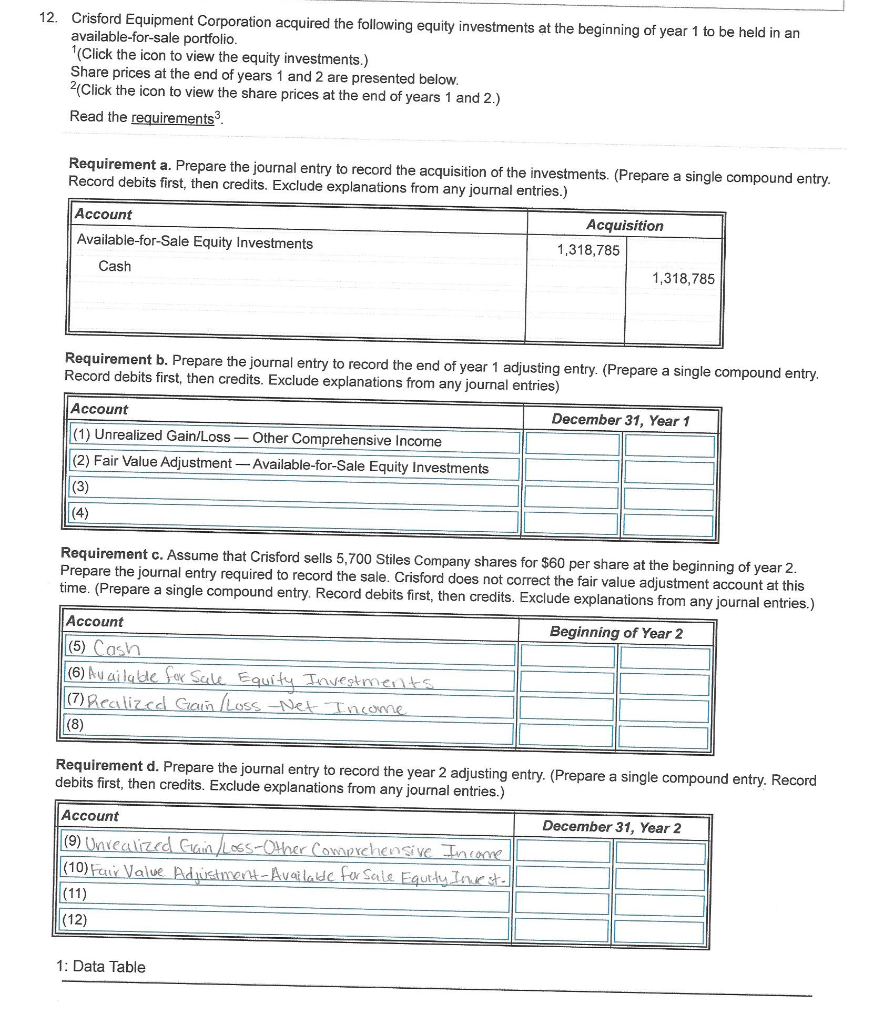

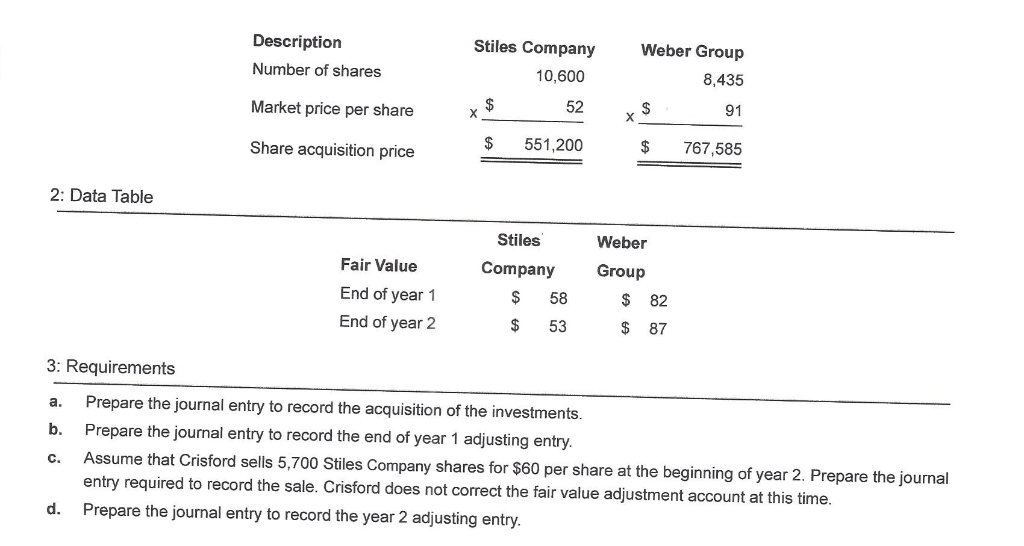

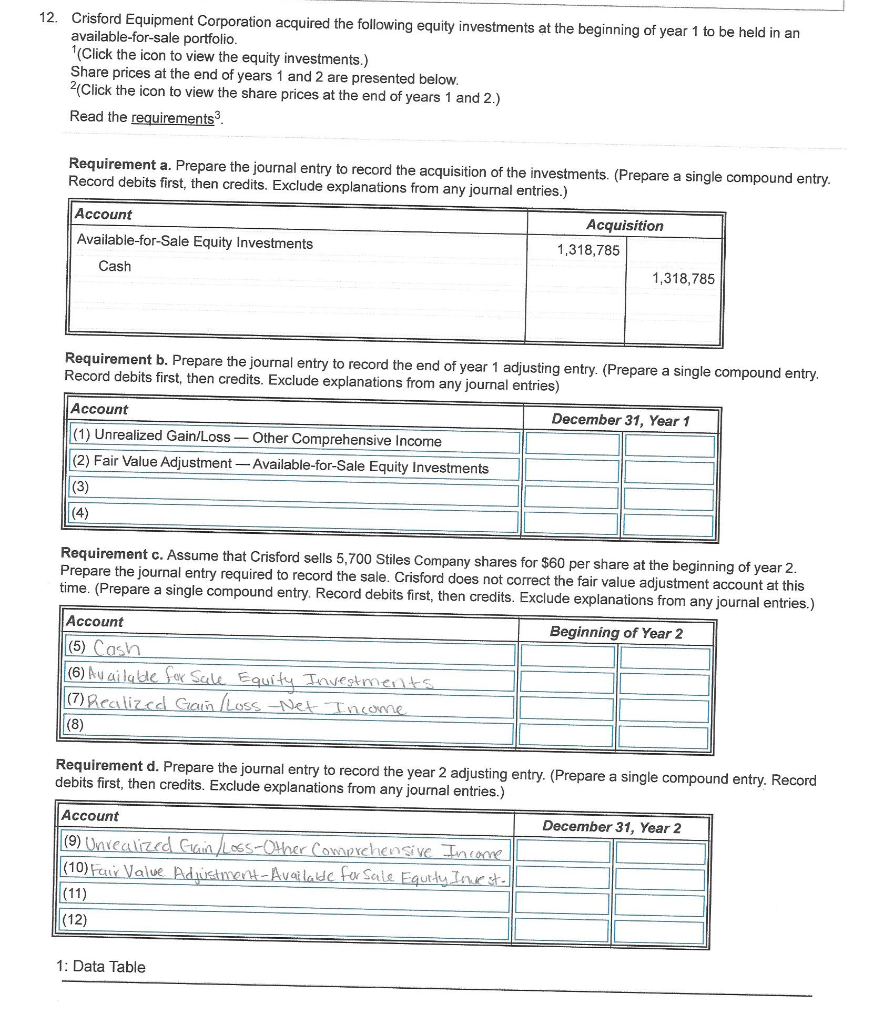

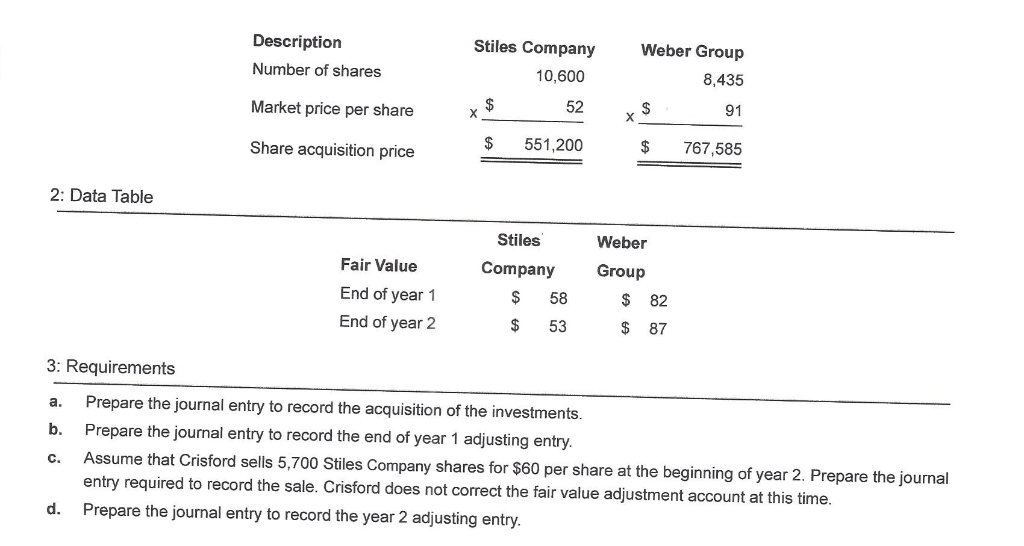

12. Crisford Equipment Corporation acquired the following equity investments at the beginning of year 1 to be held in an available-for-sale portfolio. (Click the icon to view the equity investments.) Share prices at the end of years 1 and 2 are presented below. 2(Click the icon to view the share prices at the end of years 1 and 2.) Read the requirements. Requirement a. Prepare the journal entry to record the acquisition of the investments. (Prepare a single compound entry. Record debits first, then credits. Exclude explanations from any jourmal entries.) Account Acquisition Available-for-Sale Equity Investments 1,318,785 Cash 1,318,785 Requirement b. Prepare the journal entry to record the end of year 1 adjusting entry. (Prepare