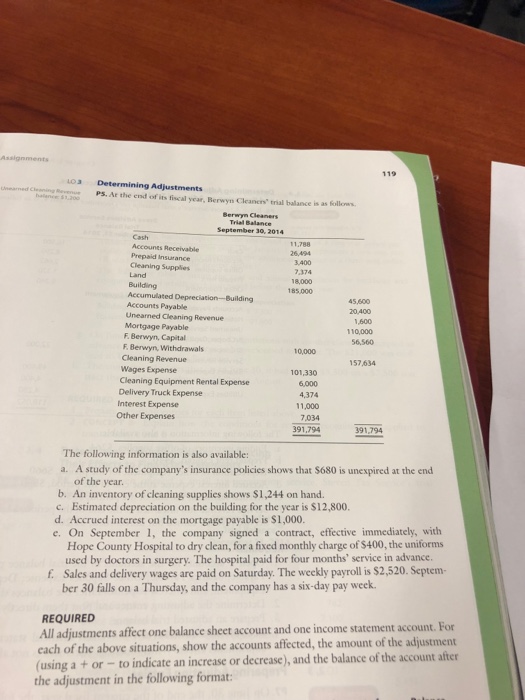

119 Loa Determining Adjustments ednPS. Ar the end of its fiscal year, Berwyn Cleaners' trial balance is as Kollones balence: 51.20 Berwyn Cleaners Accounes Receivable 26,494 3,400 Prepaid Insurance Cleaning Supplies Land Building 185000 Accumulated Depreciation-Building 45,600 Accounts Payable Unearned Cleaning Revenue 1,600 110,000 Mortgage Payable F. Berwyn, Capital F. Berwyn, Withdrawals Cleaning Revenue Wages Expense Cleaning Equipment Rental Expense Delivery Truck Expense 10,000 5560 57,634 101,330 6,000 4,374 11,000 7,034 Interest Expense Other Expenses 391,/794 391.294 391,794 The following information is also available: a. A study of the company's insurance policies shows that $680 is unexpired at the end of the year b. An inventory of cleaning supplies shows $1,244 on hand. c. Estimated depreciation on the building for the year is $12,800. d. Accrued interest on the mortgage payable is $1,000. e. On September 1, the company signed a contract, effective immediately, witlh Hope County Hospital to dry clean, for a fixed monthly charge of $400, the uniforms used by doctors in surgery. The hospital paid for four months' service in advance. f. Sales and delivery wages are paid on Saturday. The weekly payroll is $2,520. Septem ber 30 falls on a Thursday, and the company has a six-day pay week. REQUIRED All adjustments affect one balance sheet account and one income statement account., For each of the above situations, show the accounts affected, the amount of the adjustment the adjustment in the following format 119 Loa Determining Adjustments ednPS. Ar the end of its fiscal year, Berwyn Cleaners' trial balance is as Kollones balence: 51.20 Berwyn Cleaners Accounes Receivable 26,494 3,400 Prepaid Insurance Cleaning Supplies Land Building 185000 Accumulated Depreciation-Building 45,600 Accounts Payable Unearned Cleaning Revenue 1,600 110,000 Mortgage Payable F. Berwyn, Capital F. Berwyn, Withdrawals Cleaning Revenue Wages Expense Cleaning Equipment Rental Expense Delivery Truck Expense 10,000 5560 57,634 101,330 6,000 4,374 11,000 7,034 Interest Expense Other Expenses 391,/794 391.294 391,794 The following information is also available: a. A study of the company's insurance policies shows that $680 is unexpired at the end of the year b. An inventory of cleaning supplies shows $1,244 on hand. c. Estimated depreciation on the building for the year is $12,800. d. Accrued interest on the mortgage payable is $1,000. e. On September 1, the company signed a contract, effective immediately, witlh Hope County Hospital to dry clean, for a fixed monthly charge of $400, the uniforms used by doctors in surgery. The hospital paid for four months' service in advance. f. Sales and delivery wages are paid on Saturday. The weekly payroll is $2,520. Septem ber 30 falls on a Thursday, and the company has a six-day pay week. REQUIRED All adjustments affect one balance sheet account and one income statement account., For each of the above situations, show the accounts affected, the amount of the adjustment the adjustment in the following format