Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11-51 a and b please Assuming that total joint costs of $384,000 were allocated using the sales value at split-off Required (net realizable value method),

11-51 a and b please

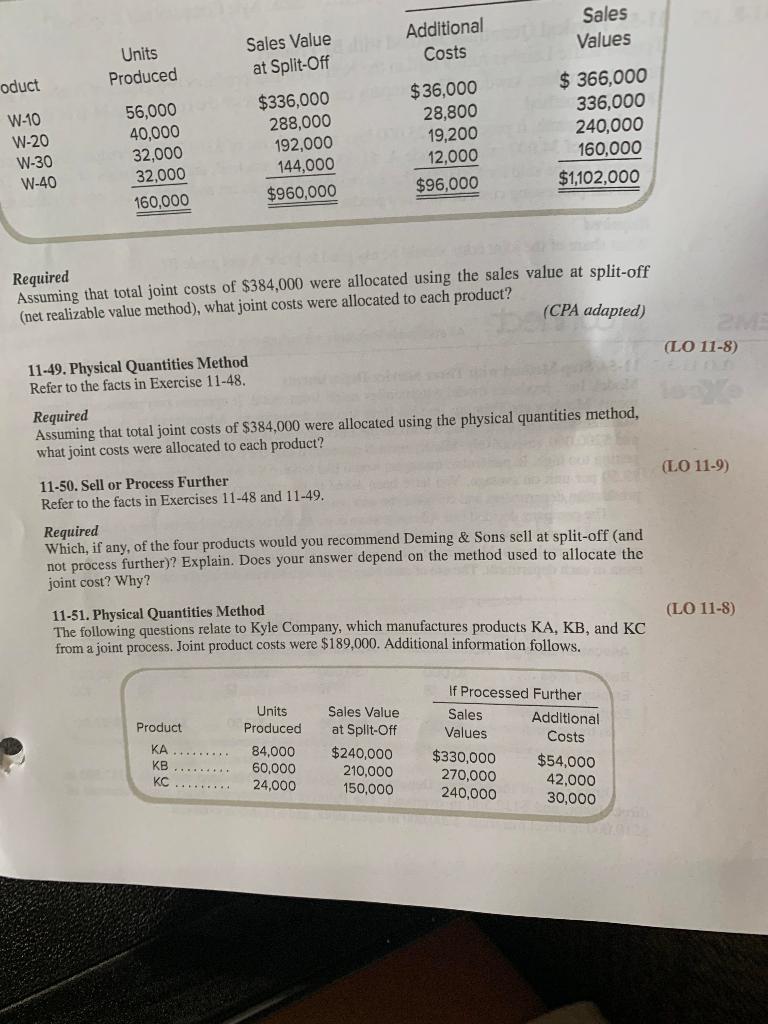

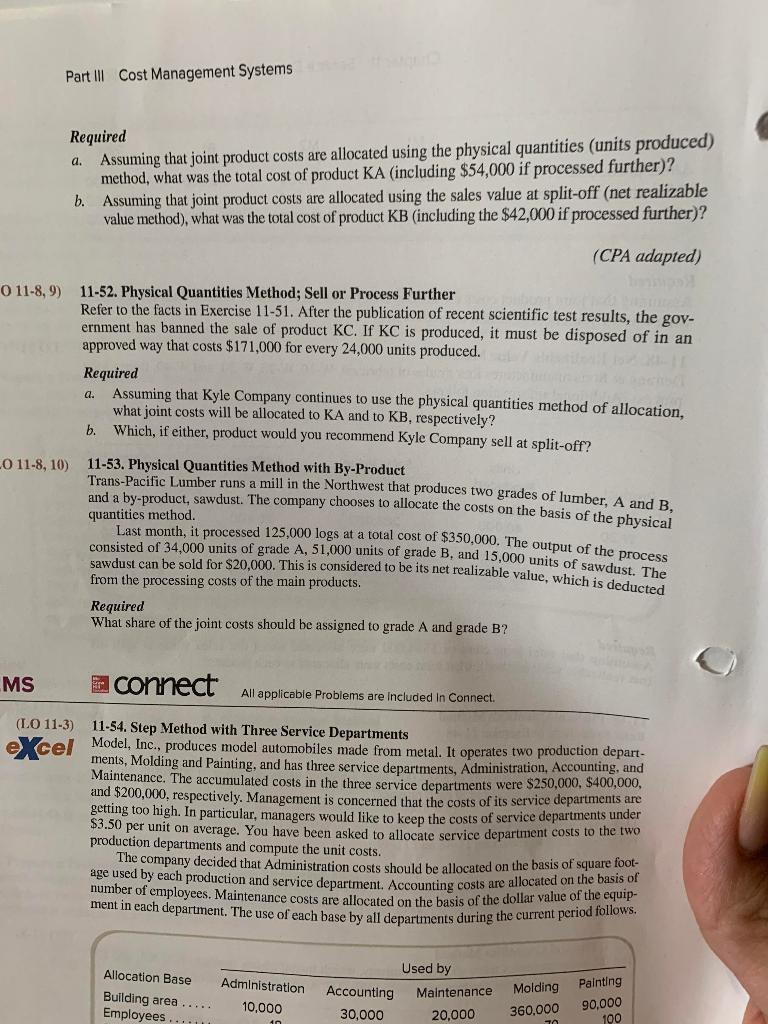

Assuming that total joint costs of $384,000 were allocated using the sales value at split-off Required (net realizable value method), what joint costs were allocated to each product? (CPA adapted) (LO 11-8) 11-49. Physical Quantities Method Refer to the facts in Exercise 11-48. Assuming that total joint costs of $384,000 were allocated using the physical quantities method, Required what joint costs were allocated to each product? (LO119) 11-50. Sell or Process Further Refer to the facts in Exercises 11-48 and 11-49. Required Which, if any, of the four products would you recommend Deming \& Sons sell at split-off (and not process further)? Explain. Does your answer depend on the method used to allocate the joint cost? Why? 11-51. Physical Quantities Method (LO 11-8) The following questions relate to Kyle Company, which manufactures products KA,KB, and KC from a joint process. Joint product costs were $189,000. Additional information follows. Part III Cost Management Systems Required a. Assuming that joint product costs are allocated using the physical quantities (units produced) method, what was the total cost of product KA (including $54,000 if processed further)? b. Assuming that joint product costs are allocated using the sales value at split-off (net realizable value method), what was the total cost of product KB (including the $42,000 if processed further)? (CPA adapted) 11-8, 9) 11-52. Physical Quantities Method; Sell or Process Further Refer to the facts in Exercise 11-51. After the publication of recent scientific test results, the government has banned the sale of product KC. If KC is produced, it must be disposed of in an approved way that costs $171,000 for every 24,000 units produced. Required a. Assuming that Kyle Company