11-72 (Inventory Cutoff Problem, LO 10) The auditor has gathered shipping cutoff information for Johnny M. Golf Company in conjunction with its December 31 year

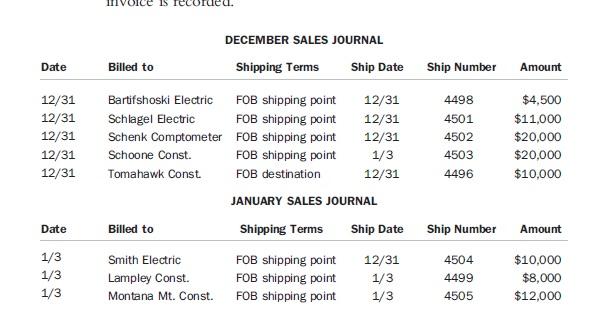

11-72 (Inventory Cutoff Problem, LO 10) The auditor has gathered shipping cutoff information for Johnny M. Golf Company in conjunction with its December 31 year end. The auditor has observed the client’s year-end physical inventory and is satisfied with the client’s inventory procedures. The client has adjusted the year-end book value to the physical inventory compilation (book to physical adjustment) so that the account balance at year end equals the physical count. For purposes of analysis, you should assume that all items have a gross margin of 30%. The last shipping document and bill of lading used during the current year is 4500 and is the primary evidence regarding whether the goods were shipped before or after inventory. All shipping documents are sequentially numbered, and the auditor has established that the client uses them in order. The shipping date listed in the journal is the date recorded on the sales invoice. Cost of goods sold is recorded at the same time the invoice is recorded.

Required

a. Briefly discuss why the auditor would rely on the shipping document number instead of the recorded shipping date as the primary evidence of whether the goods were shipped before or after inventory. There should be a bill of lading to show the transfer from the vendor to the customer. It should be signed to show the transaction actually occurred.

b. Identify the items that should be adjusted. Prepare a journal entry to record the adjustments to cost of goods sold, inventory, accounts receivable, and sales based on the preceding data. Prepare the journal entries needed only for the December 31 year end.

c. Assume that the client took physical inventory on October 31 and adjusted the books to the physical inventory at that time. Given the information from the December and January sales journals,

prepare the necessary year-end adjusting entries. Why are the entries different from those suggested for part (b)?

is recorded. DECEMBER SALES JOURNAL Date Billed to Shipping Terms Ship Date Ship Number Amount 12/31 Bartifshoski Electric FOB shipping point 12/31 4498 $4,500 12/31 Schlagel Electric FOB shipping point 12/31 4501 $11,000 12/31 Schenk Comptometer FOB shipping point 12/31 4502 $20,000 12/31 Schoone Const. FOB shipping point 1/3 4503 $20,000 12/31 Tomahawk Const. FOB destination 12/31 4496 $10,000 JANUARY SALES JOURNAL Date Billed to Shipping Terms Ship Date Ship Number Amount 1/3 Smith Electric FOB shipping point 12/31 4504 $10,000 1/3 Lampley Const. FOB shipping point 1/3 4499 $8,000 1/3 Montana Mt. Const. FOB shipping point 1/3 4505 $12,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution Adjustments for Inventory Cutoff Problem Part a Why Auditor Relies on Shipping Document Num...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started