Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1&2 Landen Corporation uses a job order costing system. At the beginning of the year, the company made the following estimates: Direct labor-hour's required to

1&2

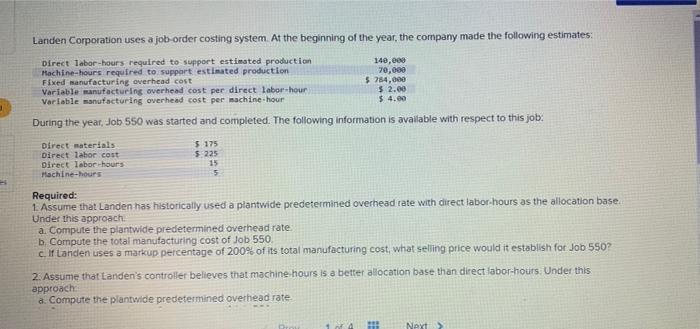

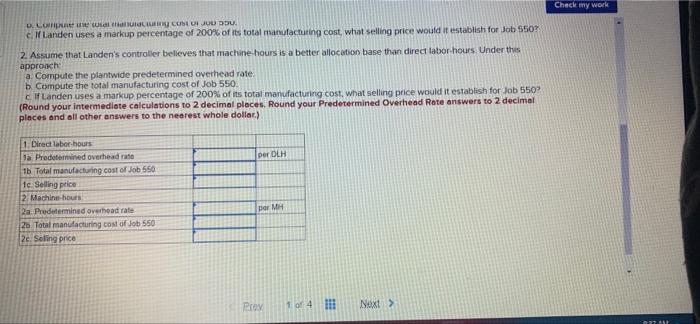

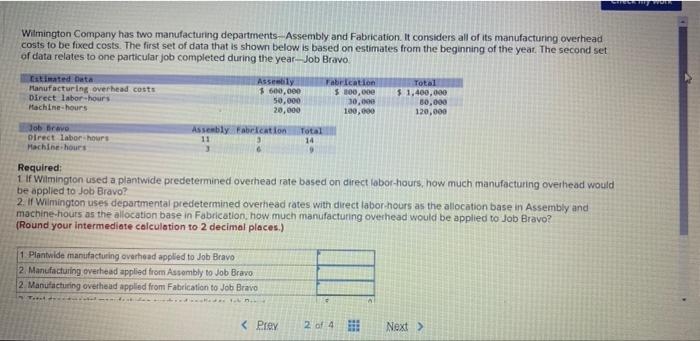

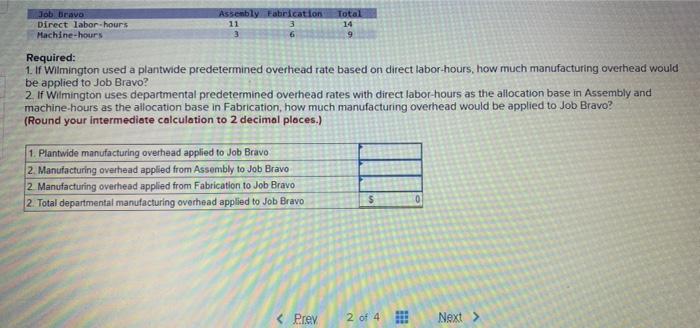

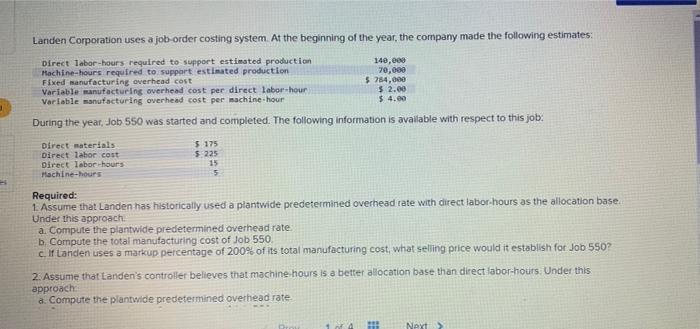

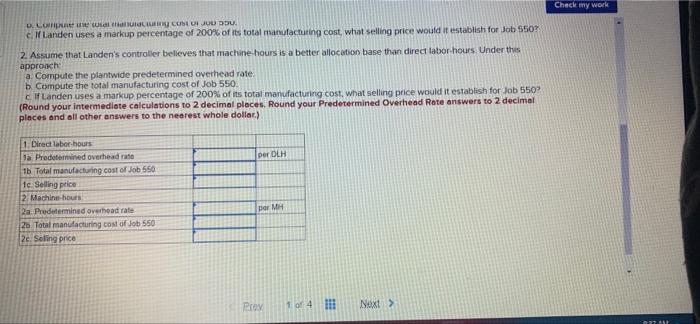

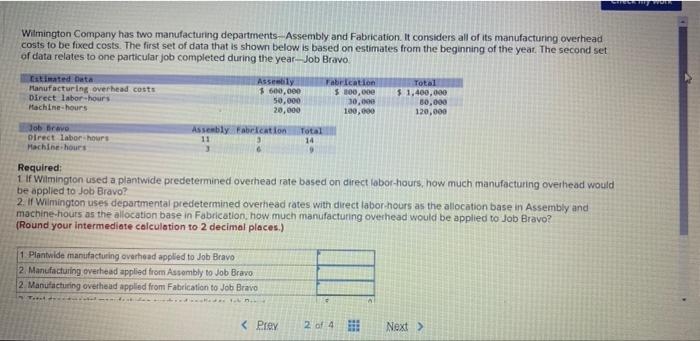

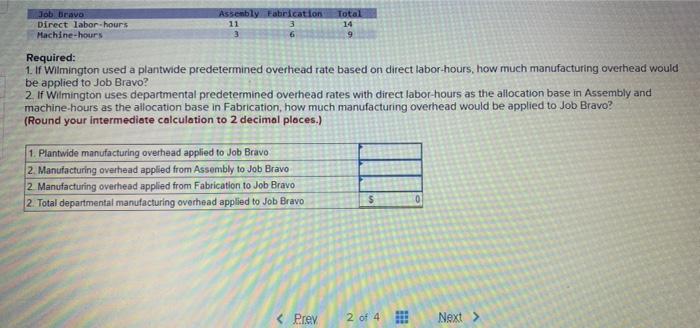

Landen Corporation uses a job order costing system. At the beginning of the year, the company made the following estimates: Direct labor-hour's required to support estimated production Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per direct labor-hour Variable manufacturing overhead cost per machine-hour 140,000 70,000 $ 284,000 $ 2.00 $ 4.00 During the year, Job 550 was started and completed. The following information is available with respect to this job: Direct materials Direct labor cost Direct Tabor hours Machine-hours 5 175 $ 225 15 5 Required: 1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach a. Compute the plantwide predetermined overhead rate b. Compute the total manufacturing cost of Job 550 c. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550? 2. Assume that Landen's controller believes that machine hours is a better allocation base than direct labor-hours. Under this approach a. Compute the plantwide predetermined overhead rate 44 HE Next > Check my work D. LA CIUCUSU JUODU c. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 5507 2. Assume that Landen's controller believes that machine hours is a better allocation base than direct labor hours Under this approach a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550. cf Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550? (Round your intermediate calculations to 2 decimal places. Round your predetermined Overhead Rote answers to 2 decimal places and all other answers to the nearest whole dollar) per DLH 1 Direct labor-hours Ja Prodetermined overhead rate 1b Total manufacturing cost of Job 556 1c Selling price 2. Machine hours 2a