a single compound entry Record debits first, then credits. Exclude explanations from any journal entries) Account December 31, Year 1 Other Comprehensive Income (1) Unrealized Gain/Loss (2) Fair Value Adjustment -Available-for-Sale Equity Investments (3) (4) Requirement c. Assume that Crisford sells 5,700 Stiles Company shares for $60 per share at the beginning of year 2. Prepare the journal entry required to record the sale. Crisford does not correct the fair value adjustment account at this time. (Prepare a single compound entry. Record debits first, then credits. Exclude explanations from any journal entries.) Account Beginning of Year 2 (5) Cash |(6) Au ai lakte for Seule Equity Tnvegtments |(7)Realized Gam Loss -Net Tncome (8) Requirement d. Prepare the journal entry to record the year 2 adjusting entry. (Prepare a single compound entry. Record debits first, then credits. Exclude explanations from any journal entries.) Account December 31, Year 2 |(9) Unxeuized Crain Loss-Oher Comerchensive Income (10) Far Value Pdristmert-Avalaklc for Sale Equrdy IsnKst (11) (12) 1: Data Table Weber Group Stiles Company Description 8,435 Number of shares 10,600 91 52 Market price per share Y 767,585 551,200 Share acquisition price 2: Data Table Stiles Weber Group Company Fair Value 58 82 End of year 1 End of year 2 $ 4$ 87 53 3: Requirements Prepare the journal entry to record the acquisition of the investments. a. Prepare the journal entry to record the end of year 1 adjusting entry b. Assume that Crisford sells 5,700 Stiles Company shares for $60 per share at the beginning of year 2. Prepare the journal entry required to record the sale. Crisford does not correct the fair value adjustment account at this time. C. Prepare the journal entry to record the year 2 adjusting entry. d