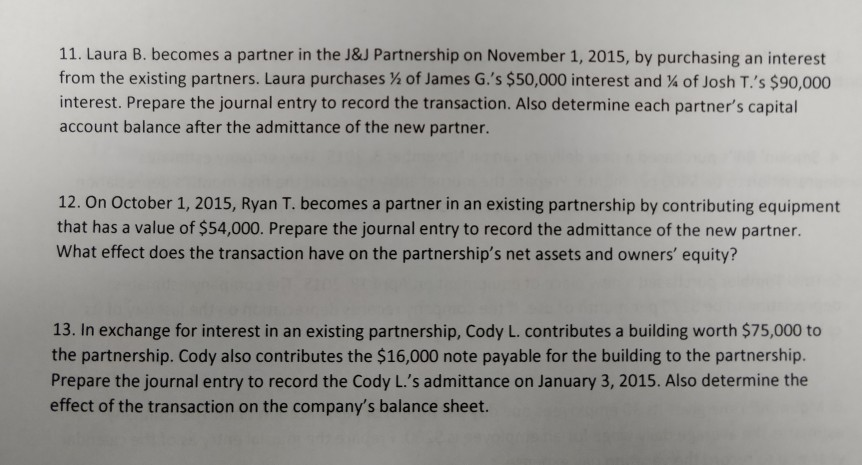

11. Laura B. becomes a partner in the J&J Partnership on November 1, 2015, by purchasing an interest from the existing partners. Laura purchases of

11. Laura B. becomes a partner in the J&J Partnership on November 1, 2015, by purchasing an interest from the existing partners. Laura purchases of James G.'s $50,000 interest and of Josh T.'s S90.000 interest. Prepare the journal entry to record the transaction. Also determine each partner's capital account balance after the admittance of the new partner. 12. On October 1, 2015, Ryan T. becomes a partner in an existing partnership by contributing equipment that has a value of $54,000. Prepare the journal entry to record the admittance of the new partner. What effect does the transaction have on the partnership's net assets and owners' equity? 13. In exchange for interest in an existing partnership, Cody L. contributes a building worth $75,000 to the partnership. Cody also contributes the $16,000 note payable for the building to the partnership. Prepare the journal entry to record the Cody L.'s admittance on January 3, 2015. Also determine the effect of the transaction on the company's balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started