Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.1 The firm of ICAEW Chartered Accountants where you work is expanding. Partners at the firm are in talks with a number of potential

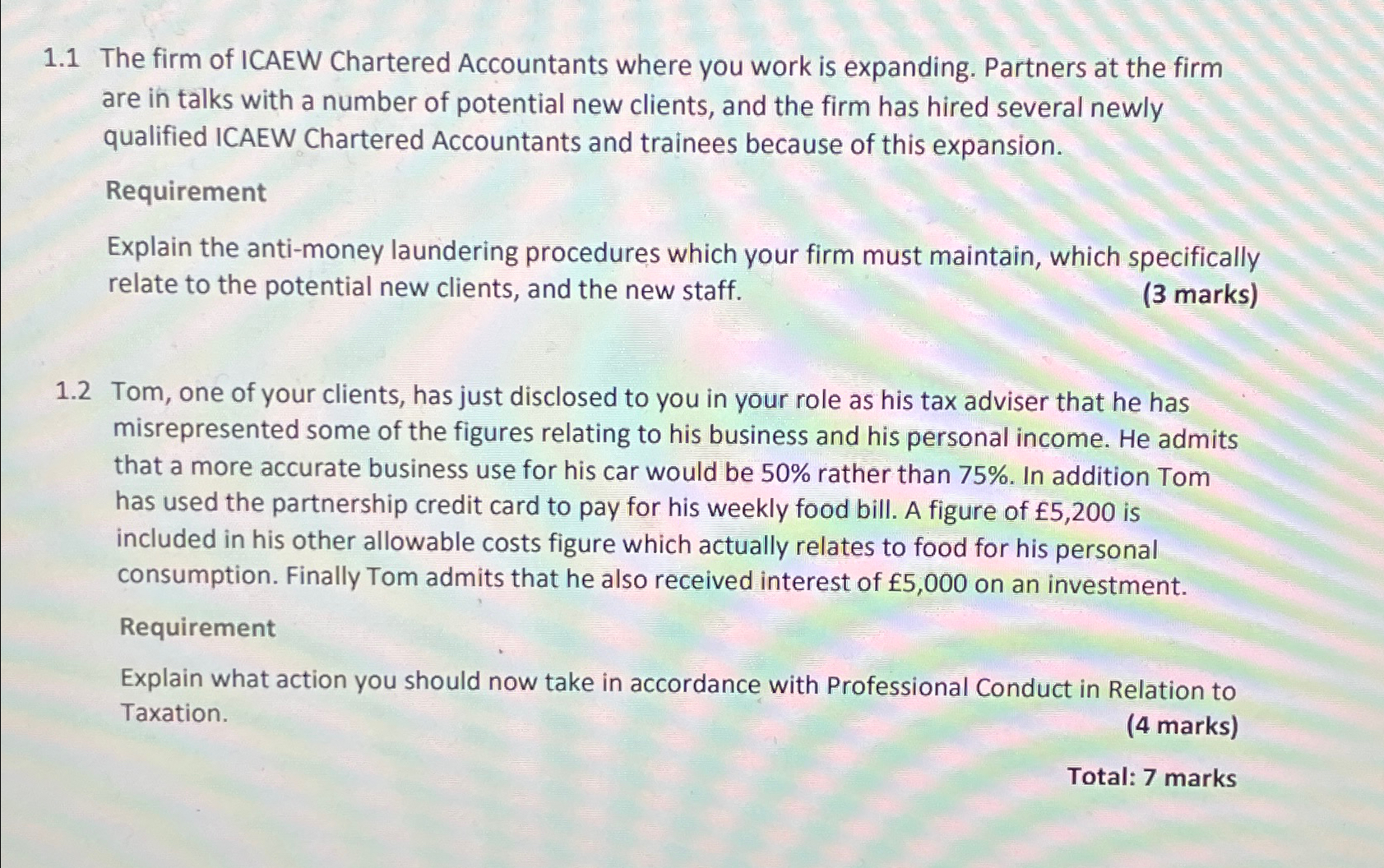

1.1 The firm of ICAEW Chartered Accountants where you work is expanding. Partners at the firm are in talks with a number of potential new clients, and the firm has hired several newly qualified ICAEW Chartered Accountants and trainees because of this expansion. Requirement Explain the anti-money laundering procedures which your firm must maintain, which specifically relate to the potential new clients, and the new staff. (3 marks) 1.2 Tom, one of your clients, has just disclosed to you in your role as his tax adviser that he has misrepresented some of the figures relating to his business and his personal income. He admits that a more accurate business use for his car would be 50% rather than 75%. In addition Tom has used the partnership credit card to pay for his weekly food bill. A figure of 5,200 is included in his other allowable costs figure which actually relates to food for his personal consumption. Finally Tom admits that he also received interest of 5,000 on an investment. Requirement Explain what action you should now take in accordance with Professional Conduct in Relation to Taxation. (4 marks) Total: 7 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

11 AntiMoney Laundering Procedures for Potential New Clients and New Staff To maintain compliance with antimoney laundering regulations our firm ICAEW Chartered Accountants must adhere to the followin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66427dd3d91c9_979833.pdf

180 KBs PDF File

66427dd3d91c9_979833.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started