Answered step by step

Verified Expert Solution

Question

1 Approved Answer

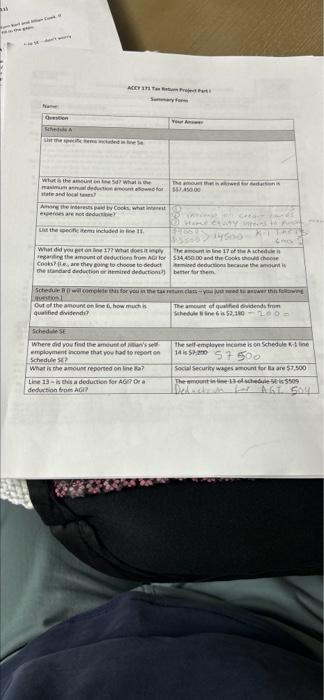

11) turn Karl and Jillian Cook. If fill in the gaps. r ule SE - don't worry Name: ACCY 171 Tax Return Project Part I

11) turn Karl and Jillian Cook. If fill in the gaps. r ule SE - don't worry Name: ACCY 171 Tax Return Project Part I Summary Form Question Schedule A List the specific items included in line 5a. What is the amount on line 5d? What is the maximum annual deduction amount allowed for state and local taxes? Among the interests paid by Cooks, what interest expenses are not deductible? List the specific items included in line 11. What did you get on line 17? What does it imply regarding the amount of deductions from AGI for Cooks? (i.e., are they going to choose to deduct the standard deduction or itemized deductions?) Out of the amount on line 6, how much is qualified dividends? Schedule SE Where did you find the amount of Jillian's self- employment income that you had to report on Schedule SE? What is the amount reported on line 8a? Your Answer Line 13- is this a deduction for AGI? Or a deduction from AGI? The amount that is allowed for deduction is $$7,450.00 Schedule B (I will complete this for you in the tax return class - you just need to answer this following question.) interest on credit cards Home equity interes to Purch New K-1 line E 14500 600 $9000 $5500 The amount in line 17 of the A schedule is $34,450.00 and the Cooks should choose itemized deductions because the amount is better for them. The amount of qualified dividends from Schedule B line 6 is $2,180 200 = The self-employee income is on Schedule K-1 line 14 is $7,200 57500 Social Security wages amount for 8a are $7,500 The amount in line 13 of schedule SE is $509 Deduction for AGI 509

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started