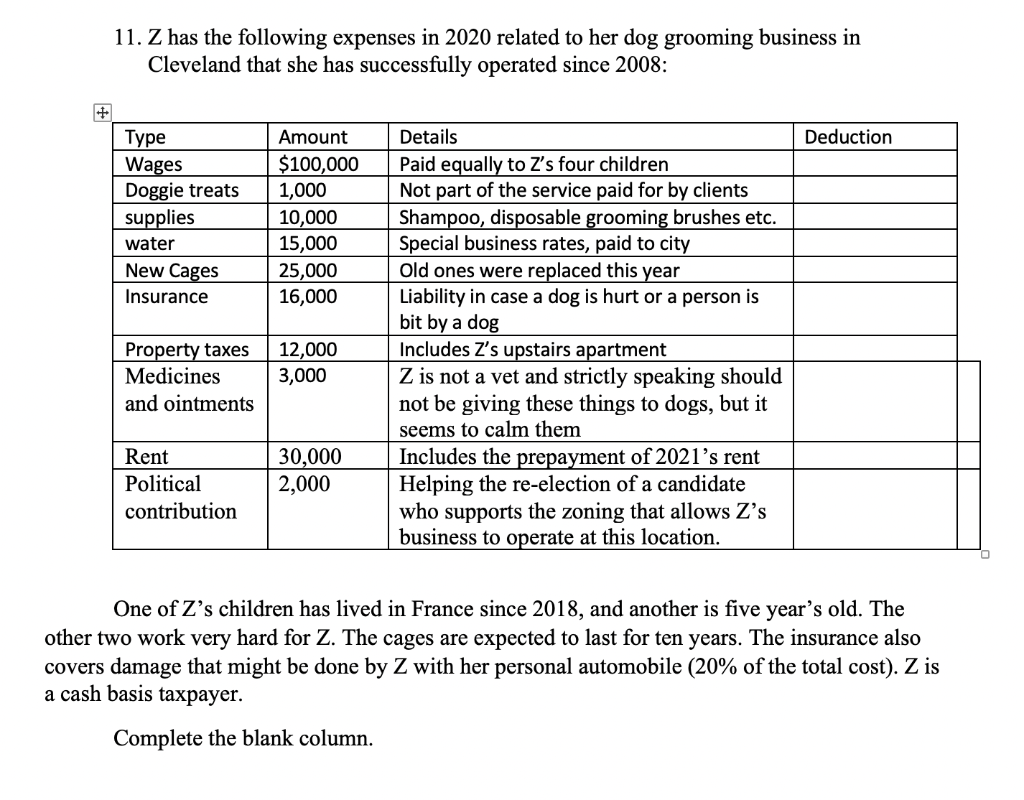

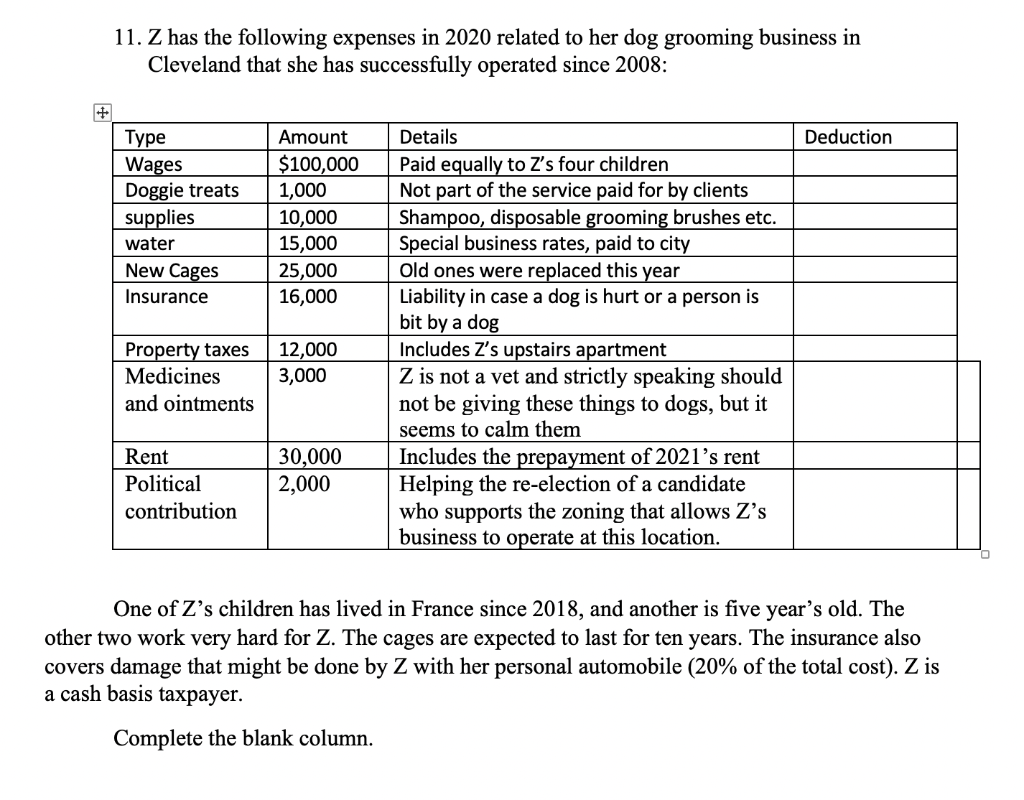

11. Z has the following expenses in 2020 related to her dog grooming business in Cleveland that she has successfully operated since 2008: Deduction Type Wages Doggie treats supplies water New Cages Insurance Amount $100,000 1,000 10,000 15,000 25,000 16,000 Details Paid equally to Z's four children Not part of the service paid for by clients Shampoo, disposable grooming brushes etc. Special business rates, paid to city Old ones were replaced this year Liability in case a dog is hurt or a person is bit by a dog Includes Z's upstairs apartment Z is not a vet and strictly speaking should not be giving these things to dogs, but it seems to calm them Includes the prepayment of 2021s rent Helping the re-election of a candidate who supports the zoning that allows Z's business to operate at this location. Property taxes Medicines and ointments 12,000 3,000 Rent Political contribution 30,000 2,000 One of Z's children has lived in France since 2018, and another is five year's old. The other two work very hard for Z. The cages are expected to last for ten years. The insurance also covers damage that might be done by Z with her personal automobile (20% of the total cost). Z is a cash basis taxpayer. Complete the blank column. 11. Z has the following expenses in 2020 related to her dog grooming business in Cleveland that she has successfully operated since 2008: Deduction Type Wages Doggie treats supplies water New Cages Insurance Amount $100,000 1,000 10,000 15,000 25,000 16,000 Details Paid equally to Z's four children Not part of the service paid for by clients Shampoo, disposable grooming brushes etc. Special business rates, paid to city Old ones were replaced this year Liability in case a dog is hurt or a person is bit by a dog Includes Z's upstairs apartment Z is not a vet and strictly speaking should not be giving these things to dogs, but it seems to calm them Includes the prepayment of 2021s rent Helping the re-election of a candidate who supports the zoning that allows Z's business to operate at this location. Property taxes Medicines and ointments 12,000 3,000 Rent Political contribution 30,000 2,000 One of Z's children has lived in France since 2018, and another is five year's old. The other two work very hard for Z. The cages are expected to last for ten years. The insurance also covers damage that might be done by Z with her personal automobile (20% of the total cost). Z is a cash basis taxpayer. Complete the blank column