Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12. Journal entries to record cash dividends are made on the a. Declaration date, record date, and payment date. b. Record date and payment

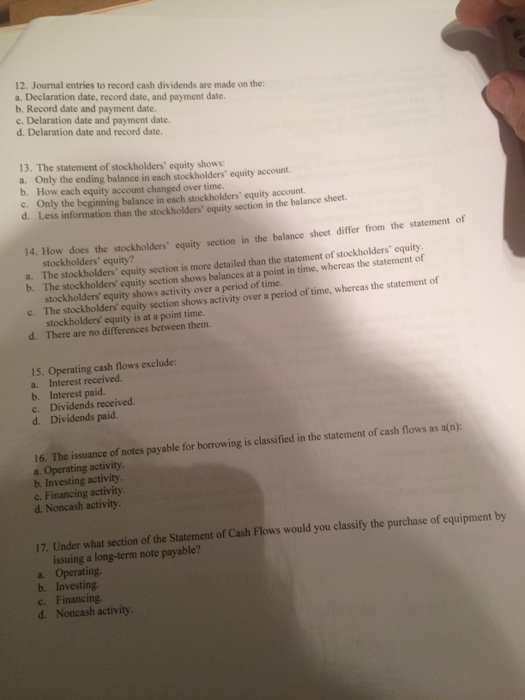

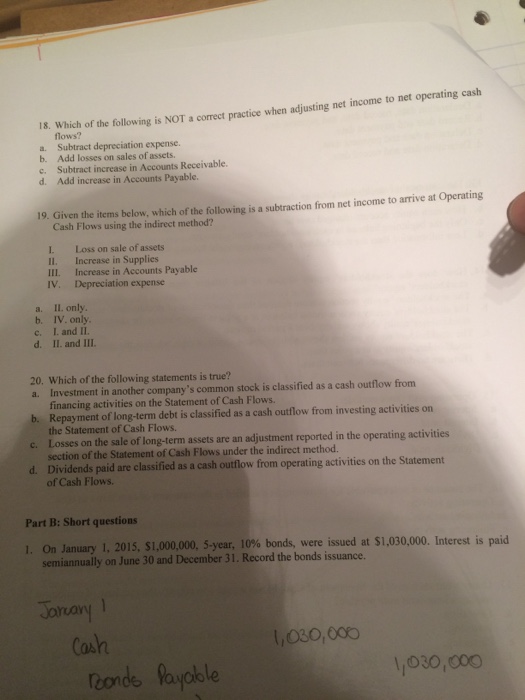

12. Journal entries to record cash dividends are made on the a. Declaration date, record date, and payment date. b. Record date and payment date. c. Delaration date and payment date. d. Delaration date and record date. 13. The statement of stockholders' equity shows: a. Only the ending balance in each stockholders' equity account. b. How each equity account changed over time. c. Only the beginning balance in each stockholders' equity account. d. Less information than the stockholders' equity section in the balance sheet. 14. How does the stockholders' equity section in the balance sheet differ from the statement of stockholders' equity? a. The stockholders' equity section is more detailed than the statement of stockholders' equity. b. The stockholders' equity section shows balances at a point in time, whereas the statement of stockholders' equity shows activity over a period of time. c. The stockholders' equity section shows activity over a period of time, whereas the statement of stockholders' equity is at a point time. d. There are no differences between them. 15. Operating cash flows exclude: Interest received. Interest paid. a. b. C. Dividends received. d. Dividends paid. 16. The issuance of notes payable for borrowing is classified a. Operating activity. b. Investing activity. c. Financing activity. d. Noncash activity. the statement of cash flows as a(n): 17. Under what section of the Statement of Cash Flows would you classify the purchase of equipment by issuing a long-term note payable? a. Operating. b. Investing. c. Financing. d. Noncash activity. 18. Which of the following is NOT a correct practice when adjusting net income to net operating cash flows? a. Subtract depreciation expense. b. Add losses on sales of assets. Subtract increase in Accounts Receivable. C. d. Add increase in Accounts Payable. 19. Given the items below, which of the following is a subtraction from net income to arrive at Operating Cash Flows using the indirect method? I. 11. III. IV. Loss on sale of assets Increase in Supplies Increase in Accounts Payable Depreciation expense II. only. a. b. IV. only. C. I. and II. d. II. and III. 20. Which of the following statements is true? a. Investment in another company's common stock is classified as a cash outflow from financing activities on the Statement of Cash Flows. b. Repayment of long-term debt is classified as a cash outflow from investing activities on the Statement of Cash Flows. c. Losses on the sale of long-term assets are an adjustment reported in the operating activities section of the Statement of Cash Flows under the indirect method. d. Dividends paid are classified as a cash outflow from operating activities on the Statement of Cash Flows. Part B: Short questions 1. On January 1, 2015, $1,000,000, 5-year, 10% bonds, were issued at $1,030,000. Interest is paid semiannually on June 30 and December 31. Record the bonds issuance. January 1 Cash Bonds Payable 1,030,000 1,030,000

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started