Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11. Suzie Sizemore owns Sizemore Aviation that operates in the Caribbean and parts of South America. She currently operates a Cessna Caravan, which she

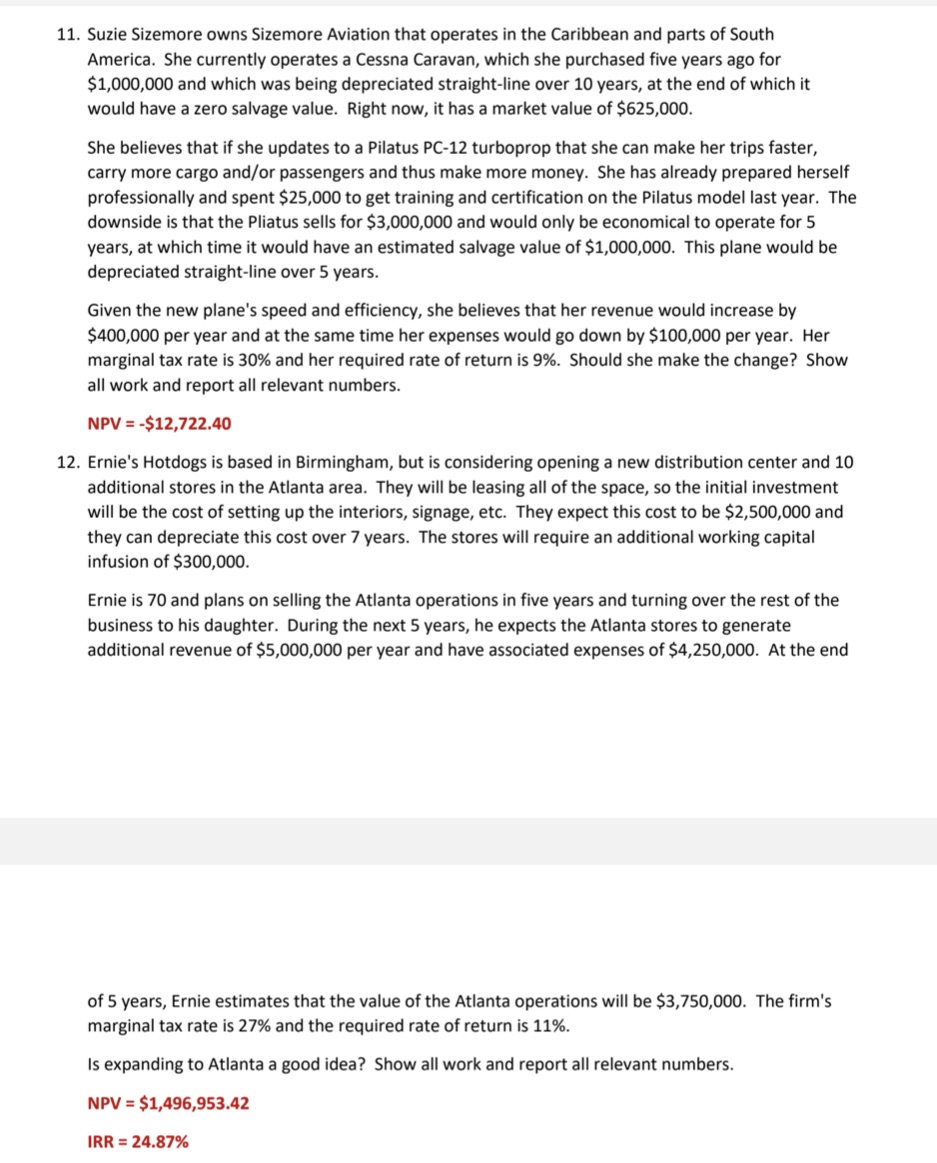

11. Suzie Sizemore owns Sizemore Aviation that operates in the Caribbean and parts of South America. She currently operates a Cessna Caravan, which she purchased five years ago for $1,000,000 and which was being depreciated straight-line over 10 years, at the end of which it would have a zero salvage value. Right now, it has a market value of $625,000. 12. She believes that if she updates to a Pilatus PC-12 turboprop that she can make her trips faster, carry more cargo and/or passengers and thus make more money. She has already prepared herself professionally and spent $25,000 to get training and certification on the Pilatus model last year. The downside is that the Pliatus sells for $3,000,000 and would only be economical to operate for 5 years, at which time it would have an estimated salvage value of $1,000,000. This plane would be depreciated straight-line over 5 years. Given the new plane's speed and efficiency, she believes that her revenue would increase by $400,000 per year and at the same time her expenses would go down by $100,000 per year. Her marginal tax rate is 30% and her required rate of return is 9%. Should she make the change? Show all work and report all relevant numbers. NPV = -$12,722.40 ie's Hotdogs is based Birmingham, but is considering opening a new distribution cent and 10 additional stores in the Atlanta area. They will be leasing all of the space, so the initial investment will be the cost of setting up the interiors, signage, etc. They expect this cost to be $2,500,000 and they can depreciate this cost over 7 years. The stores will require an additional working capital infusion of $300,000. Ernie is 70 and plans on selling the Atlanta operations in five years and turning over the rest of the business to his daughter. During the next 5 years, he expects the Atlanta stores to generate additional revenue of $5,000,000 per year and have associated expenses of $4,250,000. At the end of 5 years, Ernie estimates that the value of the Atlanta operations will be $3,750,000. The firm's marginal tax rate is 27% and the required rate of return is 11%. Is expanding to Atlanta a good idea? Show all work and report all relevant numbers. NPV = $1,496,953.42 IRR = 24.87%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets analyze each scenario Suzie Sizemores Decision Initial Investment Cost of new plane Pilatus PC12 3000000 Training and certification cost 25000 To...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started