Answered step by step

Verified Expert Solution

Question

1 Approved Answer

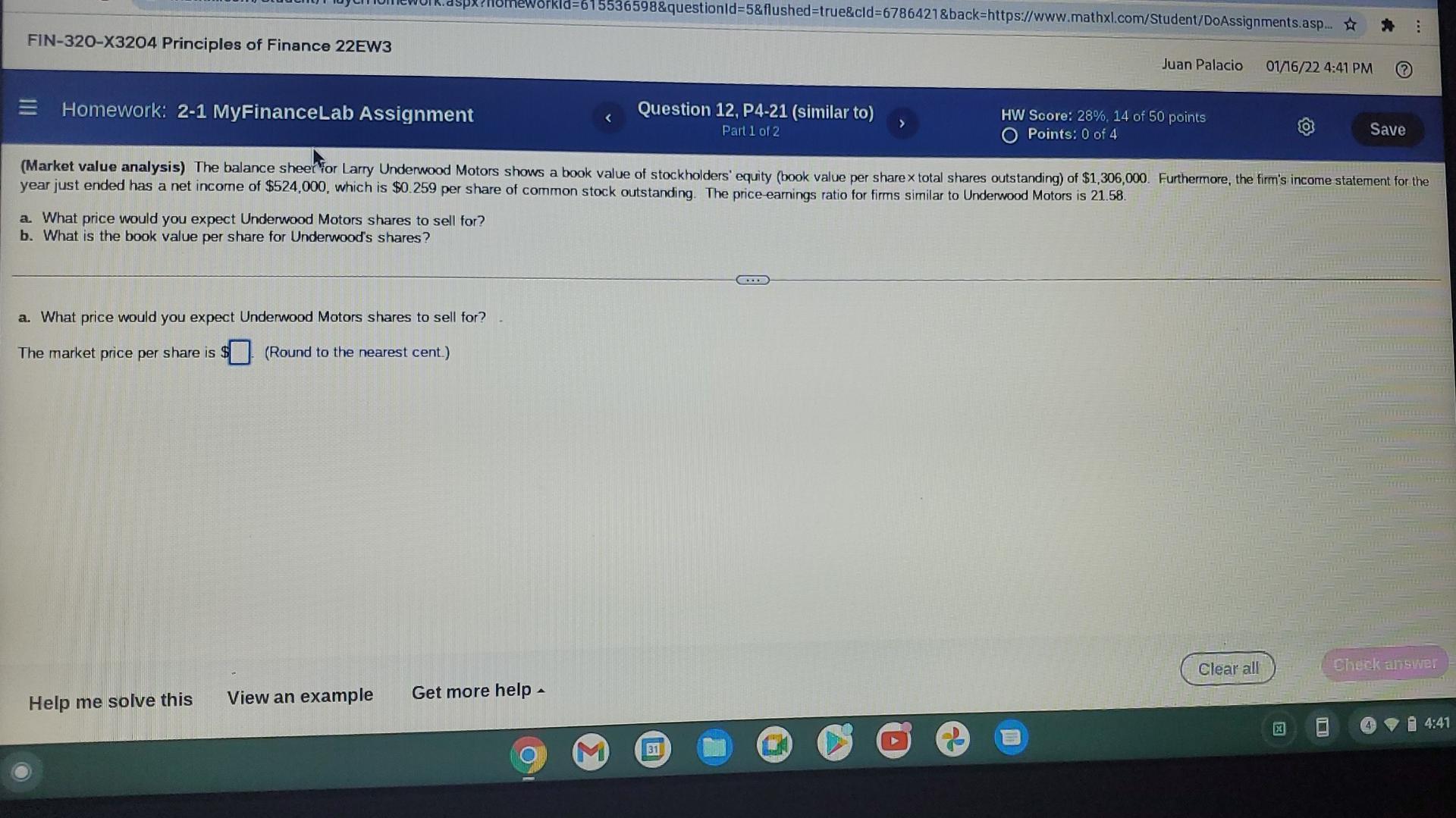

12. 2 parts homeWorkid=615536598&questionid=5&flushed=true&cld=6786421&back=https://www.mathxl.com/Student/DoAssignments.asp... FIN-320-X3204 Principles of Finance 22EW3 Juan Palacio 01/16/22 4:41 PM Homework: 2-1 MyFinanceLab Assignment Question 12, P4-21 (similar to) Part 1

12.

2 parts

homeWorkid=615536598&questionid=5&flushed=true&cld=6786421&back=https://www.mathxl.com/Student/DoAssignments.asp... FIN-320-X3204 Principles of Finance 22EW3 Juan Palacio 01/16/22 4:41 PM Homework: 2-1 MyFinanceLab Assignment Question 12, P4-21 (similar to) Part 1 of 2 HW Score: 28%, 14 of 50 points O Points: 0 of 4 Save (Market value analysis) The balance sheer For Larry Underwood Motors shows a book value of stockholders' equity (book value per share x total shares outstanding) of $1,306,000. Furthermore, the firm's income statement for the year just ended has a net income of $524,000, which is $0.259 per share of common stock outstanding. The price earnings ratio for firms similar to Underwood Motors is 21.58 a. What price would you expect Underwood Motors shares to sell for? b. What is the book value per share for Underwood's shares? a. What price would you expect Underwood Motors shares to sell for? The market price per share is (Round to the nearest cent.) Clear all Check aliwe! Help me solve this View an example Get more help 4 4:41 31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started