Answered step by step

Verified Expert Solution

Question

1 Approved Answer

117. At December 31, 2017, Sue's Boutique had 1,500 gift certificates outstanding, which had been sold to customers during 2017 for $60 each. Sue's

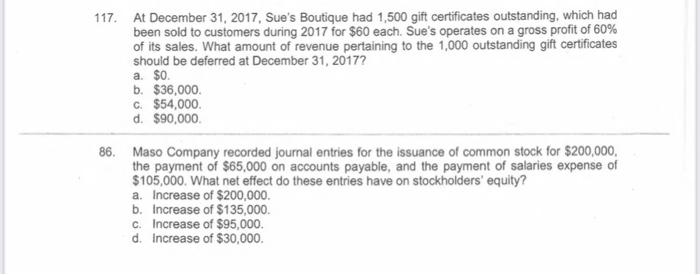

117. At December 31, 2017, Sue's Boutique had 1,500 gift certificates outstanding, which had been sold to customers during 2017 for $60 each. Sue's operates on a gross profit of 60% of its sales. What amount of revenue pertaining to the 1,000 outstanding gift certificates should be deferred at December 31, 2017? a. $0. b. $36,000. c. $54,000. d. $90,000. 86. Maso Company recorded journal entries for the issuance of common stock for $200,000, the payment of $65,000 on accounts payable, and the payment of salaries expense of $105,000. What net effect do these entries have on stockholders' equity? a. Increase of $200,000. b. Increase of $135,000. c. Increase of $95,000. d. increase of $30,000.

Step by Step Solution

★★★★★

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

117Deferred revenue is amount of revenue which is received in advanc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started