Answered step by step

Verified Expert Solution

Question

1 Approved Answer

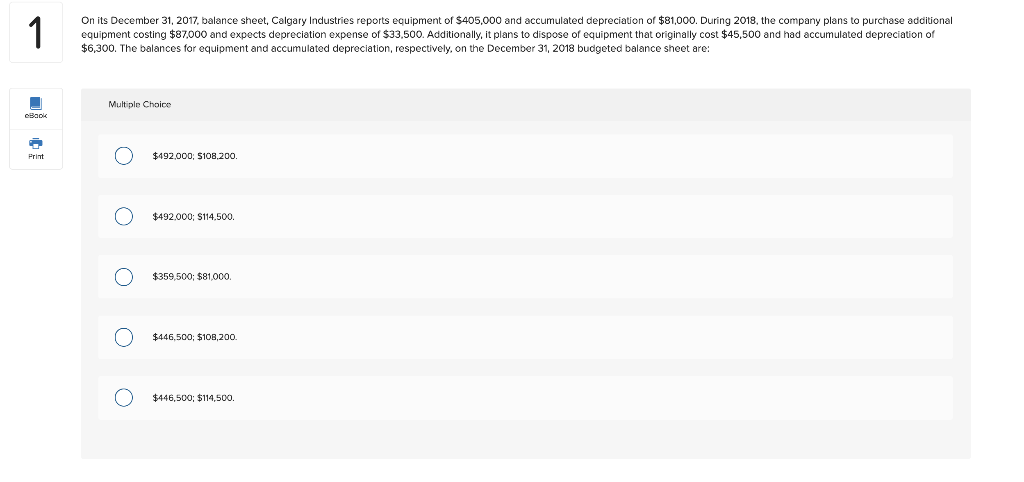

1-10? On its December 31, 2017, balance sheet, Calgary Industries reports equipment of $405,000 and accumulated depreciation of $81,000. During 2018, the company plans to

