Answered step by step

Verified Expert Solution

Question

1 Approved Answer

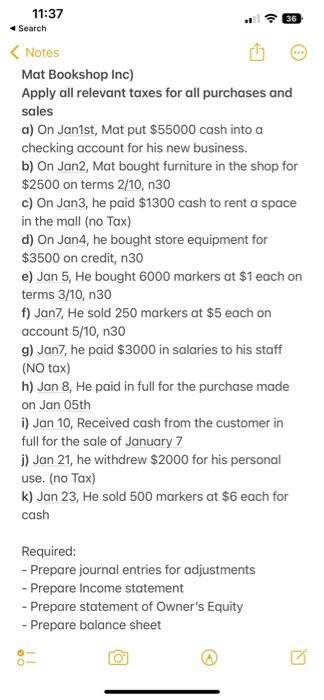

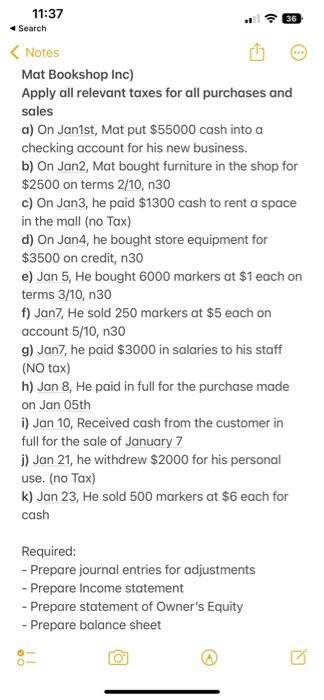

11:37 Search 4 Search Notes Mat Bookshop Inc) Apply all relevant taxes for all purchases and sales a) On Jan1st, Mat put $55000 cash into

11:37 Search

4 Search Notes Mat Bookshop Inc) Apply all relevant taxes for all purchases and sales a) On Jan1st, Mat put $55000 cash into a checking account for his new business. b) On Jan2, Mat bought furniture in the shop for $2500 on terms 2/10, n30 c) On Jan3, he paid $1300 cash to rent a space in the mall (no Tax) d) On Jan4, he bought store equipment for $3500 on credit, n30 e) Jan 5, He bought 6000 markers at $1 each on terms 3/10, n 30 f) Jan7, He sold 250 markers at $5 each on account 5/10,n30 g) Jan7, he paid $3000 in salaries to his staff (NO tax) h) Jan 8 , He paid in full for the purchase made on Jan 05th i) Jan 10, Received cash from the customer in full for the sale of January 7 . j) Jan 21 , he withdrew $2000 for his personal use. (no Tax) k) Jan 23 , He sold 500 markers at $6 each for cash Required: - Prepare journal entries for adjustments - Prepare Income statement - Prepare statement of Owner's Equity - Prepare balance sheet 4 Search Notes Mat Bookshop Inc) Apply all relevant taxes for all purchases and sales a) On Jan1st, Mat put $55000 cash into a checking account for his new business. b) On Jan2, Mat bought furniture in the shop for $2500 on terms 2/10, n30 c) On Jan3, he paid $1300 cash to rent a space in the mall (no Tax) d) On Jan4, he bought store equipment for $3500 on credit, n30 e) Jan 5, He bought 6000 markers at $1 each on terms 3/10, n 30 f) Jan7, He sold 250 markers at $5 each on account 5/10,n30 g) Jan7, he paid $3000 in salaries to his staff (NO tax) h) Jan 8 , He paid in full for the purchase made on Jan 05th i) Jan 10, Received cash from the customer in full for the sale of January 7 . j) Jan 21 , he withdrew $2000 for his personal use. (no Tax) k) Jan 23 , He sold 500 markers at $6 each for cash Required: - Prepare journal entries for adjustments - Prepare Income statement - Prepare statement of Owner's Equity - Prepare balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started