Answered step by step

Verified Expert Solution

Question

1 Approved Answer

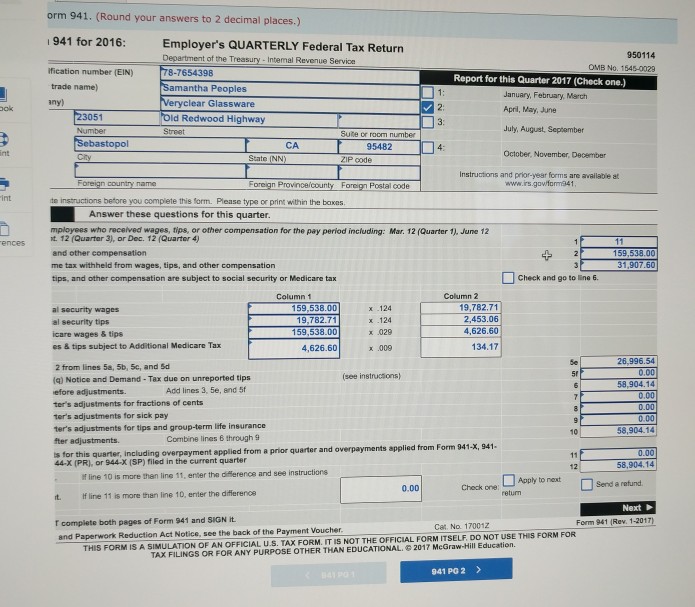

11. total deposits for this quarter, including overpayment applied from a prior quarter and overpayments applied from form 941-x, 941-x (pr) Check my work 0

11. total deposits for this quarter, including overpayment applied from a prior quarter and overpayments applied from form 941-x, 941-x (pr)

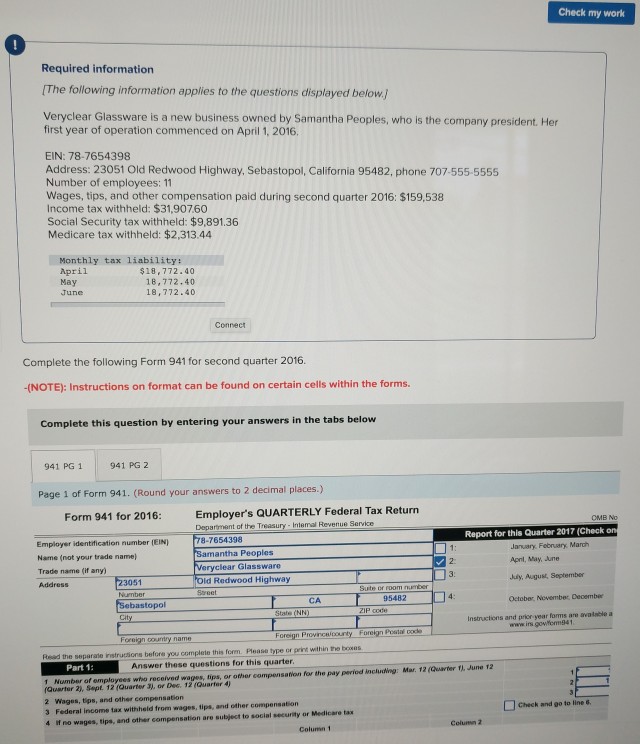

Check my work 0 Required information The following information applies to the questions displayed below.J Veryclear Glassware is a new business owned by Samantha Peoples, who is the company president. Her first year of operation commenced on April 1, 2016. EIN: 78-7654398 Address: 23051 Old Redwood Highway, Sebastopol, California 95482, phone 707-555-5555 Number of employees: 11 Wages, tips, and other compensation paid during second quarter 2016: $159,538 Income tax withheld: $31,90760 Social Security tax withheld: $9,891.36 Medicare tax withheld: $2,313.44 Monthly tax liability: April May June $18,772.40 18,772.40 18,772.40 Connect Complete the following Form 941 for second quarter 2016. (NOTE): Instructions on format can be found on certain cells within the forms. Complete this question by entering your answers in the tabs below 941 PG 1941 PG 2 Page 1 of Form 941. (Round your answers to 2 decimal places.) Employer's QUARTERLY Federal Tax Return Deparment of the Treasury Interral Revenue Serv Form 941 for 2016: MB No Report for this Quarter 2017 (Check on Employer identification number (EIN) Name (not your trade name) Trade name (if any) 78-7654398 Samantha Peoples Very Janvary. Febnuary March Apnl, May, June Judy, Augusr September October, Novembe: December 2: clear Glassware 3051 Redwood Highway CA 95482 bastopol Instructions and prior year foms are avalable a Foroign oournry name Read the separane rstrucions before you complete this form Prease type or grine within The boxes Answer these questions for this quarter yees who received wages, tips, or othor compensation for the pay period including: Mar. 12(Qater Th June 12 Part 1: (Quarter 2), Sept. 12 (Quarter 3), or DeG. 12 (Quarfer 4) 2 Wages, tips, and other compensation 3 Federal income tax withheld from wages, tips, and other compensation 4 if no wages, tips, and other compensation are subject to social security or Medicare tax Check and go to line . Column 2 Column Check my work 0 Required information The following information applies to the questions displayed below.J Veryclear Glassware is a new business owned by Samantha Peoples, who is the company president. Her first year of operation commenced on April 1, 2016. EIN: 78-7654398 Address: 23051 Old Redwood Highway, Sebastopol, California 95482, phone 707-555-5555 Number of employees: 11 Wages, tips, and other compensation paid during second quarter 2016: $159,538 Income tax withheld: $31,90760 Social Security tax withheld: $9,891.36 Medicare tax withheld: $2,313.44 Monthly tax liability: April May June $18,772.40 18,772.40 18,772.40 Connect Complete the following Form 941 for second quarter 2016. (NOTE): Instructions on format can be found on certain cells within the forms. Complete this question by entering your answers in the tabs below 941 PG 1941 PG 2 Page 1 of Form 941. (Round your answers to 2 decimal places.) Employer's QUARTERLY Federal Tax Return Deparment of the Treasury Interral Revenue Serv Form 941 for 2016: MB No Report for this Quarter 2017 (Check on Employer identification number (EIN) Name (not your trade name) Trade name (if any) 78-7654398 Samantha Peoples Very Janvary. Febnuary March Apnl, May, June Judy, Augusr September October, Novembe: December 2: clear Glassware 3051 Redwood Highway CA 95482 bastopol Instructions and prior year foms are avalable a Foroign oournry name Read the separane rstrucions before you complete this form Prease type or grine within The boxes Answer these questions for this quarter yees who received wages, tips, or othor compensation for the pay period including: Mar. 12(Qater Th June 12 Part 1: (Quarter 2), Sept. 12 (Quarter 3), or DeG. 12 (Quarfer 4) 2 Wages, tips, and other compensation 3 Federal income tax withheld from wages, tips, and other compensation 4 if no wages, tips, and other compensation are subject to social security or Medicare tax Check and go to line . Column 2 ColumnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started