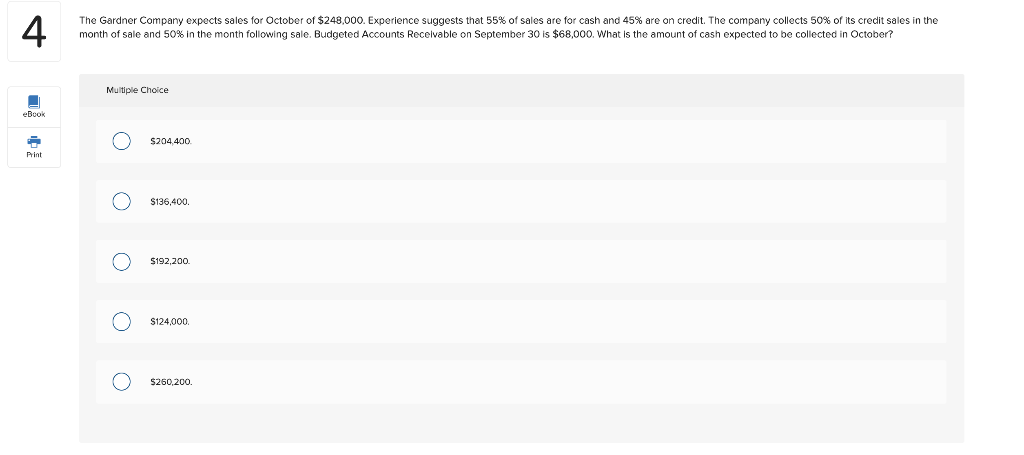

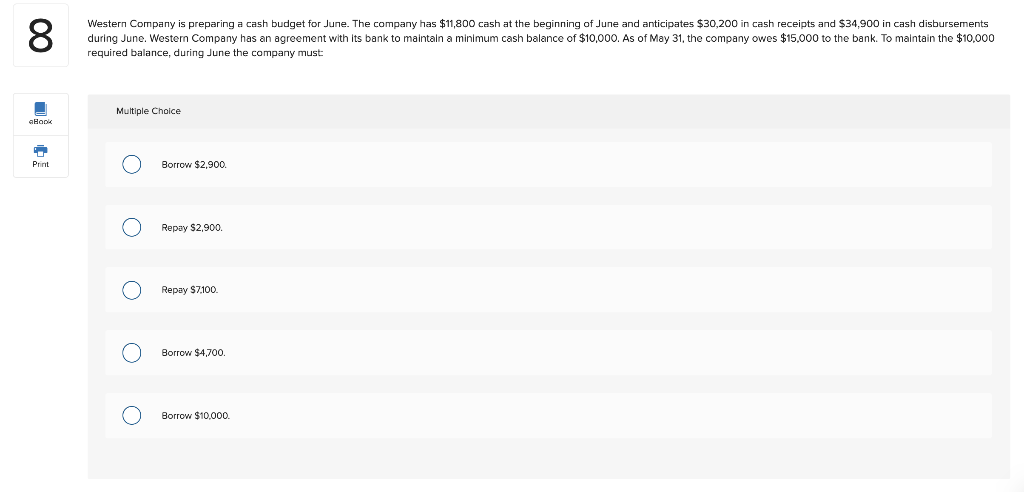

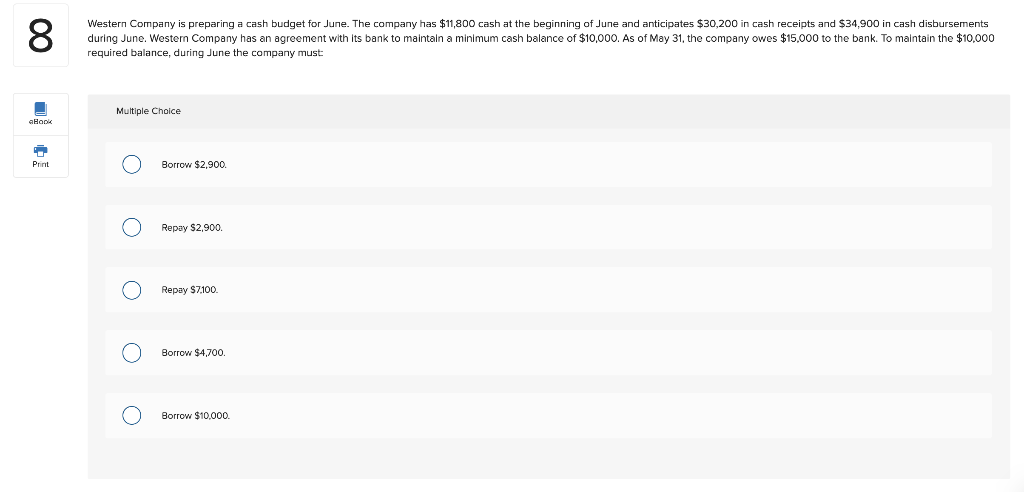

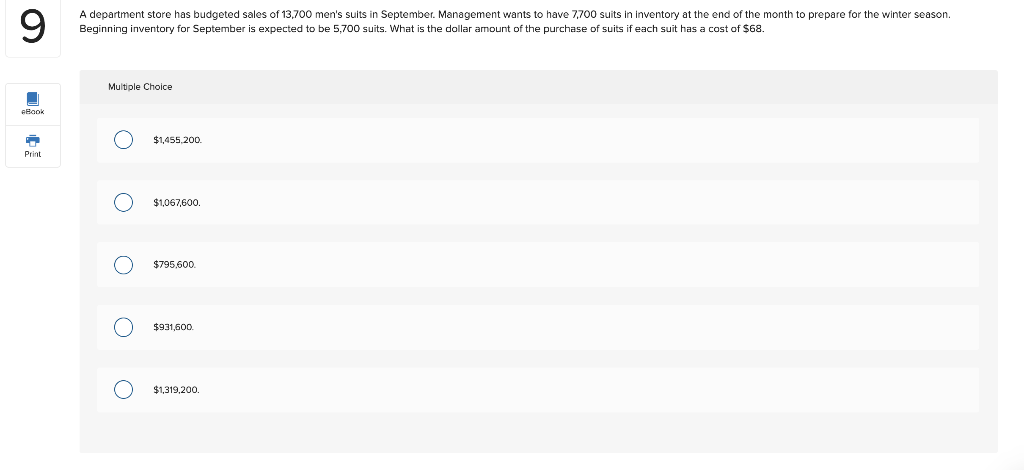

