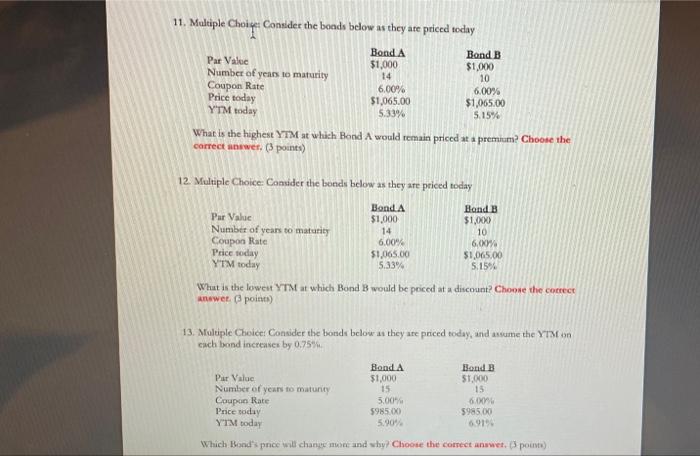

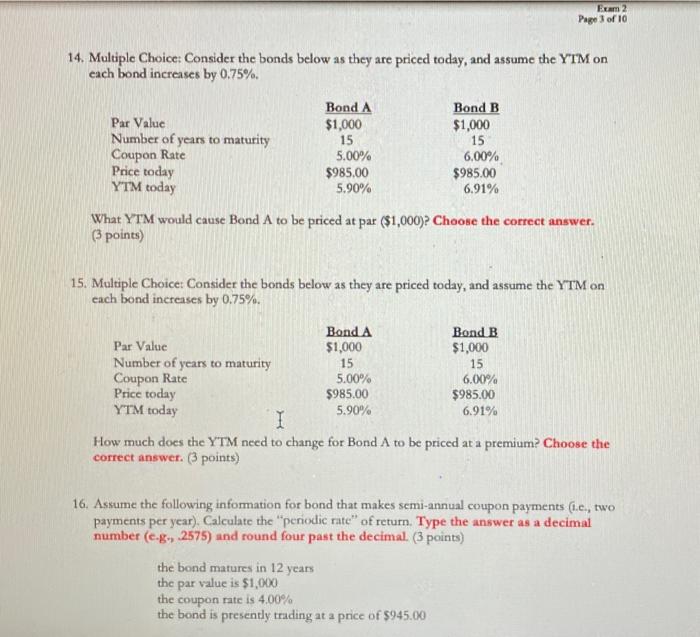

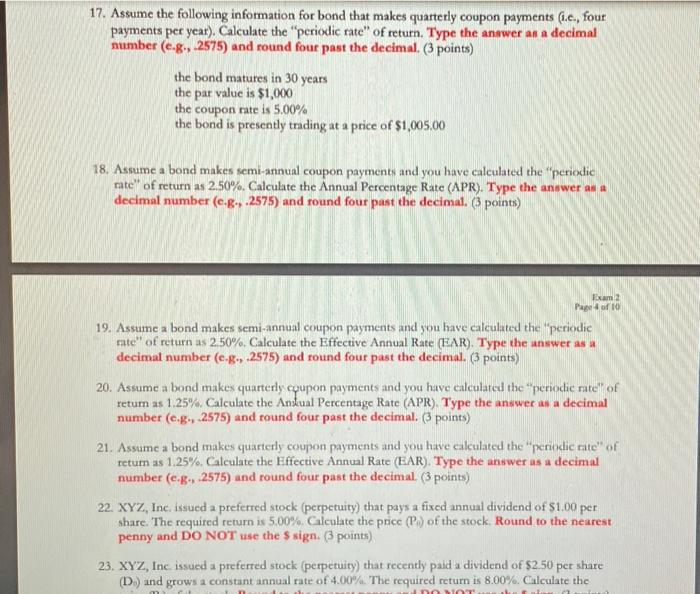

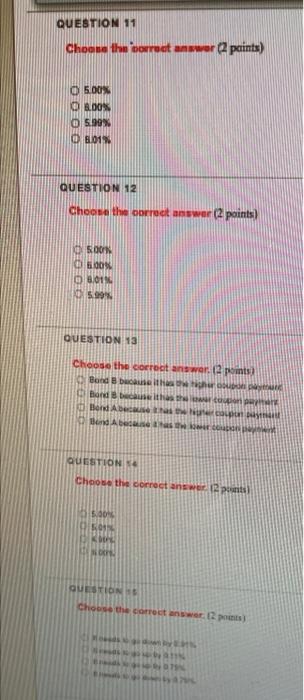

11. Multiple Choice : Consider the bonds below as they are priced today Bond A Bond B Par Valec $1,000 $1,000 Number of years to maturity 14 10 Coupon Rate 6.00% 6.00% Price today $1,065.00 $1,065,00 YIM today 5.3394 5.15% What is the highest YTM at which Bond A would remain priced at a premium? Choose the correct answer. (3 points) 12. Multiple Choice: Comider the bonds below as they are priced today Bond A Band B Par Value $1,000 $1,000 Number of years to mat 14 10 Coupon Rate 6.00% 6,09% Price today $1,065.00 $1,065,00 YTM today 5.33% 5.15% What is the lower YTM at which Bond B would be priced at a discount? Choose the correct werpoints) 13. Multiple Choice Consider the bonds below as they are priced today, and assume the YTM each bond increases by 0.75%. Hond A Bond B Par Value $1,000 $1.000 Number of years to maturity 15 15 Coupon Rate 5.00 6.009 Price today $985 (X) 5985.00 YTM today 5,90% 6919 Which Bond's pnce will change mom and why Choose the correct answet. 3 points) Eum 2 Page 3 of 10 14. Multiple Choice: Consider the bonds below as they are priced today, and assume the YIM on each bond increases by 0.75%. Bond A Bond B Par Value $1,000 $1,000 Number of years to maturity 15 15 Coupon Rate 5.00% 6.00% Price today $985,00 $985.00 YTM today 5.90% 6.91% What YTM would cause Bond A to be priced at par ($1,000)? Choose the correct answer. (3 points) 15. Multiple Choice: Consider the bonds below as they are priced today, and assume the YTM on each bond increases by 0.75%. Bond A Bond B Par Value $1,000 $1,000 Number of years to maturity 15 15 Coupon Rate 5.00% 6.00% Price today $985.00 $985.00 YTM today 5.90% I 6.91% How much does the YTM need to change for Bond A to be priced at a premium? Choose the correct answer. (3 points) 16. Assume the following information for bond that makes semi-annual coupon payments (1.c., two payments per year). Calculate the "penodic rate" of return. Type the answer as a decimal number (c-g-2575) and round four past the decimal. (3 points) the bond matures in 12 years the par value is $1,000 the coupon rate is 4.00% the bond is presently trading at a price of $945.00 17. Assume the following information for bond that makes quarterly coupon payments (i.c., four payments per year). Calculate the periodic rate" of return. Type the answer as a decimal number (c.8., 2575) and round four past the decimal (3 points) the bond matures in 30 years the par value is $1,000 the coupon rate is 5.00% the bond is presently trading at a price of $1,005.00 18. Assume a bond makes semi-annual coupon payments and you have calculated the periodic rate of return as 2.50%. Calculate the Annual Percentage Rate (APR). Type the answer as a decimal number (c.g.,.2575) and round four past the decimal. 6 points) Exam Page of 10 19. Assume a bond makes semi-annual coupon payments and you have calculated the periodic rate" of return as 2,50%, Calculate the Effective Annual Rate (EAR). Type the answer as a decimal number (c.8, 2575) and round four past the decimal. 6 points) 20. Assume a bond makes quarterly coupon payments and you have calculated the periodic rate of retum as 1.25% Calculate the Ankual Percentage Rate (APR) Type the answer as a decimal number (e.g., 2575) and round four past the decimal. (3 points) 21. Assume a bond makes quarterly coupon payments and you have calculated the periodic rite of return as 1.25%. Calculate the Effective Annual Rate (EAR). Type the answer as a decimal number (6.8., 2575) and round four past the decimal (3 points) 22. XYZ, Inc issued a preferred stock (perpetuity) that pays a fixed annual dividend of $1.00 per share. The required return is 5,00%. Galculate the price (P) of the stock. Round to the nearest penny and DO NOT use the S sign. (3 points) 23. XYZ, Inc issued a preferred stock (perpetuity) that recently paid a dividend of $2.50 per share (D) and grows a constant annual rate of 4.00%. The required return is 8.00%. Calculate the DOOT QUESTION 11 Choose the borrect answer points) O 5.00% 8.00% 05.99% 0 601 QUESTION 12 Choose the correct answer (2 points) SON 0.01 599 QUESTION 13 Choose the correct answer. (2 points) Band bathroom Bond that Best AL BABWE QUESTION Choose the correct answer 2 pots 16.30 2014 QUESTIONS Choose the correct answer 12 points) 15