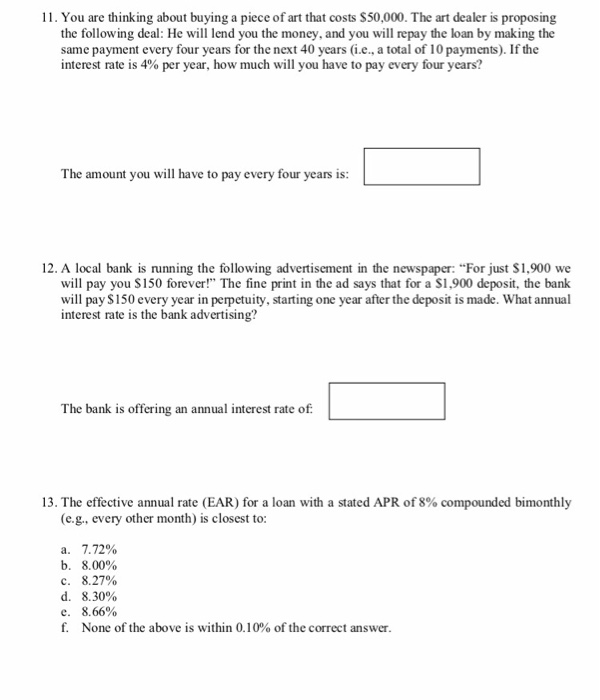

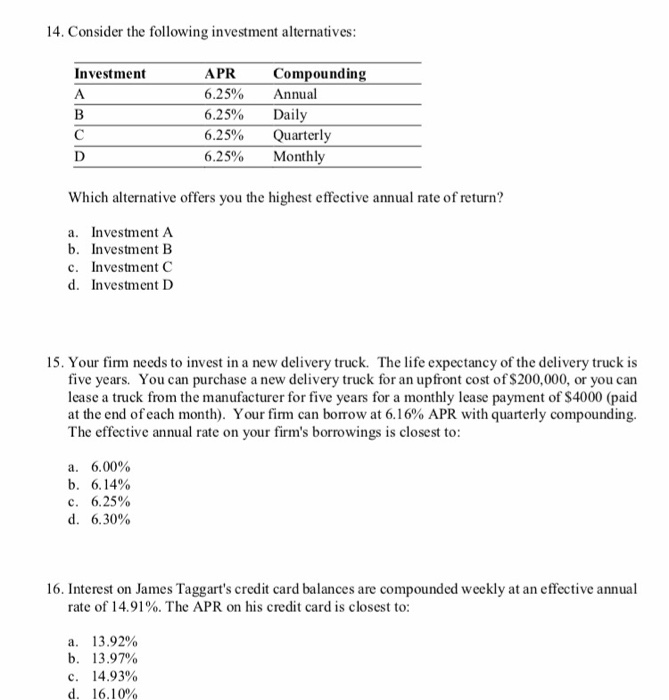

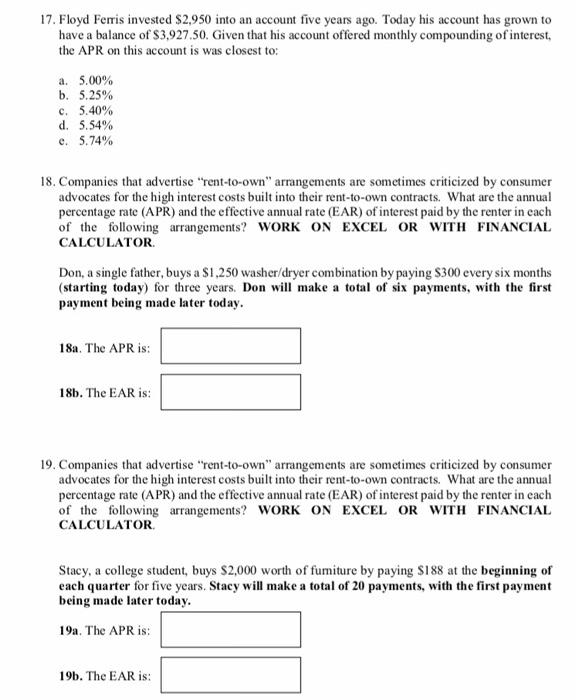

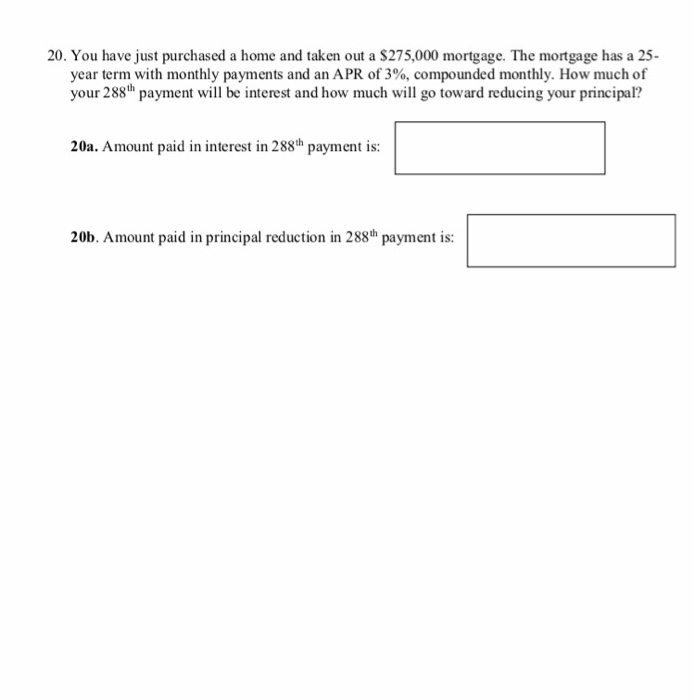

11. You are thinking about buying a piece of art that costs $50,000. The art dealer is proposing the following deal: He will lend you the money, and you will repay the loan by making the same payment every four years for the next 40 years (i.e., a total of 10 payments). If the interest rate is 4% per year, how much will you have to pay every four years? The amount you will have to pay every four years is: 12. A local bank is running the following advertisement in the newspaper: "For just S1,900 we will pay you S150 forever!" The fine print in the ad says that for a S1,900 deposit, the bank will pay $150 every year in perpetuity, starting one year after the deposit is made. What annual interest rate is the bank advertising? The bank is offering an annual interest rate of 13. The effective annual rate (EAR) for a loan with a stated APR of 8% compounded bimonthly (e.g., every other month) is closest to: a. 7.72% b. 8.00% . 8.27% d. 8.30% e. 8.66% f. None of the above is within 0.10% of the correct answer. 14. Consider the following investment alternatives: Investment APR 6.25% 6.25%, 6.25% 6.25% Compounding Annual Daily Quarterly Monthly Which alternative offers you the highest effective annual rate of return? a. Investment A b. Investment B c. Investment C d. Investment D 15. Your firm needs to invest in a new delivery truck. The life expectancy of the delivery truck is five years. You can purchase a new delivery truck for an upfront cost of S200,000, or you can lease a truck from the manufacturer for five years for a monthly lease payment of $4000 (paid at the end of each month). Your firm can borrow at 6.16% APR with quarterly compounding. The effective annual rate on your firm's borrowings is closest to a. b. c. d. 6.00% 6, 14% 6.25% 6.30% 16. Interest on James Taggart's credit card balances