12. Kate would like to borrow $50,000 for five years and she is comparing two loan contracts. Contract A requires fixed equal monthly payment,

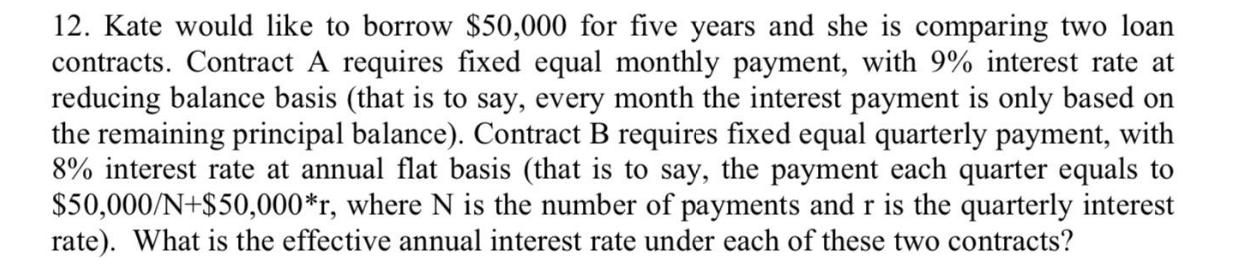

12. Kate would like to borrow $50,000 for five years and she is comparing two loan contracts. Contract A requires fixed equal monthly payment, with 9% interest rate at reducing balance basis (that is to say, every month the interest payment is only based on the remaining principal balance). Contract B requires fixed equal quarterly payment, with 8% interest rate at annual flat basis (that is to say, the payment each quarter equals to $50,000/N+$50,000*r, where N is the number of payments and r is the quarterly interest rate). What is the effective annual interest rate under each of these two contracts?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Contract A Principal Amount 50000 Interest Rate 9 per annum Calculated as monthly rate 9 12 months 0...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started