Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.1 Peter started his business as a Locksmith in Pietermaritzburg on 1 July 2019 and intends to expand his business to all major towns

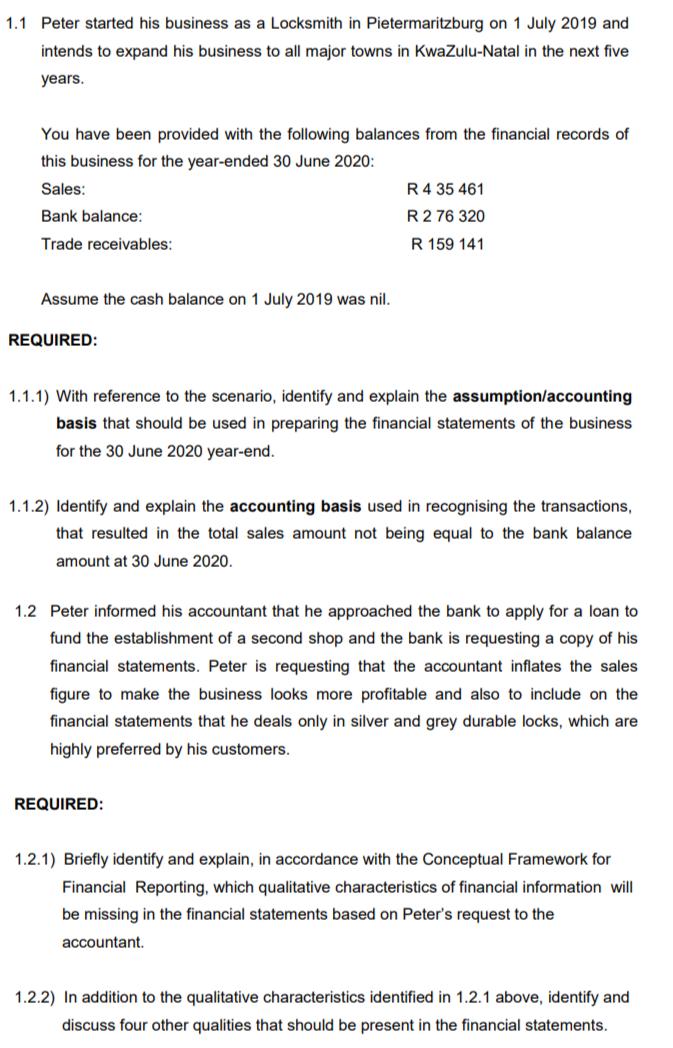

1.1 Peter started his business as a Locksmith in Pietermaritzburg on 1 July 2019 and intends to expand his business to all major towns in KwaZulu-Natal in the next five years. You have been provided with the following balances from the financial records of this business for the year-ended 30 June 2020: Sales: R 4 35 461 Bank balance: R 2 76 320 R 159 141 Trade receivables: Assume the cash balance on 1 July 2019 was nil. REQUIRED: 1.1.1) With reference to the scenario, identify and explain the assumption/accounting basis that should be used in preparing the financial statements of the business for the 30 June 2020 year-end. 1.1.2) Identify and explain the accounting basis used in recognising the transactions, that resulted in the total sales amount not being equal to the bank balance amount at 30 June 2020. 1.2 Peter informed his accountant that he approached the bank to apply for a loan to fund the establishment of a second shop and the bank is requesting a copy of his financial statements. Peter is requesting that the accountant inflates the sales figure to make the business looks more profitable and also to include on the financial statements that he deals only in silver and grey durable locks, which are highly preferred by his customers. REQUIRED: 1.2.1) Briefly identify and explain, in accordance with the Conceptual Framework for Financial Reporting, which qualitative characteristics of financial information will be missing in the financial statements based on Peter's request to the accountant. 1.2.2) In addition to the qualitative characteristics identified in 1.2.1 above, identify and discuss four other qualities that should be present in the financial statements.

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

111 Assumption that should be used while preparing the financial statements are a Economic entity That the business is a separate legal entity and owners personal transactions are separate and not mix...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started