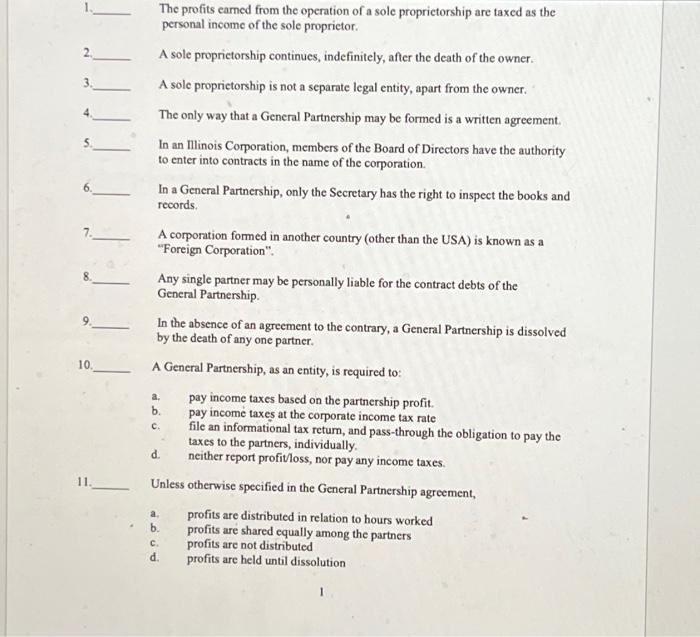

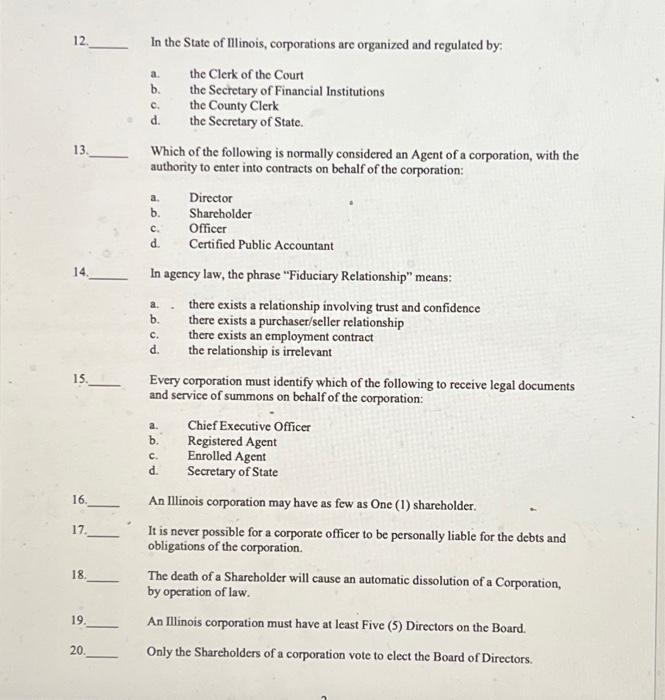

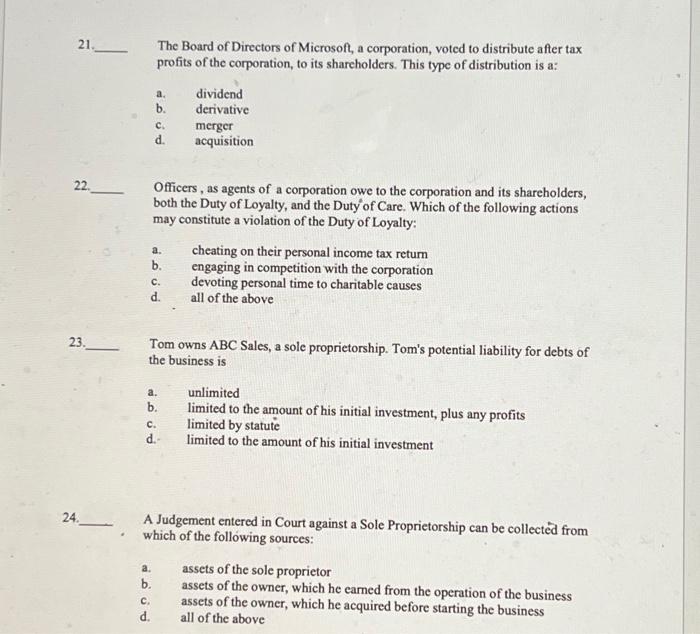

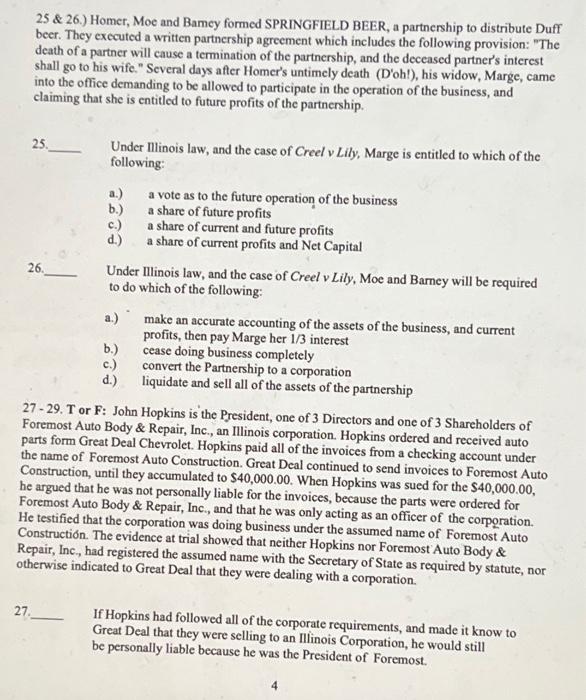

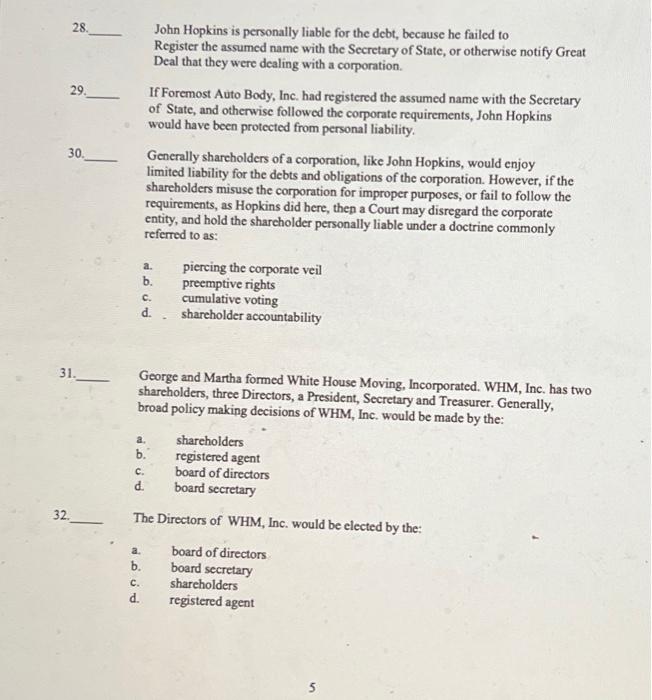

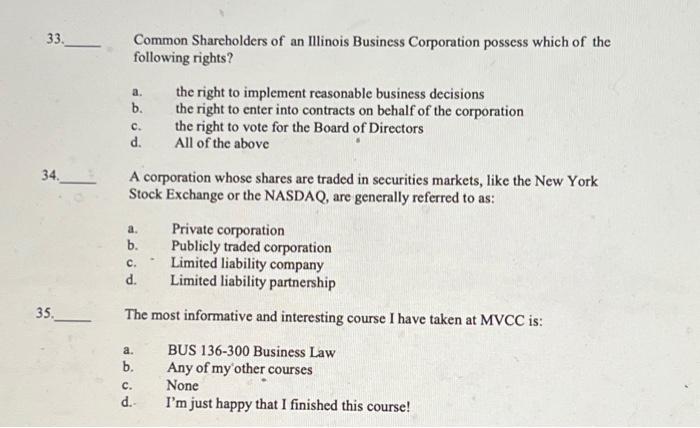

12 In the State of IIlinois, corporations are organized and regulated by: a. the Clerk of the Court b. the Sectetary of Financial Institutions c. the County Clerk d. the Secretary of State. 13 Which of the following is normally considered an Agent of a corporation, with the authority to enter into contracts on behalf of the corporation: a. Director b. Shareholder c. Officer d. Certified Public Accountant 14 In agency law, the phrase "Fiduciary Relationship" means: a. there exists a relationship involving trust and confidence b. there exists a purchaser/seller relationship c. there exists an employment contract d. the relationship is irrelevant 15 Every corporation must identify which of the following to receive legal documents and service of summons on behalf of the corporation: a. Chief Executive Officer b. Registered Agent c. Enrolled Agent d. Secretary of State 16 An llinois corporation may have as few as One (1) shareholder. 17 18 It is never possible for a corporate officer to be personally liable for the debts and obligations of the corporation. The death of a Shareholder will cause an automatic dissolution of a Corporation, by operation of law. 19 An Illinois corporation must have at least Five (5) Directors on the Board. 20 Only the Shareholders of a corporation vote to elect the Board of Directors. 33 Common Shareholders of an Illinois Business Corporation possess which of the following rights? a. the right to implement reasonable business decisions b. the right to enter into contracts on behalf of the corporation c. the right to vote for the Board of Directors d. All of the above 34. A corporation whose shares are traded in securities markets, like the New York Stock Exchange or the NASDAQ, are generally referred to as: a. Private corporation b. Publicly traded corporation c. Limited liability company d. Limited liability partnership 35 The most informative and interesting course I have taken at MVCC is: a. BUS 136-300 Business Law b. Any of my'other courses c. None d. I'm just happy that I finished this course! 28 John Hopkins is personally liable for the debt, because he failed to Register the assumed name with the Secretary of State, or otherwise notify Great Deal that they were dealing with a corporation. 29 If Foremost Auto Body, Inc. had registered the assumed name with the Secretary of State, and otherwise followed the corporate requirements, John Hopkins would have been protected from personal liability. 