1 2 3 4 5 6 EA11. LO 11.4 The following intangible assets were purchased by Goldstein Corporation: A. A patent with a remaining

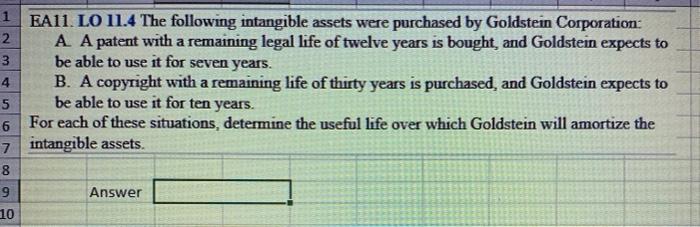

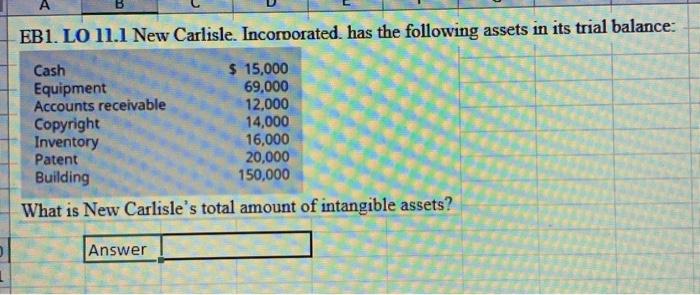

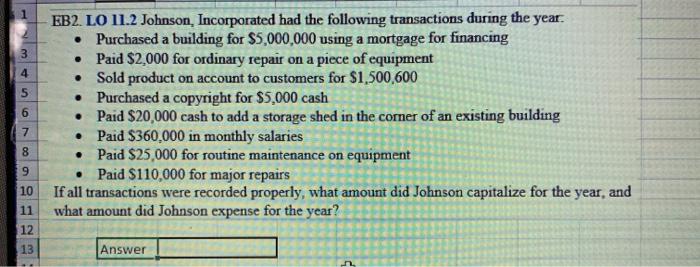

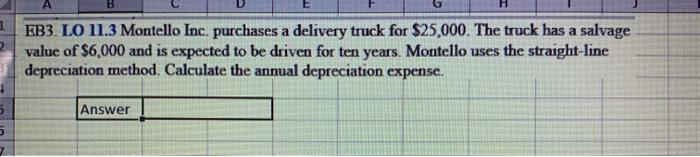

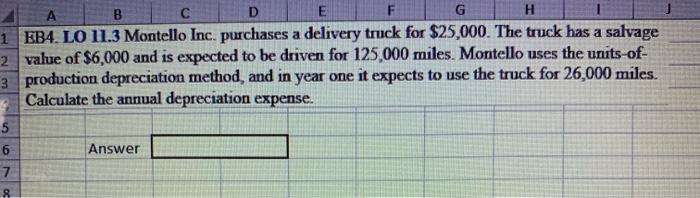

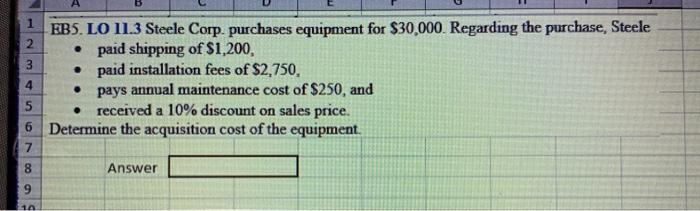

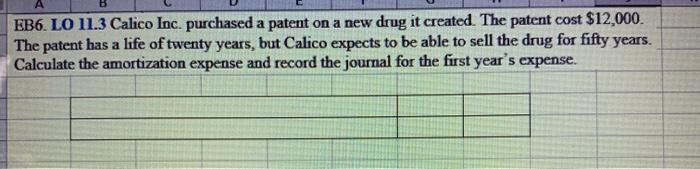

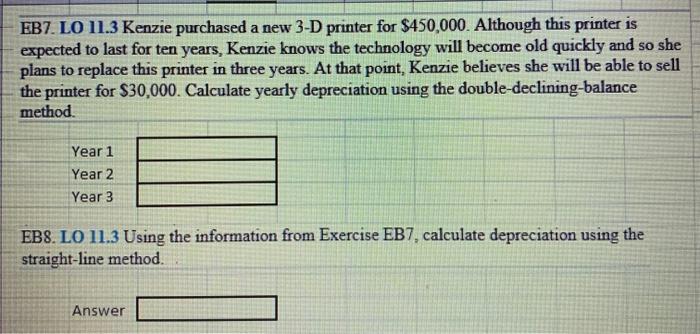

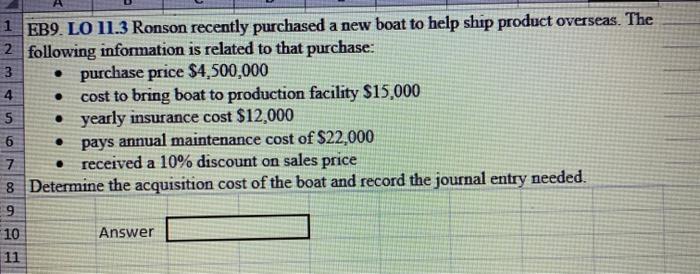

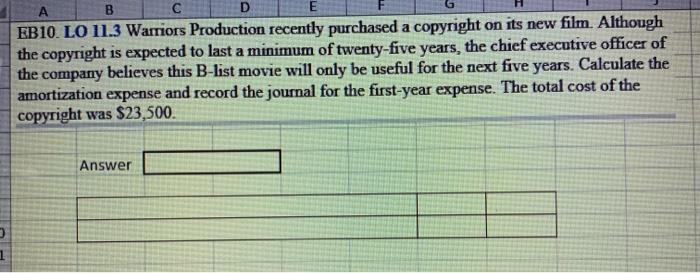

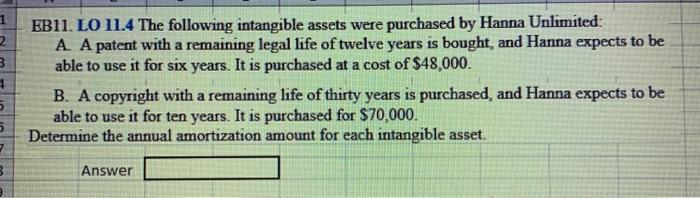

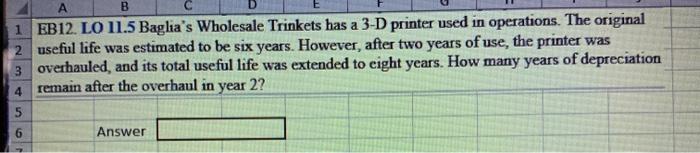

1 2 3 4 5 6 EA11. LO 11.4 The following intangible assets were purchased by Goldstein Corporation: A. A patent with a remaining legal life of twelve years is bought, and Goldstein expects to be able to use it for seven years. B. A copyright with a remaining life of thirty years is purchased, and Goldstein expects to be able to use it for ten years. For each of these situations, determine the useful life over which Goldstein will amortize the 7 intangible assets. 8 9 Answer 10 A EB1. LO 11.1 New Carlisle. Incorporated. has the following assets in its trial balance: Cash $ 15,000 Equipment 69,000 Accounts receivable 12,000 Copyright 14,000 Inventory 16,000 Patent 20,000 Building 150,000 What is New Carlisle's total amount of intangible assets? Answer EB2. LO 11.2 Johnson, Incorporated had the following transactions during the year. Purchased a building for $5,000,000 using a mortgage for financing 3 4 5 6 60 Paid $2,000 for ordinary repair on a piece of equipment Sold product on account to customers for $1,500,600 Purchased a copyright for $5,000 cash Paid $20,000 cash to add a storage shed in the corner of an existing building Paid $360,000 in monthly salaries 7 8 6 10 11 12 Paid $25,000 for routine maintenance on equipment Paid $110,000 for major repairs If all transactions were recorded properly, what amount did Johnson capitalize for the year, and what amount did Johnson expense for the year? 13 Answer 1 2 5 5 EB3. LO 11.3 Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for ten years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense. Answer A B C D E 1 EB4. LO 11.3 Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage 2 value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of- 3 production depreciation method, and in year one it expects to use the truck for 26,000 miles. Calculate the annual depreciation expense. 