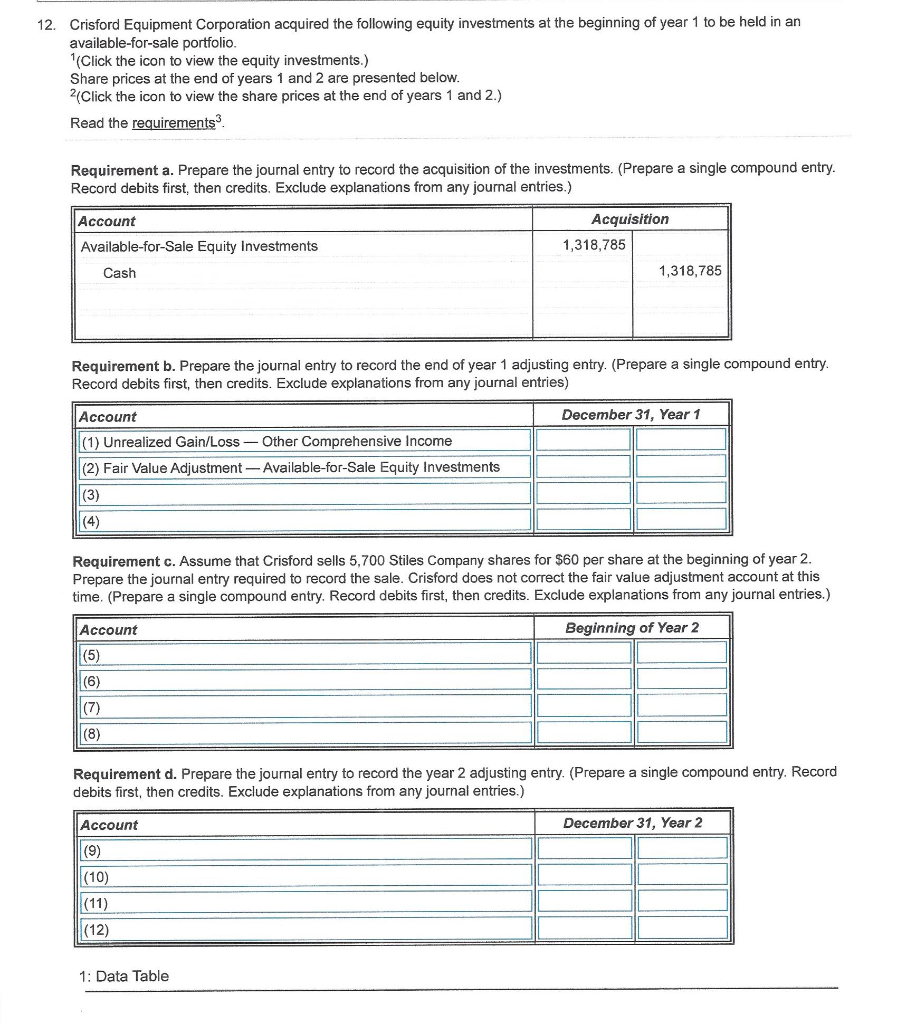

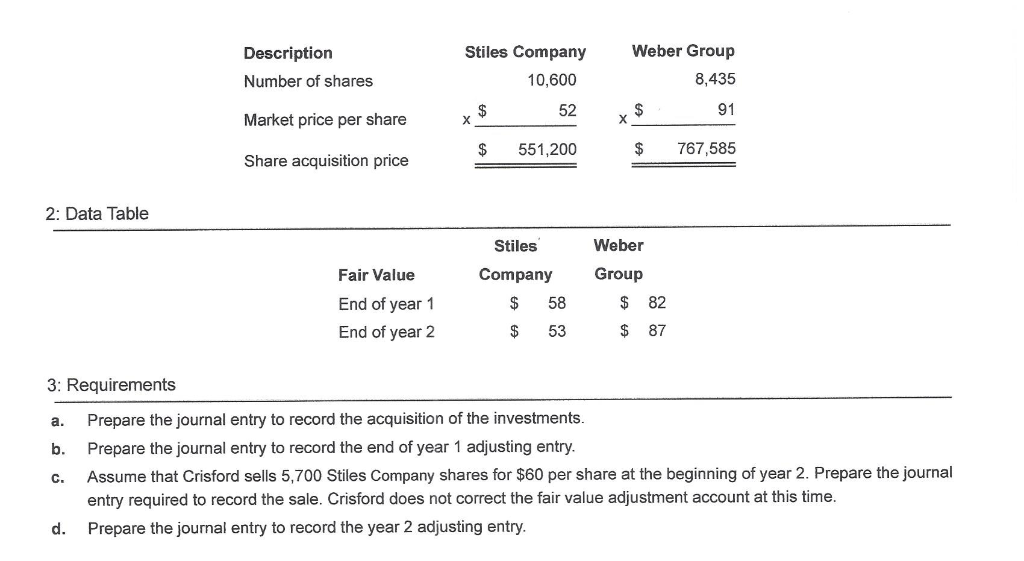

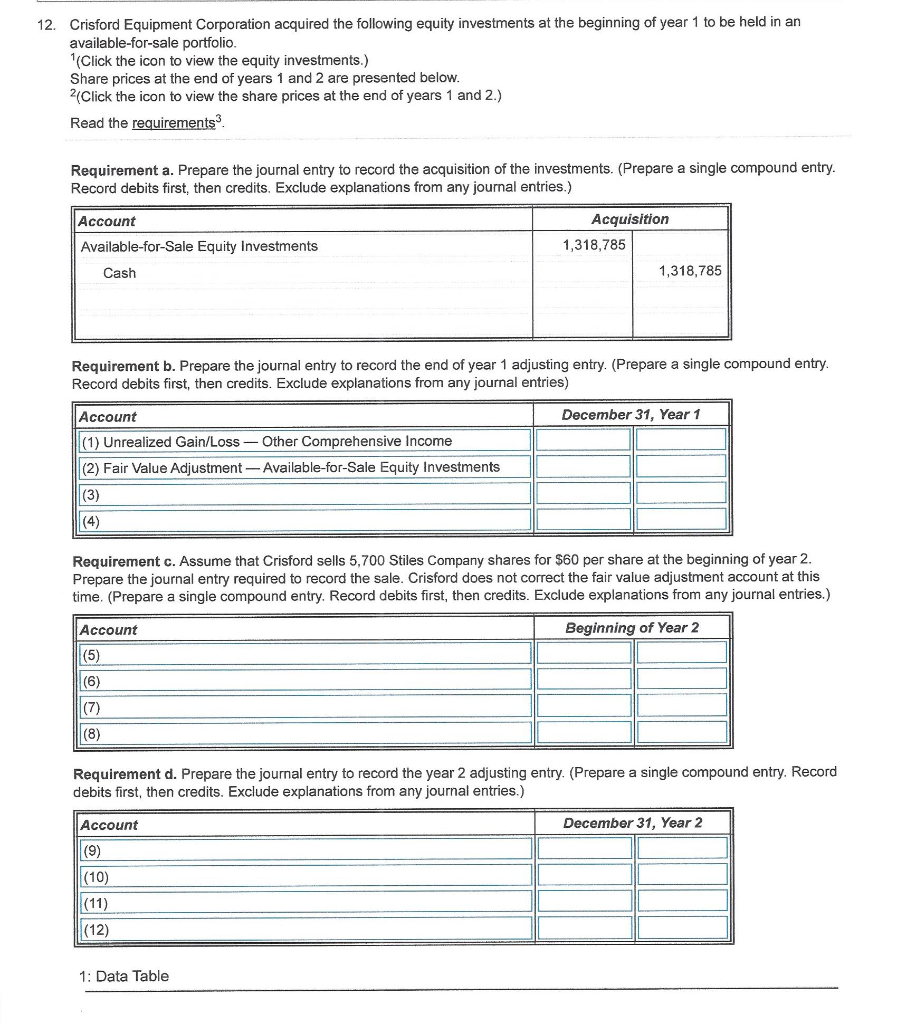

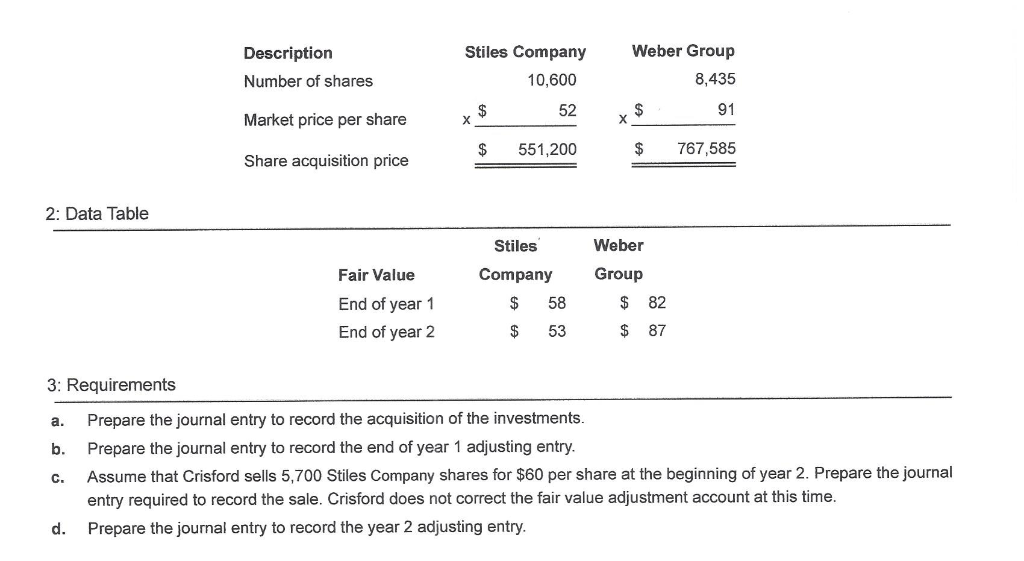

12. Crisford Equipment Corporation acquired the following equity investments at the beginning of year 1 to be held in an available-for-sale portfolio. (Click the icon to view the equity investments.) Share prices at the end of years 1 and 2 are presented below. 2(Click the icon to view the share prices at the end of years 1 and 2.) Read the requirements Requirement a. Prepare the journal entry to record the acquisition of the investments. (Prepare a single compound entry. Record debits first, then credits. Exclude explanations from any journal entries.) Account Available-for-Sale Equity Investments Cash Acquisition 1,318,785 1,318,785 Requirement b. Prepare the journal entry to record the end of year 1 adjusting entry. (Prepare a single compound entry. Record debits first, then credits. Exclude explanations from any journal entries) December 31, Year 1 Account |(1) Unrealized Gain/Loss - Other Comprehensive Income (2) Fair Value Adjustment - Available-for-Sale Equity Investments (3) (4) Requirement c. Assume that Crisford sells 5,700 Stiles Company shares for $60 per share at the beginning of year 2. Prepare the journal entry required to record the sale. Crisford does not correct the fair value adjustment account at this time. (Prepare a single compound entry. Record debits first, then credits. Exclude explanations from any journal entries.) Account Beginning of Year 2 (8) Requirement d. Prepare the journal entry to record the year 2 adjusting