Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11 The CEO of Garneau Cinemas is considering making a movie and must decide between a comedy and a thriller--it doesn't have the production space

11

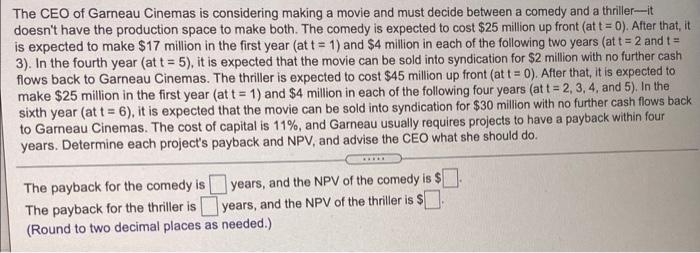

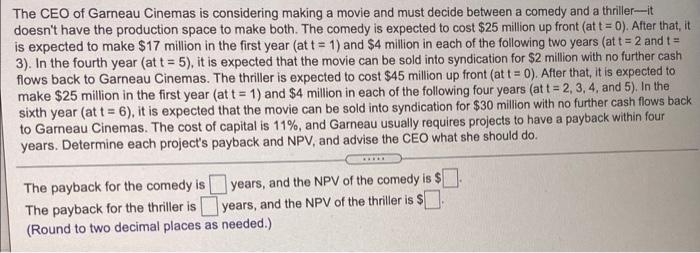

The CEO of Garneau Cinemas is considering making a movie and must decide between a comedy and a thriller--it doesn't have the production space to make both. The comedy is expected to cost $25 million up front (at t = 0). After that, it is expected to make $17 million in the first year (at t = 1) and $4 million in each of the following two years (at t = 2 and t- 3). In the fourth year (at t = 5), it is expected that the movie can be sold into syndication for $2 million with no further cash flows back to Garneau Cinemas. The thriller is expected to cost $45 million up front (at t = 0). After that, it is expected to make $25 million in the first year (at t = 1) and $4 million in each of the following four years (at t = 2, 3, 4, and 5). In the sixth year (at t = 6), it is expected that the movie can be sold into syndication for $30 million with no further cash flows back to Garneau Cinemas. The cost of capital is 11%, and Garneau usually requires projects to have a payback within four years. Determine each project's payback and NPV, and advise the CEO what she should do a The payback for the comedy is years, and the NPV of the comedy is $0 The payback for the thriller is years, and the NPV of the thriller is $[ (Round to two decimal places as needed.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started