5 6 7 8 Answer EB5. LO 11.3 Steele Corp. purchases equipment for $30,000. Regarding the purchase, Steele paid shipping of $1,200, paid installation fees of $2,750, 1 2 3 4 pays annual maintenance cost of $250, and 5 6 7 8 9 10 received a 10% discount on sales price. Determine the acquisition cost of the equipment. Answer EB6. LO 11.3 Calico Inc. purchased a patent on a new drug it created. The patent cost $12,000. The patent has a life of twenty years, but Calico expects to be able to sell the drug for fifty years. Calculate the amortization expense and record the journal for the first year's expense. EB7. LO 11.3 Kenzie purchased a new 3-D printer for $450,000. Although this printer is expected to last for ten years, Kenzie knows the technology will become old quickly and so she plans to replace this printer in three years. At that point, Kenzie believes she will be able to sell the printer for $30,000. Calculate yearly depreciation using the double-declining-balance method. Year 1 Year 2 Year 3 EB8. LO 11.3 Using the information from Exercise EB7, calculate depreciation using the straight-line method. Answer 1 EB9. LO 11.3 Ronson recently purchased a new boat to help ship product overseas. The 2 following information is related to that purchase: 3 4 5 6 7 purchase price $4,500,000 cost to bring boat to production facility $15,000 yearly insurance cost $12,000 pays annual maintenance cost of $22,000 received a 10% discount on sales price 8 Determine the acquisition cost of the boat and record the journal entry needed. 9 10 Answer 11 . 1 B D EB10. LO 11.3 Warriors Production recently purchased a copyright on its new film. Although the copyright is expected to last a minimum of twenty-five years, the chief executive officer of the company believes this B-list movie will only be useful for the next five years. Calculate the amortization expense and record the journal for the first-year expense. The total cost of the copyright was $23,500. Answer A. A patent with a remaining legal life of twelve years is bought, and Hanna expects to be able to use it for six years. It is purchased at a cost of $48,000. 1 EB11. LO 11.4 The following intangible assets were purchased by Hanna Unlimited: 2 B 4 5 5 7 B B. A copyright with a remaining life of thirty years is purchased, and Hanna expects to be able to use it for ten years. It is purchased for $70,000. Determine the annual amortization amount for each intangible asset. Answer 56 Answer B 1 EB12. LO 11.5 Baglia's Wholesale Trinkets has a 3-D printer used in operations. The original 2 useful life was estimated to be six years. However, after two years of use, the printer was 3 overhauled, and its total useful life was extended to eight years. How many years of depreciation remain after the overhaul in year 2? 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

EA11 LO 114 Intangible Assets Amortization A Patent with a remaining legal life of 12 years but expected to be used for 7 years Useful life for amortization 7 years the shorter of the legal life or us...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started