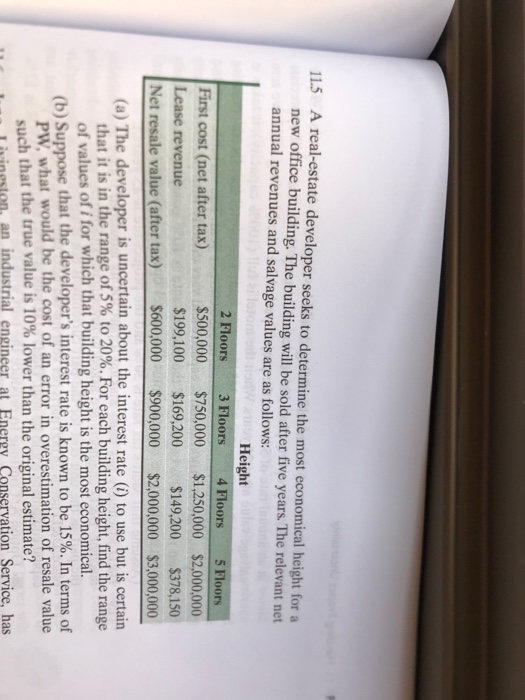

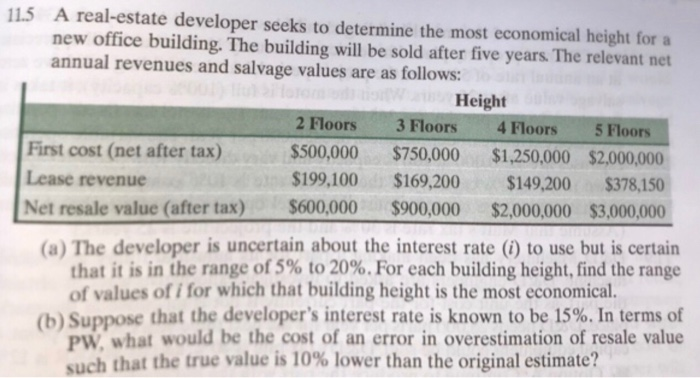

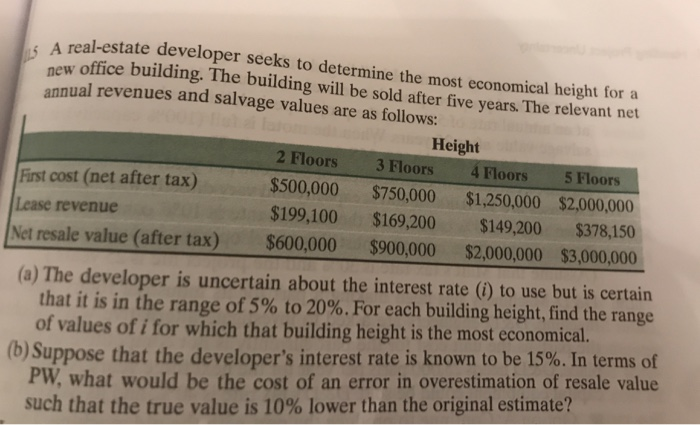

11.5 A real-estate developer seeks to determine the most economical height for a new office building. The building will be sold after five years. The relevant net annual revenues and salvage values are as follows: ESTE Height 2 Floors 3 Floors 4 Floors 5 Floors First cost (net after tax) $500,000 $750,000 $1,250,000 $2,000,000 Lease revenue $199,100 $169,200 $149,200 $378,150 Net resale value (after tax) $600,000 $900,000 $2,000,000 $3,000,000 (a) The developer is uncertain about the interest rate (i) to use but is certain that it is in the range of 5% to 20%. For each building height, find the range of values of i for which that building height is the most economical. (b) Suppose that the developer's interest rate is known to be 15%. In terms of PW, what would be the cost of an error in overestimation of resale value such that the true value is 10% lower than the original estimate? Livingston, an industrial engineer at Energy Conservation Service, has 11.5 A real-estate developer seeks to determine the most economical height for a new office building. The building will be sold after five years. The relevant net annual revenues and salvage values are as follows: Height 2 Floors 3 Floors 4 Floors 5 Floors First cost (net after tax) $500,000 $750,000 $1,250,000 $2,000,000 Lease revenue $199,100 $169,200 $149,200 $378,150 Net resale value (after tax) $600,000 $900,000 $2,000,000 $3,000,000 (a) The developer is uncertain about the interest rate (i) to use but is certain that it is in the range of 5% to 20%. For each building height, find the range of values of i for which that building height is the most economical. (b) Suppose that the developer's interest rate is known to be 15%. In terms of PW. what would be the cost of an error in overestimation of resale value such that the true value is 10% lower than the original estimate? real-estate developer seeks to determine the most economical height for a new office building. The building will be sold after five years. The relevant net annual revenues and salvage values are as follows: Height 2 Floors 3 Floors 4 Floors 5 Floors First cost (net after tax) $500,000 $750,000 $1,250,000 $2,000,000 Lease revenue $199,100 $169,200 $149,200 $378,150 Net resale value (after tax) $600,000 $900,000 $2,000,000 $3,000,000 (a) The developer is uncertain about the interest rate (i) to use but is certain that it is in the range of 5% to 20%. For each building height, find the range of values of i for which that building height is the most economical. (b) Suppose that the developer's interest rate is known to be 15%. In terms of PW, what would be the cost of an error in overestimation of resale value such that the true value is 10% lower than the original estimate