entry. (Prepare a single compound entry. Record debits first, then credits. Exclude explanations from any journal entries.) December 31, Year 2 Account (9) (10) (11) (12) 1: Data Table Description Number of shares Stiles Company 10,600 52 $ 551,200 Weber Group 8,435 x $ 91 Market price per share $ 767,585 Share acquisition price 2: Data Table Fair Value End of year 1 End of year 2 Stiles Company $ 58 $ 53 Weber Group $ 82 $ 87 3: Requirements a. Prepare the journal entry to record the acquisition of the investments. b. Prepare the journal entry to record the end of year 1 adjusting entry. C. Assume that Crisford sells 5,700 Stiles Company shares for $60 per share at the beginning of year 2. Prepare the journal entry required to record the sale. Crisford does not correct the fair value adjustment account at this time. d. Prepare the journal entry to record the year 2 adjusting entry. 12. Crisford Equipment Corporation acquired the following equity investments at the beginning of year 1 to be held in an available-for-sale portfolio. (Click the icon to view the equity investments.) Share prices at the end of years 1 and 2 are presented below. 2(Click the icon to view the share prices at the end of years 1 and 2.) Read the requirements Requirement a. Prepare the journal entry to record the acquisition of the investments. (Prepare a single compound entry. Record debits first, then credits. Exclude explanations from any journal entries.) Account Available-for-Sale Equity Investments Cash Acquisition 1,318,785 1,318,785 Requirement b. Prepare the journal entry to record the end of year 1 adjusting entry. (Prepare