are compounded weekly at an effective annual rate of 14.91%. The APR on his credit card is closest to: b. c. d. 13.92% 13.97% 14.93% 16.10% 17. Floyd Ferris invested $2,950 into an account five years ago. Today his account has grown to have a balance of S3,927.50. Given that his account offered monthly compounding of interest, the APR on this account is was closest to: a. b. c. d. e. 5.00% 5.25% 5.40% 5.54% 5.74% 18. Companies that advertise rent-to-own" arrangements are sometimes criticized by consumer advocates for the high interest costs built into their rent-to-own contracts. What are the annual percentage rate (APR) and the effective annual rate (EAR) of interest paid by the renter in each of the following arrangements? WORK ON EXCEL OR WITH FINANCIAL CALCULATOR Don, a single father, buys a $1,250 washer/dryer combination by paying S300 every six months (starting today) for three years. Don wl make a total of six payments, with the first payment being made later today 18a. The APR is: 18b. The EAR is: 19. Companies that advertise "rent-to-own" arrangements are sometimes criticized by consumer advocates for the high interest costs built into their rent-to-own contracts. What are the annual percentage rate (APR) and the effective annual rate (EAR) of interest paid by the renter in each of the following arrangements? WORK ON EXCEL OR WTH FINANCIAL CALCULATOR. Stacy, a college student, buys $2,000 worth of fumiture by paying S188 at the beginning of each quarter for five years. Stacy will make a total of 20 payments, with the first payment being made later today 19a. The APR is 19b. The EAR is: 20. You have just purchased a home and taken out a $275,000 mortgage. The mortgage has a 25 year term with monthly payments and an APR of 3%, compounded monthly. How much of your 288h payment will be interest and how much will go toward reducing your principal? 20a. Amount paid in inerest in 2pament is 20b. Amount paid in principal reduction in 288th payment is