Predetermined overhead rate 20 Total manufacturing cost of Job 550 12c. Soling price Dior Pies 1 of 4 II: Next > Com Wilmington Company has two manufacturing departments Assembly and Fabrication. It considers all of its manufacturing overhead costs to be fixed costs. The first set of data that is shown below is based on estimates from the beginning of the year. The second set of data relates to one particular job completed during the year-Job Bravo Estimated Data Manufacturing overhead costs Direct labor-hours Machine-hours Assembly $ 60,000 50,000 20,000 Fabrication $ 100,00 30.00 100,000 Total $ 1.400,000 80,000 120,000 Job Dravo Direct labor hours Machine hours Assembly Fabrication 11 Total 14 9 Required: 1 if Wilmington used a plantwide predetermined overhead rate based on direct lobor-hours, how much manufacturing overhead would be applied to Job Bravo? 2. Wilmington uses departmental predetermined overhead rates with direct labor hours as the allocation base in Assembly and machine-hours as the allocation base in Fabrication how much manufacturing overhead would be applied to Job Bravo? (Round your intermediate calculation to 2 decimal places.) 1 Plantvide manufacturing overhead applied to Job Bravo 2 Manufacturing overhead applied from Assembly to Job Bravo 2 Manufacturing overhead applied from Fabrication to Job Bravo van A Job bravo Direct labor-hours Machine-hours Assembly Fabrication 11 3 3 6 Total 14 9 Required: 1. If Wilmington used a plantwide predetermined overhead rate based on direct labor-hours, how much manufacturing overhead would be applied to Job Bravo? 2. If Wilmington uses departmental predetermined overhead rates with direct labor-hours as the allocation base in Assembly and machine-hours as the allocation base in Fabrication, how much manufacturing overhead would be applied to Job Bravo? (Round your Intermediate calculation to 2 decimal places.) 1. Plantwide manufacturing overhead applied to Job Bravo 2 Manufacturing overhead applied from Assembly to Job Bravo 2 Manufacturing overhead applied from Fabrication to Job Bravo 2. Total departmental manufacturing overhead applied to Job Bravo $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started