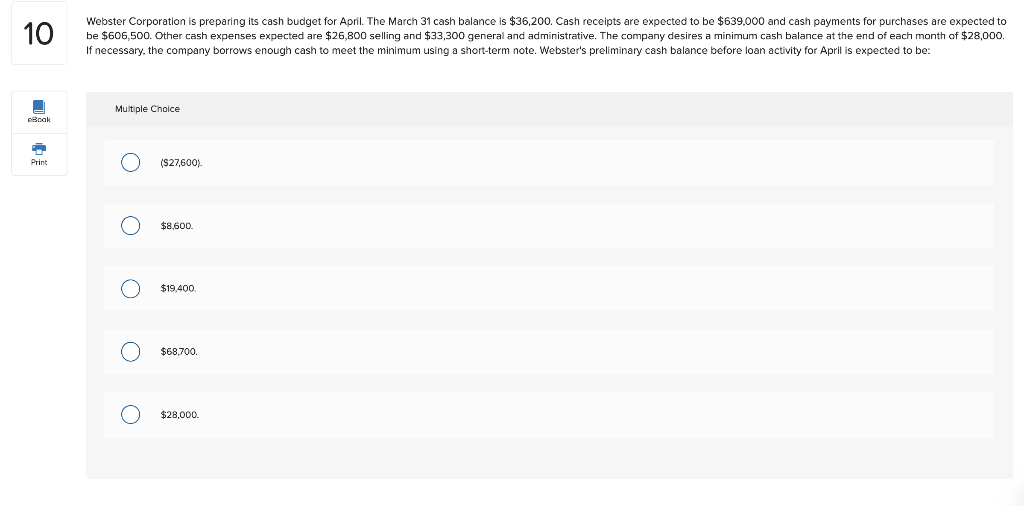

1-10?

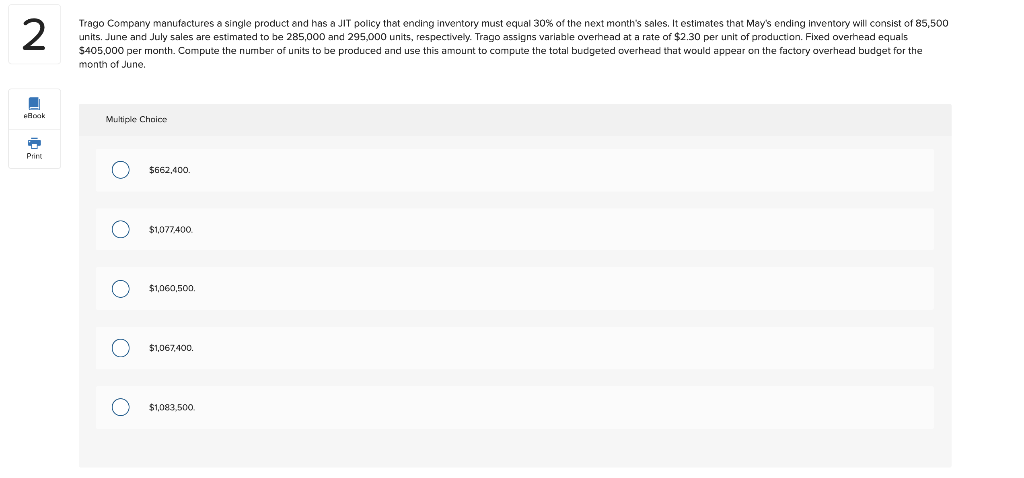

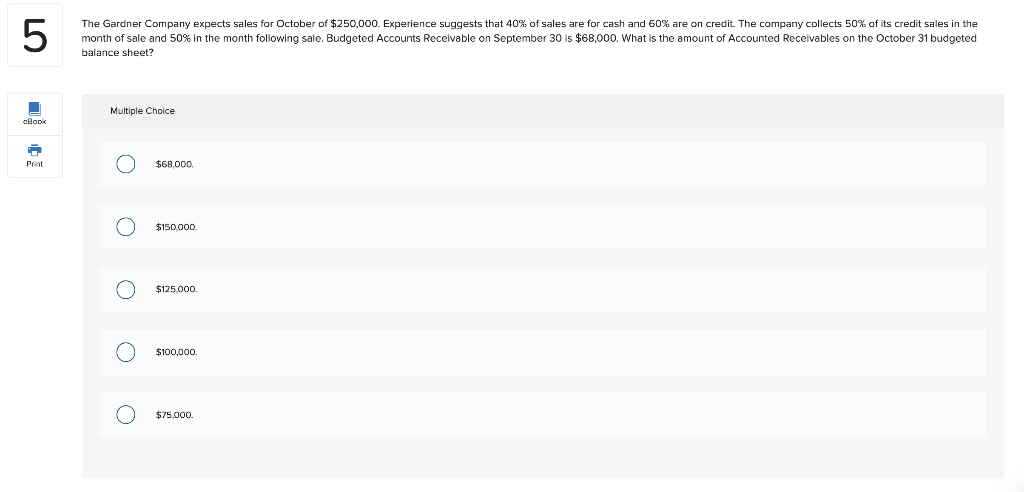

1-10?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started