Answered step by step

Verified Expert Solution

Question

1 Approved Answer

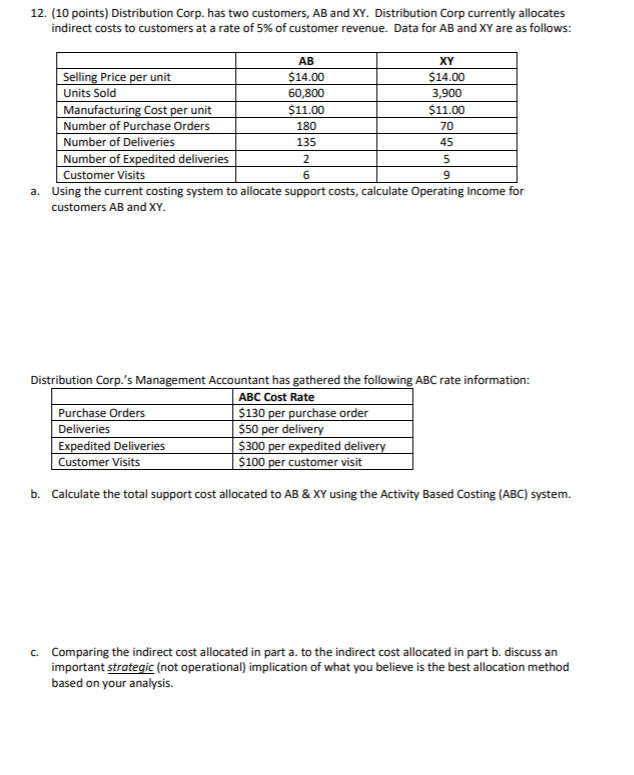

12. (10 points) Distribution Corp. has two customers, AB and XY. Distribution Corp currently allocates indirect costs to customers at a rate of 5%

12. (10 points) Distribution Corp. has two customers, AB and XY. Distribution Corp currently allocates indirect costs to customers at a rate of 5% of customer revenue. Data for AB and XY are as follows: AB XY Selling Price per unit $14.00 60,800 $14.00 Units Sold 3,900 Manufacturing Cost per unit $11.00 $11.00 Number of Purchase Orders 180 70 Number of Deliveries 135 45 Number of Expedited deliveries 2 Customer Visits 9 a. Using the current costing system to allocate support costs, calculate Operating Income for customers AB and XY. Distribution Corp.'s Management Accountant has gathered the following ABC rate information: ABC Cost Rate Purchase Orders | $130 per purchase order $50 per delivery $300 per expedited delivery $100 per customer visit Deliveries Expedited Deliveries Customer Visits b. Calculate the total support cost allocated to AB & XY using the Activity Based Costing (ABC) system. c. Comparing the indirect cost allocated in part a. to the indirect cost allocated in part b. discuss an important strategic (not operational) implication of what you believe is the best allocation method based on your analysis.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Part A AB XY Sales Selling price per unit Units sold 60800 14 851200 3900 14 54600 Less Manufacturin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started