a single compound entry. Record debits first, then credits. Exclude explanations from any journal entries) December 31, Year 1 Account |(1) Unrealized Gain/Loss - Other Comprehensive Income (2) Fair Value Adjustment - Available-for-Sale Equity Investments (3) (4) Requirement c. Assume that Crisford sells 5,700 Stiles Company shares for $60 per share at the beginning of year 2. Prepare the journal entry required to record the sale. Crisford does not correct the fair value adjustment account at this time. (Prepare a single compound entry. Record debits first, then credits. Exclude explanations from any journal entries.) Account Beginning of Year 2 (8) Requirement d. Prepare the journal entry to record the year 2 adjusting entry. (Prepare a single compound entry. Record debits first, then credits. Exclude explanations from any journal entries.) December 31, Year 2 Account (9) (10) (11) (12) 1: Data Table Description Number of shares Stiles Company 10,600 52 $ 551,200 Weber Group 8,435 x $ 91 Market price per share $ 767,585 Share acquisition price 2: Data Table Fair Value End of year 1 End of year 2 Stiles Company $ 58 $ 53 Weber Group $ 82 $ 87 3: Requirements a. Prepare the journal entry to record the acquisition of the investments. b. Prepare the journal entry to record the end of year 1 adjusting entry. C. Assume that Crisford sells 5,700 Stiles Company shares for $60 per share at the beginning of year 2. Prepare the journal entry required to record the sale. Crisford does not correct the fair value adjustment account at this time. d. Prepare the journal entry to record the year 2 adjusting entry