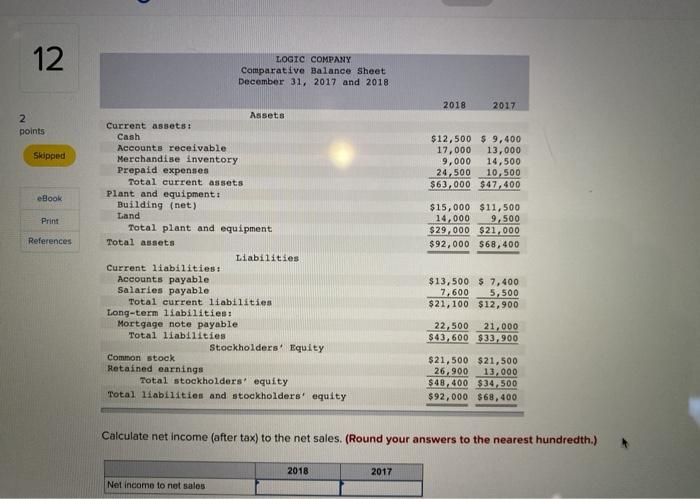

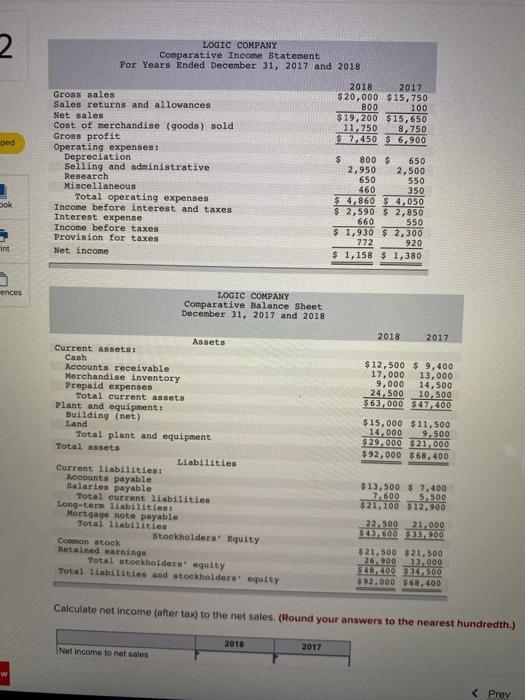

12 LOGIC COMPANY Comparative Balance Sheet December 31, 2017 and 2018 2018 2017 2 points Skipped $12,500 $ 9,400 17,000 13,000 9,000 14,500 24,500 10,500 $63,000 $47, 400 eBook Print $15,000 $11,500 14,000 9,500 $29,000 $21,000 $92,000 $68,400 References Assets Current assetst Cash Accounts receivable Merchandise inventory Prepaid expenses Total current assets Plant and equipment ! Building (net) Land Total plant and equipment Total assets Liabilities Current liabilities: Accounts payable Salaries payable Total current liabilities Long-term liabilities: Mortgage note payable Total liabilities Stockholders. Equity Common stock Retained earnings Total stockholders equity Total liabilities and stockholders' equity $13,500 $ 7,400 7,600 5,500 $21,100 $12,900 22,500 21,000 $43,600 $33,900 $21,500 $21,500 26,900 13,000 $48,400 $34,500 $92,000 $68,400 Calculate net income (after tax) to the net sales. (Round your answers to the nearest hundredth.) 2018 2017 Net Income to net sales 2 LOGIC COMPANY Comparative Income Statement For Years Ended December 31, 2017 and 2018 2018 2012 $ 20,000 $15,750 800 100 $19,200 $ 15,650 11,750 8,750 $ 7,450 $ 6.900 ped Gross sales Sales returns and allowances Net sales Cost of merchandise (goods) sold Gross profit Operating expenses Depreciation Selling and administrative Research Miscellaneous Total operating expenses Income before interest and taxes Interest expense Income before taxes Provision for taxes Net income ok $ 800 $ 650 2,950 2,500 650 550 460 350 $4,860 $ 4,050 $ 2,590 $ 2,850 660 550 $ 1,930 $ 2,300 772 920 $ 1,158 $ 1,380 int ences LOGIC COMPANY Comparative Balance Sheet December 31, 2017 and 2018 2018 2017 $12,500 $ 9,400 17,000 13,000 9,000 14,500 24,500 10.500 $63,000 $47,400 Assets Current assets: Cash Accounts receivable Merchandise inventory Prepaid expenses Total current assets Plant and equipment Building (net) Land Total plant and equipment Total assets Liabilities Current liabilities: Accounts payable Salaries payable Total current liabilities Long-term liabilities: Mortgage note payable Total liabilities stockholders' Equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $15,000 $11,500 14,000 9.500 $ 29,000 $21.000 $92,000 $68.400 $13,500 $ 2.400 2/600 5.500 321,100 $12,900 22.500 21.000 54600 $33.900 $21,500 $21.500 26,900 12.000 SB0014.500 592.000 968,400 Calculate net income (after tax) to the net sales. (Round your answers to the nearest hundredth.) 2018 Net income to net sales 2017 w