Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.2) Apple and Microsoft, both leading companies in the tech industry, adjust their financial strategies in reaction to fluctuations in specific macroeconomic variables. These variables

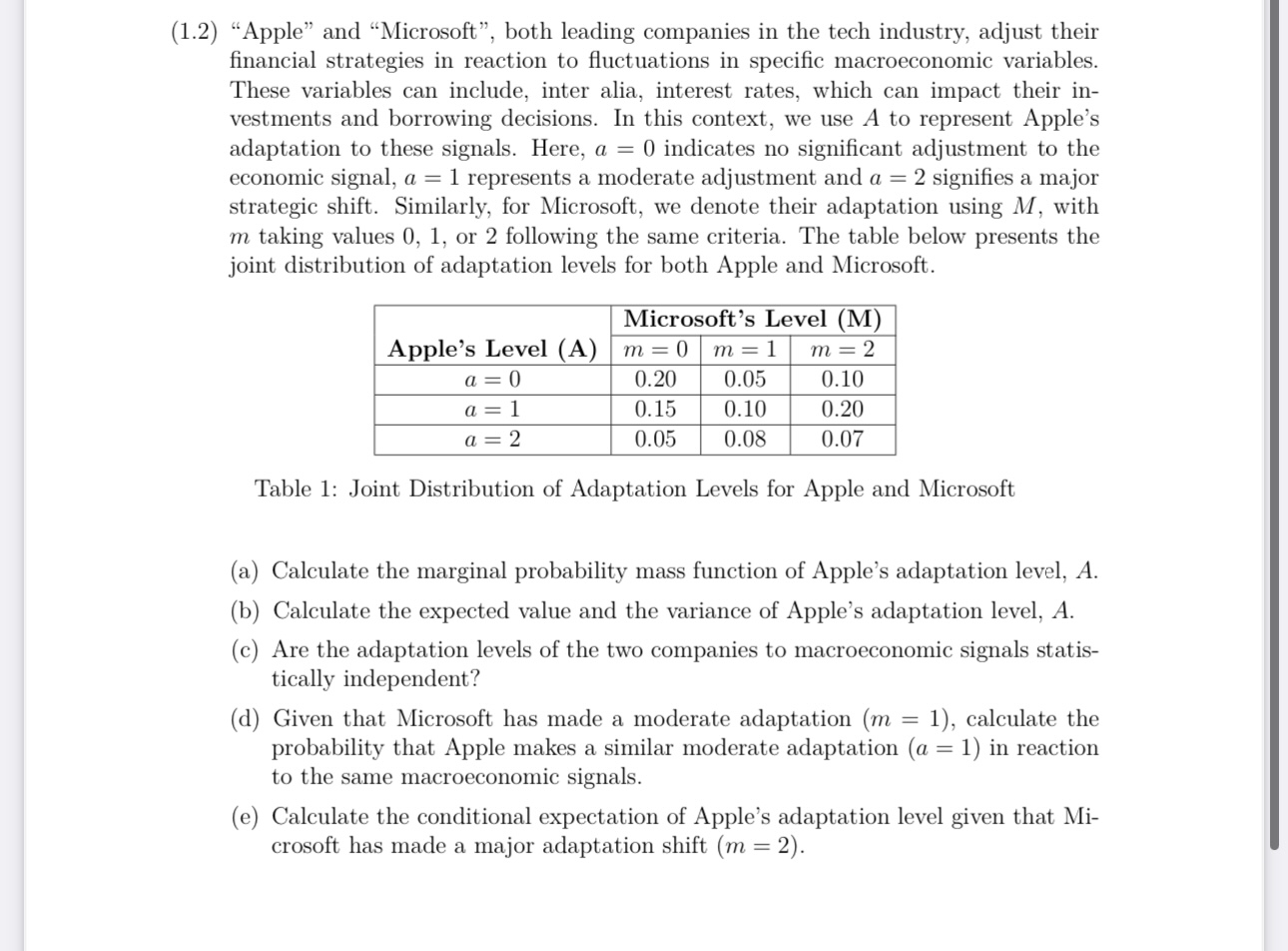

1.2) "Apple" and "Microsoft", both leading companies in the tech industry, adjust their financial strategies in reaction to fluctuations in specific macroeconomic variables. These variables can include, inter alia, interest rates, which can impact their investments and borrowing decisions. In this context, we use A to represent Apple's adaptation to these signals. Here, a=0 indicates no significant adjustment to the economic signal, a=1 represents a moderate adjustment and a=2 signifies a major strategic shift. Similarly, for Microsoft, we denote their adaptation using M, with m taking values 0,1 , or 2 following the same criteria. The table below presents the joint distribution of adaptation levels for both Apple and Microsoft. Table 1: Joint Distribution of Adaptation Levels for Apple and Microsoft (a) Calculate the marginal probability mass function of Apple's adaptation level, A. (b) Calculate the expected value and the variance of Apple's adaptation level, A. (c) Are the adaptation levels of the two companies to macroeconomic signals statistically independent? (d) Given that Microsoft has made a moderate adaptation (m=1), calculate the probability that Apple makes a similar moderate adaptation (a=1) in reaction to the same macroeconomic signals. (e) Calculate the conditional expectation of Apple's adaptation level given that Microsoft has made a major adaptation shift (m=2)

1.2) "Apple" and "Microsoft", both leading companies in the tech industry, adjust their financial strategies in reaction to fluctuations in specific macroeconomic variables. These variables can include, inter alia, interest rates, which can impact their investments and borrowing decisions. In this context, we use A to represent Apple's adaptation to these signals. Here, a=0 indicates no significant adjustment to the economic signal, a=1 represents a moderate adjustment and a=2 signifies a major strategic shift. Similarly, for Microsoft, we denote their adaptation using M, with m taking values 0,1 , or 2 following the same criteria. The table below presents the joint distribution of adaptation levels for both Apple and Microsoft. Table 1: Joint Distribution of Adaptation Levels for Apple and Microsoft (a) Calculate the marginal probability mass function of Apple's adaptation level, A. (b) Calculate the expected value and the variance of Apple's adaptation level, A. (c) Are the adaptation levels of the two companies to macroeconomic signals statistically independent? (d) Given that Microsoft has made a moderate adaptation (m=1), calculate the probability that Apple makes a similar moderate adaptation (a=1) in reaction to the same macroeconomic signals. (e) Calculate the conditional expectation of Apple's adaptation level given that Microsoft has made a major adaptation shift (m=2) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started