30 Generally shareholders of a corporation, like John Hopkins, would enjoy limited liability for the debts and obligations of the corporation. However, if the shareholders misuse the corporation for improper purposes, or fail to follow the requirements, as Hopkins did here, thep a Court may disregard the corporate entity, and hold the sharcholder personally liable under a doctrine commonly referred to as: a. piercing the corporate veil b. preemptive rights c. cumulative voting d. shareholder accountability 31 George and Martha formed White House Moving, Incorporated. WHM, Inc. has two shareholders, three Directors, a President, Secretary and Treasurer. Generally, broad policy making decisions of WHM, Inc. would be made by the: a. shareholders b. registered agent c. board of directors d. board secretary 32 The Directors of WHM, Inc. would be elected by the: a. board of directors b. board secretary c. shareholders d. registered agent 7 8 9 10 The profits earned from the operation of a sole proprictorship are taxed as the personal income of the sole proprictor. A sole proprictorship continues, indefinitely, after the death of the owner. A sole proprictorship is not a separate legal entity, apart from the owner. The only way that a General Partnership may be formed is a written agreement. In an Illinois Corporation, members of the Board of Directors have the authority to enter into contracts in the name of the corporation. In a General Partnership, only the Secretary has the right to inspect the books and records. A corporation formed in another country (other than the USA) is known as a "Foreign Corporation". Any single partner may be personally liable for the contract debts of the General Partnership. In the absence of an agreement to the contrary, a General Partnership is dissolved by the death of any one partner. A General Partnership, as an entity, is required to: a. pay income taxes based on the partnership profit. b. pay income taxes at the corporate income tax rate c. file an informational tax retum, and pass-through the obligation to pay the d. taxes to the partners, individually. d. neither report profitloss, nor pay any income taxes. 11 Unless otherwise specified in the General Partnership agreement, a. profits are distributed in relation to hours worked b. profits are shared equally among the partners c. profits are not distributed d. profits are held until dissolution 1 21 The Board of Directors of Microsoft, a corporation, voted to distribute after tax profits of the corporation, to its shareholders. This type of distribution is a: a. dividend b. derivative c. merger d. acquisition 22 Officers, as agents of a corporation owe to the corporation and its shareholders, both the Duty of Loyalty, and the Duty' of Care. Which of the following actions may constitute a violation of the Duty of Loyalty: a. cheating on their personal income tax return b. engaging in competition with the corporation c. devoting personal time to charitable causes d. all of the above 23 Tom owns ABC Sales, a sole proprietorship. Tom's potential liability for debts of the business