Answered step by step

Verified Expert Solution

Question

1 Approved Answer

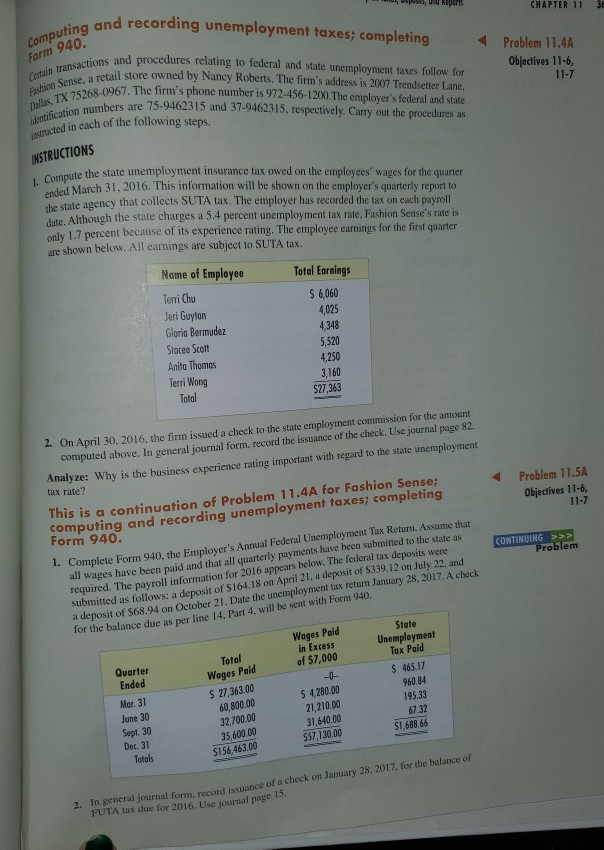

11.4A and 11.5A please! , , REDES CHAPTER 11 30 and recording unemployment taxes; completing Problem 11.4 Objectives 11-6, 11-7 Computing and re Form 940.

11.4A and 11.5A please!

, , REDES CHAPTER 11 30 and recording unemployment taxes; completing Problem 11.4 Objectives 11-6, 11-7 Computing and re Form 940. Certain transactions a Fashion Sense, a retail Dallas, TX 75268-0967 Mentification numbers sions and procedures relating to federal and state unemployment taxes follow for vetail store owned by Nancy Roberts. The firm's address is 2007 Trendsetter Lang 4 0967. The firm's phone number is 972-456-1200. The employer's federal and stara numbers are 75-9462315 and 37-9462315, respectively. Carry out the procedures as sted in each of the following steps. INSTRUCTIONS I. Compute the sta wse the state unemployment insurance tax owed on the employees' wages for the quarter March 31, 2016. This information will be shown on the employer's quarterly report to the state agency that collects SUTA tax. The employer has recorded the tax on each payroll date. Although the state charges a 5.4 percent unemployment tax rate, Fashion Sense's rate is only 1.7 percent because of its experience rating. The employee earnings for the first quarter are shown below. All earnings are subject to SUTA tax. Name of Employee Total Earnings Terri Chu $ 6,060 4,025 Jeri Guyton Gloria Bermudez 5,520 Stacee Scott 4,250 Anita Thomas 3,160 Terri Wong $27,363 Total 4348 - On April 30, 2016, the firm issued a check to the state employment commission for the amount computed above. In general journal form, record the issuance of the check. Use journal page 82 ze: Why is the business experience rating important with regard to the state unemployment tax rate? Problem 11.5A Objectives 11-6, 11-7 CONTINUING >>> Problem 1. Complete Form 940, the find that all quarterly pays below. The federa This is a continuation of Problem 11.4A for Fashion Sense computing and recording unemployment taxes; completing Form 940. Complete Form 9.40. the Emplover's Annual Federal Unemployment Tax Return. Assume all wages have been naid and that all quarterly payments have been submitted to the state as required. The payroll information for 2016 appears below. The federal tax deposits were submitted as follows: a deposit of $164.18 on April 21, a deposit of $339.12 on July 22 and a deposit of $68.94 on October 21. Date the unemployment tax return January 28, 2017 Acheck for the balance dues par line 14. Part 4, will be sent with Form 940. mation to A.18 on employers Form Wages Paid In Excess of $7,000 Quarter State Unemployment Tex Paid $ 465.17 960.84 195.33 67.32 $1,688.66 Total Wages Paid S 27,363.00 60,800.00 32,700.00 35,600.00 $156,463.00 Ended Mar. 31 June 30 Sept. 30 Dec 31 Totals $ 4,280.00 21,210.00 31,640.00 $57,130.00 2. In general journal form record issuance of a check on January 28, 2017 for the balance of FUTA tax due for 2016. Use journal page 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started