Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11. The price of XYZ is $40. You have established the following position: Short 1 XYZ40 Call @ 1 If the delta of the call

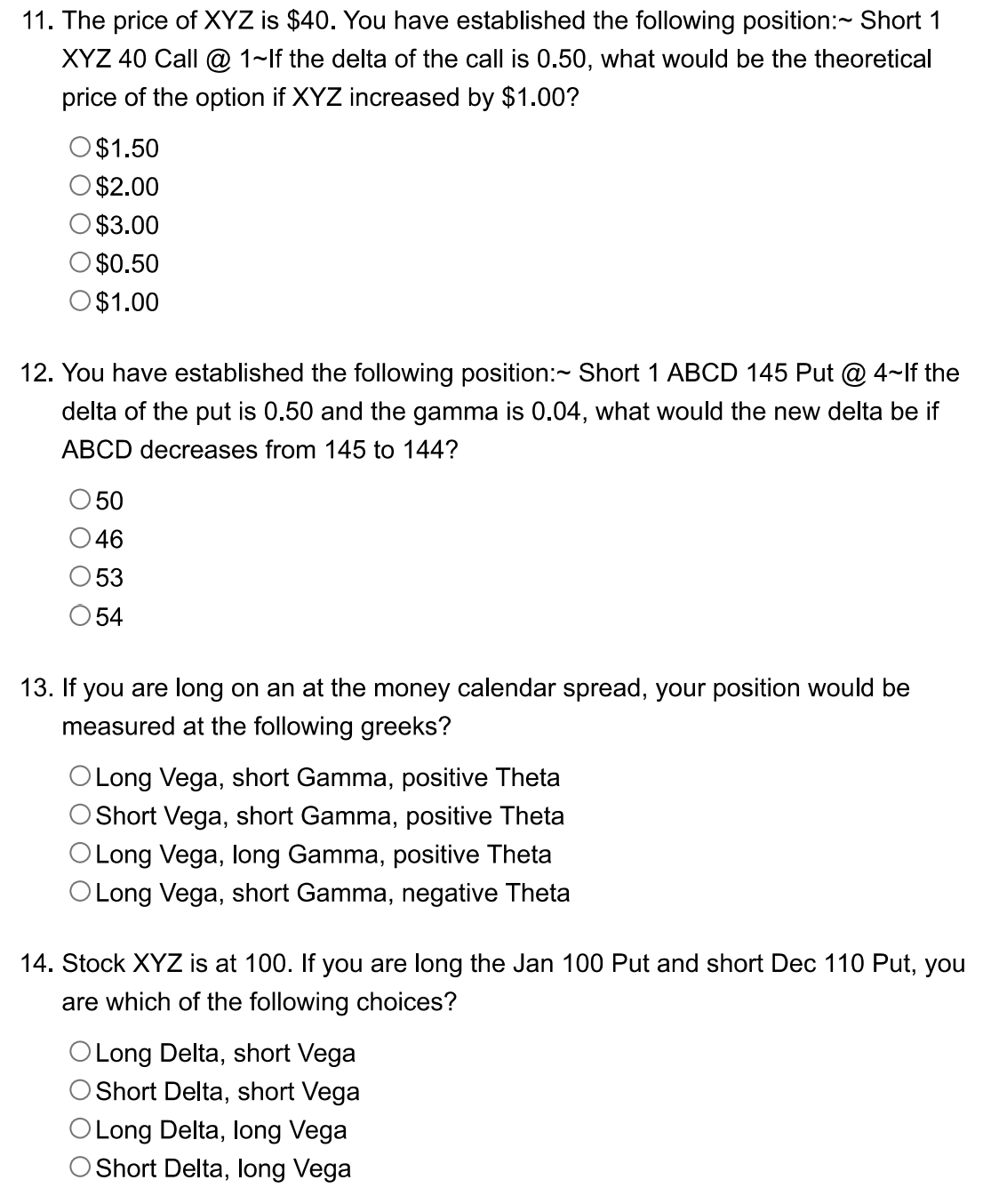

11. The price of XYZ is $40. You have established the following position: Short 1 XYZ40 Call @ 1 If the delta of the call is 0.50 , what would be the theoretical price of the option if XYZ increased by $1.00 ? $1.50$2.00$3.00$0.50$1.00 12. You have established the following position: Short 1 ABCD 145 Put @ 4 If the delta of the put is 0.50 and the gamma is 0.04 , what would the new delta be if ABCD decreases from 145 to 144 ? 50 46 53 54 13. If you are long on an at the money calendar spread, your position would be measured at the following greeks? Long Vega, short Gamma, positive Theta Short Vega, short Gamma, positive Theta Long Vega, long Gamma, positive Theta Long Vega, short Gamma, negative Theta 14. Stock XYZ is at 100. If you are long the Jan 100 Put and short Dec 110 Put, you are which of the following choices? Long Delta, short Vega Short Delta, short Vega Long Delta, long Vega Short Delta, long Vega

11. The price of XYZ is $40. You have established the following position: Short 1 XYZ40 Call @ 1 If the delta of the call is 0.50 , what would be the theoretical price of the option if XYZ increased by $1.00 ? $1.50$2.00$3.00$0.50$1.00 12. You have established the following position: Short 1 ABCD 145 Put @ 4 If the delta of the put is 0.50 and the gamma is 0.04 , what would the new delta be if ABCD decreases from 145 to 144 ? 50 46 53 54 13. If you are long on an at the money calendar spread, your position would be measured at the following greeks? Long Vega, short Gamma, positive Theta Short Vega, short Gamma, positive Theta Long Vega, long Gamma, positive Theta Long Vega, short Gamma, negative Theta 14. Stock XYZ is at 100. If you are long the Jan 100 Put and short Dec 110 Put, you are which of the following choices? Long Delta, short Vega Short Delta, short Vega Long Delta, long Vega Short Delta, long Vega Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started