is a. unlimited b. limited to the amount of his initial investment, plus any profits c. limited by statute d. limited to the amount of his initial investment 24 A Judgement entered in Court against a Sole Proprietorship can be collectd from which of the following sources: a. assets of the sole proprietor b. assets of the owner, which he earned from the operation of the business c. assets of the owner, which he acquired before starting the business d. all of the above 25 \& 26.) Homer, Moe and Bamcy formed SPRINGFIELD BEER, a partnership to distribute Duff beer. They executed a written partnership agreement which includes the following provision: "The death of a partner will cause a termination of the partnership, and the deceased partner's interest shall go to his wife." Several days after Homer's untimely death (D'oh!), his widow, Marge, came into the office demanding to be allowed to participate in the operation of the business, and claiming that she is entitled to future profits of the partnership. 25 Under Illinois law, and the case of Creel v Lily, Marge is entitled to which of the following: a.) a vote as to the future operation of the business b.) a share of future profits c.) a share of current and future profits d.) a share of current profits and Net Capital 26 Under Illinois law, and the case of Creel v Lily, Moe and Barney will be required to do which of the following: a.) make an accurate accounting of the assets of the business, and current profits, then pay Marge her 1/3 interest b.) cease doing business completely c.) convert the Partnership to a corporation d.) liquidate and sell all of the assets of the partnership 27 - 29. T or F: John Hopkins is the President, one of 3 Directors and one of 3 Shareholders of Foremost Auto Body \& Repair, Inc., an Illinois corporation. Hopkins ordered and received auto parts form Great Deal Chevrolet. Hopkins paid all of the invoices from a checking account under the name of Foremost Auto Construction. Great Deal continued to send invoices to Foremost Auto Construction, until they accumulated to $40,000.00. When Hopkins was sued for the $40,000.00, he argued that he was not personally liable for the invoices, because the parts were ordered for Foremost Auto Body \& Repair, Inc., and that he was only acting as an officer of the corporation. He testified that the corporation was doing business under the assumed name of Foremost Auto Construction. The evidence at trial showed that neither Hopkins nor Foremost Auto Body \& Repair, Inc., had registered the assumed name with the Secretary of State as required by statute, nor otherwise indicated to Great Deal that they were dealing with a corporation. 27 If Hopkins had followed all of the corporate requirements, and made it know to Great Deal that they were selling to an Illinois Corporation, he would still be personally liable because he was the President of Foremost. 4