Answered step by step

Verified Expert Solution

Question

1 Approved Answer

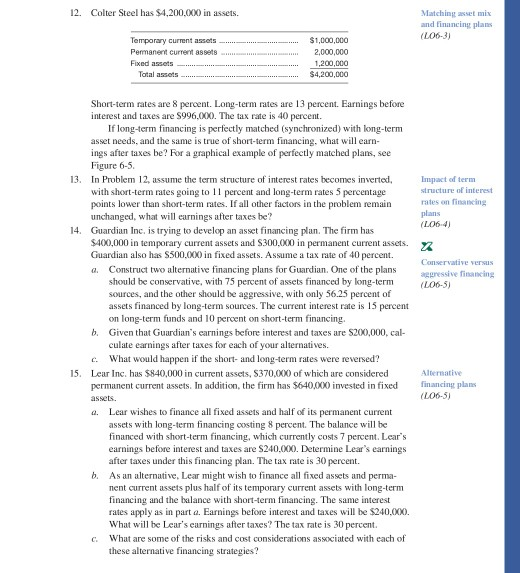

12 & 13. answered ASAP due at 11:59 also number 15! 12. Colter Steel has $4,200,000 in assets. Matching asset mix and financing plans (L06-3)

12 & 13. answered ASAP due at 11:59

also number 15!

12. Colter Steel has $4,200,000 in assets. Matching asset mix and financing plans (L06-3) Temporary current assets Penmanent curret 889818 $1,000,000 2,000,000 Fixed assets 1,200,000 Total assets $4,200,000 Short-terrn rates are percent. Long-term rates are 13 percent. Earnings before interest and taxes are S996.000. The tax rate is 40 percent. If long-term financing is perfectly matched (synchronized) with long-term asset needs, and the same is true of short-term financing. what will earn- ings after taxes be? For a graphical example of perfectly matched plans, see Figure 6-5, 13, In Problem 12, assume the term structure of interest rates becomes inverted with short-term rates going to 11 points lower than short-term rates. If all other factors in the problem remainrates on financing unchanged, what will earnings after taxes be? Impact ed term structure of interest and long-term rates 5 percentage plans LO64 14. Guardian Inc. is trying to develop an asset financing plan. The firm has $400,000 in temporary current assets and S300,000 in permanent current assets. n Guardian also has S500,000 in fixed assets. Assume a tax r a. Construct two alternative financing plans for Guardian. One of the plans should be conservative, with 75 percent of assets financed by long-term sources, and the other should be aggressive, with only 56.25 percent of assets financed by long-term sources. The current interest rate is 15 percent rate of 40 percent.onservative versus (L06-5) on long-term funds and 10 percent on short-term financing. b. Given that Guardian's earnings before interest and taxes are 5200,000, cal- culate earnings after taxes for each of your alternatives. What would happen if the short- and long-term rates were reversed? c. 15, Lear Inc, has $840,000 in current assets, S370,000 of which are considered permanent current assets. In addition, the firm has $640,000 invested in fixed fnacing plans (L06-5) assets Lear wishes to finance all fixed assets and half of its permanent current a. assets with long-term financing costing 8 percent. The balance will be financed with short-term financing, which currently costs 7 percent. Lear's earnings before interest and taxes are S240,000. Determine Lear's earnings after taxes under this financing plan. The tax rate is 30 percent. b. As an alternative, Lear might wish to finance all fixed assets and perma- ment current assets plus half of its temporary current assets with long-term financing and the balance with short-term financing. The same interest rates apply as in part a. Earnings before interest and taxes will be $240,00x0. What will be Lear's carnings after taxes? The tax rate is 30 percent. What are some of the risks and cost considerations associated with each of c. these alternative financing strategiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started