Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11 QUESTION (50 marks) A lessor entered into a ten-year lease agreement on 1 January 2021. In terms of this agreement, the lessee contracted

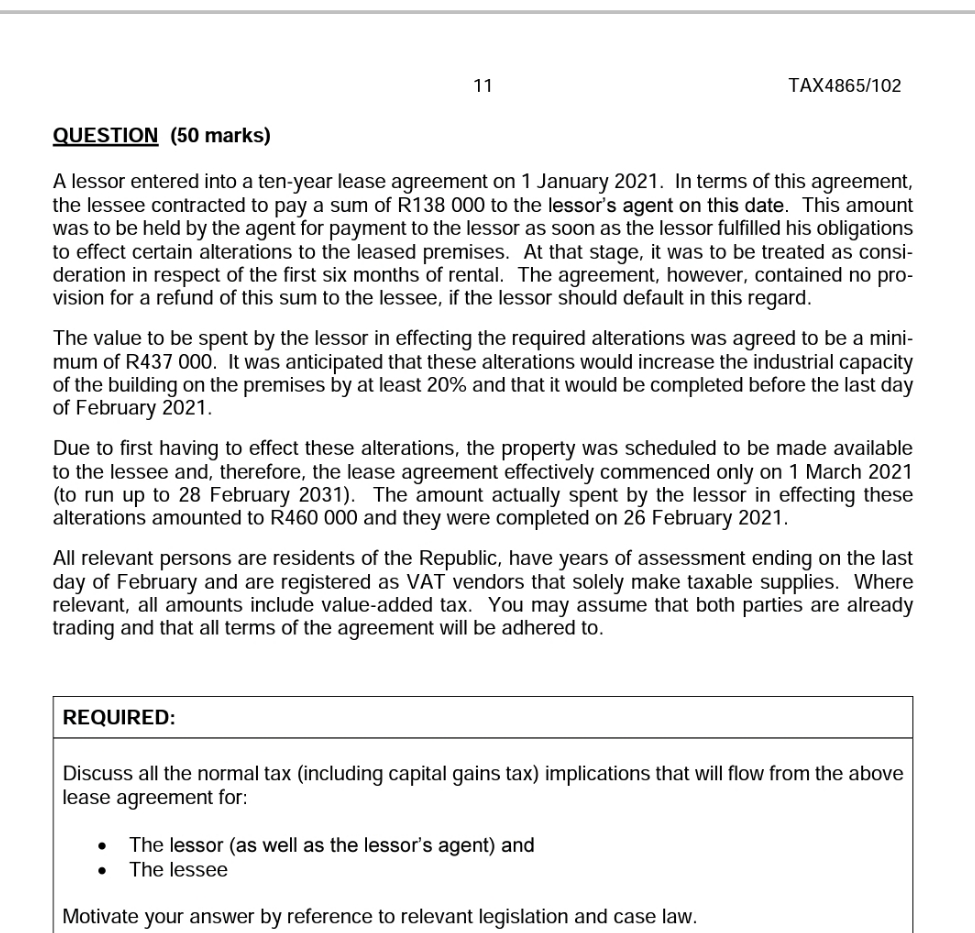

11 QUESTION (50 marks) A lessor entered into a ten-year lease agreement on 1 January 2021. In terms of this agreement, the lessee contracted to pay a sum of R138 000 to the lessor's agent on this date. This amount was to be held by the agent for payment to the lessor as soon as the lessor fulfilled his obligations to effect certain alterations to the leased premises. At that stage, it was to be treated as consi- deration in respect of the first six months of rental. The agreement, however, contained no pro- vision for a refund of this sum to the lessee, if the lessor should default in this regard. The value to be spent by the lessor in effecting the required alterations was agreed to be a mini- mum of R437 000. It was anticipated that these alterations would increase the industrial capacity of the building on the premises by at least 20% and that it would be completed before the last day of February 2021. TAX4865/102 Due to first having to effect these alterations, the property was scheduled to be made available to the lessee and, therefore, the lease agreement effectively commenced only on 1 March 2021 (to run up to 28 February 2031). The amount actually spent by the lessor in effecting these alterations amounted to R460 000 and they were completed on 26 February 2021. REQUIRED: All relevant persons are residents of the Republic, have years of assessment ending on the last day of February and are registered as VAT vendors that solely make taxable supplies. Where relevant, all amounts include value-added tax. You may assume that both parties are already trading and that all terms of the agreement will be adhered to. Discuss all the normal tax (including capital gains tax) implications that will flow from the above lease agreement for: The lessor (as well as the lessor's agent) and The lessee Motivate your answer by reference to relevant legislation and case law.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The tax implications of the lease agreement need to be considered for both the lessor including the lessors agent and the lessee Below is a discussion ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started