Answered step by step

Verified Expert Solution

Question

1 Approved Answer

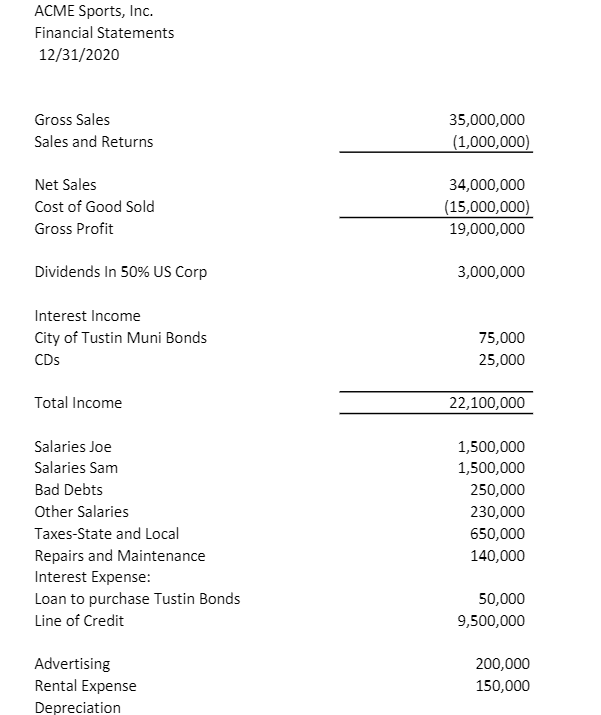

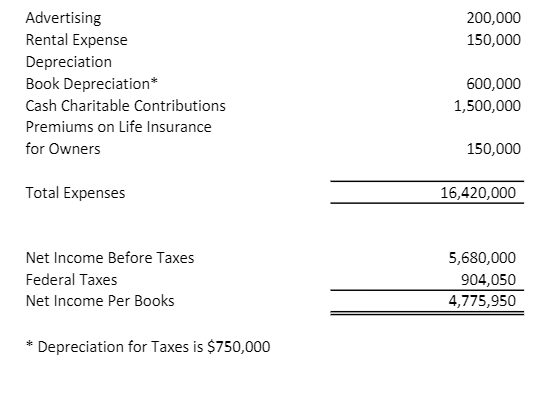

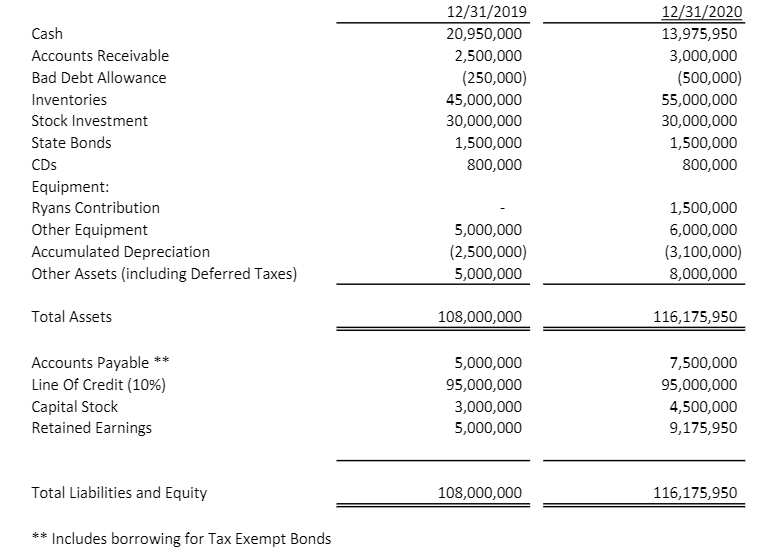

1120 U.S Corporation Income Tax Return, explain how you determined what is taxable, not taxable, deductible, or not deductible. ACME Sports, Inc. Financial Statements 12/31/2020

1120 U.S Corporation Income Tax Return, explain how you determined what is taxable, not taxable, deductible, or not deductible.

