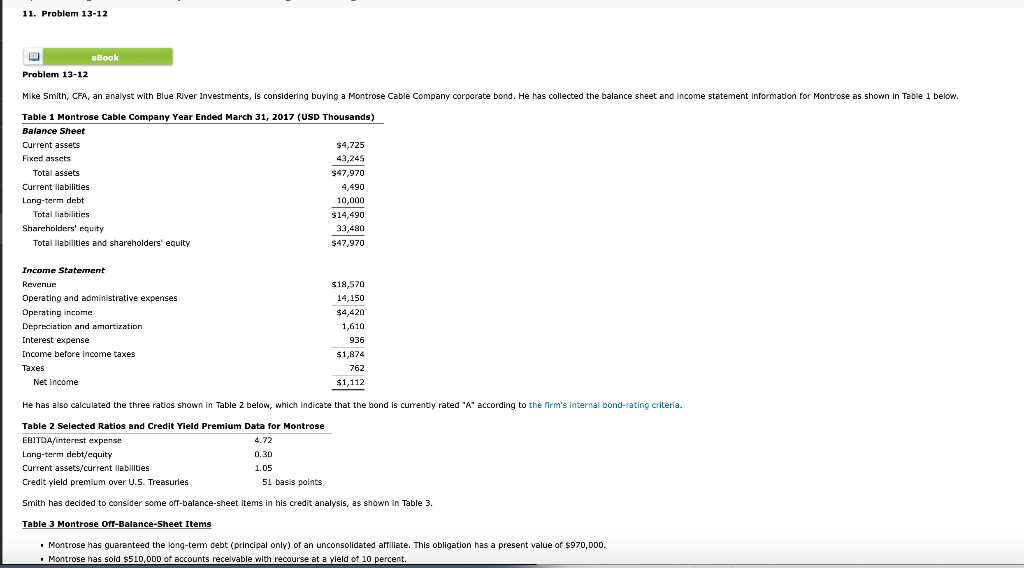

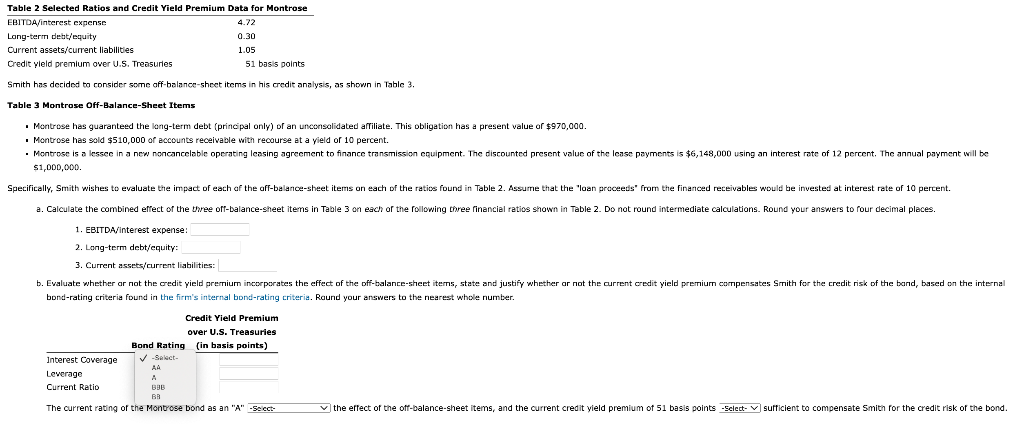

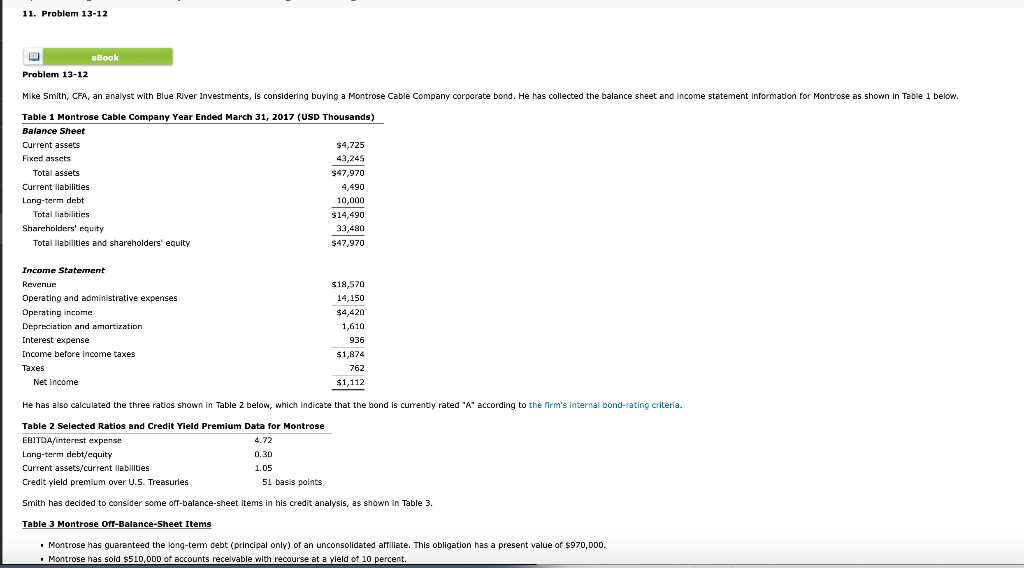

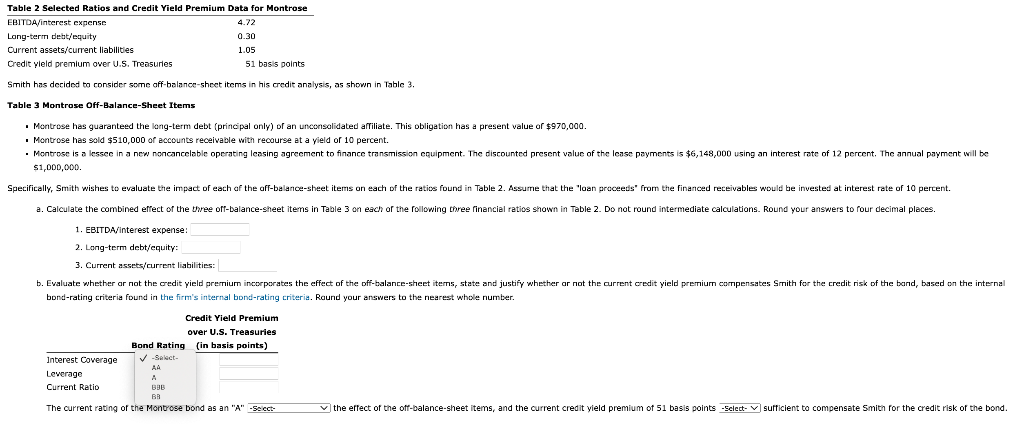

11. Problem 13-12 Problem 13-12 Mike 5 mith, CFA, an analyst with Blue River Investments, is considering buying a Montrose Cable Company corporate bond. He has collected the balance He has also calculated the three ratios shown in Table 2 below, which indicate that the bond is currently rated "A" according to the firm's internal bond-r. Smith has decided to consider some off-balance-sheet items in his credit analysis, as shown in Table 3. Table 3 Montrose Orr-Balance-Sheet Items - Montrose has guaranteed the long-term debt (principal only) of an unconsolidated affiliate. This obligation has a present value of $970,000. - Montrose has sold $510,000 of accounts receivable with recourse at a yield of 10 percent. Emith has decided to consider seme off-balance-sheet items in his credit analysis, as shown in Table 3. Table 3 Montrose Off-Balance-Sheet Items - Montrose has guaranteed the lang-term debt (principal only) of an unconsalidated afTiliate. This obligation has a present value of $970,000. - Montrose has sold $510,000 of accounts receivable with recourse at a yield of 10 percent. 51,000,000. 1. EBITDA/interest expense: 2. Long-term debt/equity: 3. Current assetsicurrent liabilities: bond-rating criteria found in the firm's internal bond-rating criteria. Raund your answers to the nearest whole number. 11. Problem 13-12 Problem 13-12 Mike 5 mith, CFA, an analyst with Blue River Investments, is considering buying a Montrose Cable Company corporate bond. He has collected the balance He has also calculated the three ratios shown in Table 2 below, which indicate that the bond is currently rated "A" according to the firm's internal bond-r. Smith has decided to consider some off-balance-sheet items in his credit analysis, as shown in Table 3. Table 3 Montrose Orr-Balance-Sheet Items - Montrose has guaranteed the long-term debt (principal only) of an unconsolidated affiliate. This obligation has a present value of $970,000. - Montrose has sold $510,000 of accounts receivable with recourse at a yield of 10 percent. Emith has decided to consider seme off-balance-sheet items in his credit analysis, as shown in Table 3. Table 3 Montrose Off-Balance-Sheet Items - Montrose has guaranteed the lang-term debt (principal only) of an unconsalidated afTiliate. This obligation has a present value of $970,000. - Montrose has sold $510,000 of accounts receivable with recourse at a yield of 10 percent. 51,000,000. 1. EBITDA/interest expense: 2. Long-term debt/equity: 3. Current assetsicurrent liabilities: bond-rating criteria found in the firm's internal bond-rating criteria. Raund your answers to the nearest whole number