continues to use the physical quantities method of allocation, what joint costs will be allocated to KA and to KB, respectively? b. Which, if either, product would you recommend Kyle Company sell at split-off? 11-8, 10) 11-53. Physical Quantities Method with By-Product Trans-Pacific Lumber runs a mill in the Northwest that produces two grades of lumber, A and B, and a by-product, sawdust. The company chooses to allocate the costs on the basis of the physical Last month, it processed 125,000 logs at a total cost of $350,000. The output of the process consisted of 34,000 units of grade A, 51,000 units of grade B, and 15,000 units of sawdust. The sawdust can be sold for $20,000. This is considered to be its net realizable value, which is deducted from the processing costs of the main products. Required What share of the joint costs should be assigned to grade A and grade B? Cicitict All applicable Problems are Included In Connect. (LO 11-3) 11-54. Step Method with Three Service Departments Model, Inc., produces model automobiles made from metal. It operates two production departments, Molding and Painting, and has three service departments, Administration, Accounting, and Maintenance. The accumulated costs in the three service departments were $250,000,$400,000, and $200,000, respectively. Management is concerned that the costs of its service departments are getting too high. In particular, managers would like to keep the costs of service departments under $3.50 per unit on average. You have been asked to allocate service department costs to the two production departments and compute the unit costs. The company decided that Administration costs should be allocated on the basis of square footage used by each production and service department. Accounting costs are allocated on the basis of number of employees. Maintenance costs are allocated on the basis of the dollar value of the equipment in each department. The use of each base by all departments during the current period followsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started