ACME Sports, Inc. Financial Statements 12/31/2020 Gross Sales Sales and Returns 35,000,000 (1,000,000) Net Sales Cost of Good Sold Gross Profit 34,000,000 (15,000,000) 19,000,000 Dividends In 50% US Corp 3,000,000 Interest Income City of Tustin Muni Bonds CDS 75,000 25,000 Total Income 22,100,000 Salaries Joe Salaries Sam Bad Debts Other Salaries Taxes-State and Local Repairs and Maintenance Interest Expense: Loan to purchase Tustin Bonds Line of Credit 1,500,000 1,500,000 250,000 230,000 650,000 140,000 50,000 9,500,000 Advertising Rental Expense Depreciation 200,000 150,000 200,000 150,000 Advertising Rental Expense Depreciation Book Depreciation* Cash Charitable contributions Premiums on Life Insurance for Owners 600,000 1,500,000 150,000 Total Expenses 16,420,000 Net Income Before Taxes Federal Taxes Net Income Per Books 5,680,000 904,050 4,775,950 * Depreciation for Taxes is $750,000 Cash Accounts Receivable Bad Debt Allowance Inventories Stock Investment State Bonds CDs Equipment: Ryans Contribution Other Equipment Accumulated Depreciation Other Assets (including Deferred Taxes) 12/31/2019 20,950,000 2,500,000 (250,000) 45,000,000 30,000,000 1,500,000 800,000 12/31/2020 13,975,950 3,000,000 (500,000) 55,000,000 30,000,000 1,500,000 800,000 5,000,000 (2,500,000) 5,000,000 1,500,000 6,000,000 (3,100,000) 8,000,000 Total Assets 108,000,000 116,175,950 Accounts Payable ** Line Of Credit (10%) Capital Stock Retained Earnings 5,000,000 95,000,000 3,000,000 5,000,000 7,500,000 95,000,000 4,500,000 9,175,950 Total Liabilities and Equity 108,000,000 116,175,950 ** Includes borrowing for Tax Exempt Bonds ACME Sports, Inc. Financial Statements 12/31/2020 Gross Sales Sales and Returns 35,000,000 (1,000,000) Net Sales Cost of Good Sold Gross Profit 34,000,000 (15,000,000) 19,000,000 Dividends In 50% US Corp 3,000,000 Interest Income City of Tustin Muni Bonds CDS 75,000 25,000 Total Income 22,100,000 Salaries Joe Salaries Sam Bad Debts Other Salaries Taxes-State and Local Repairs and Maintenance Interest Expense: Loan to purchase Tustin Bonds Line of Credit 1,500,000 1,500,000 250,000 230,000 650,000 140,000 50,000 9,500,000 Advertising Rental Expense Depreciation 200,000 150,000 200,000 150,000 Advertising Rental Expense Depreciation Book Depreciation* Cash Charitable contributions Premiums on Life Insurance for Owners 600,000 1,500,000 150,000 Total Expenses 16,420,000 Net Income Before Taxes Federal Taxes Net Income Per Books 5,680,000 904,050 4,775,950 * Depreciation for Taxes is $750,000 Cash Accounts Receivable Bad Debt Allowance Inventories Stock Investment State Bonds CDs Equipment: Ryans Contribution Other Equipment Accumulated Depreciation Other Assets (including Deferred Taxes) 12/31/2019 20,950,000 2,500,000 (250,000) 45,000,000 30,000,000 1,500,000 800,000 12/31/2020 13,975,950 3,000,000 (500,000) 55,000,000 30,000,000 1,500,000 800,000 5,000,000 (2,500,000) 5,000,000 1,500,000 6,000,000 (3,100,000) 8,000,000 Total Assets 108,000,000 116,175,950 Accounts Payable ** Line Of Credit (10%) Capital Stock Retained Earnings 5,000,000 95,000,000 3,000,000 5,000,000 7,500,000 95,000,000 4,500,000 9,175,950 Total Liabilities and Equity 108,000,000 116,175,950 ** Includes borrowing for Tax Exempt BondsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started