Answered step by step

Verified Expert Solution

Question

1 Approved Answer

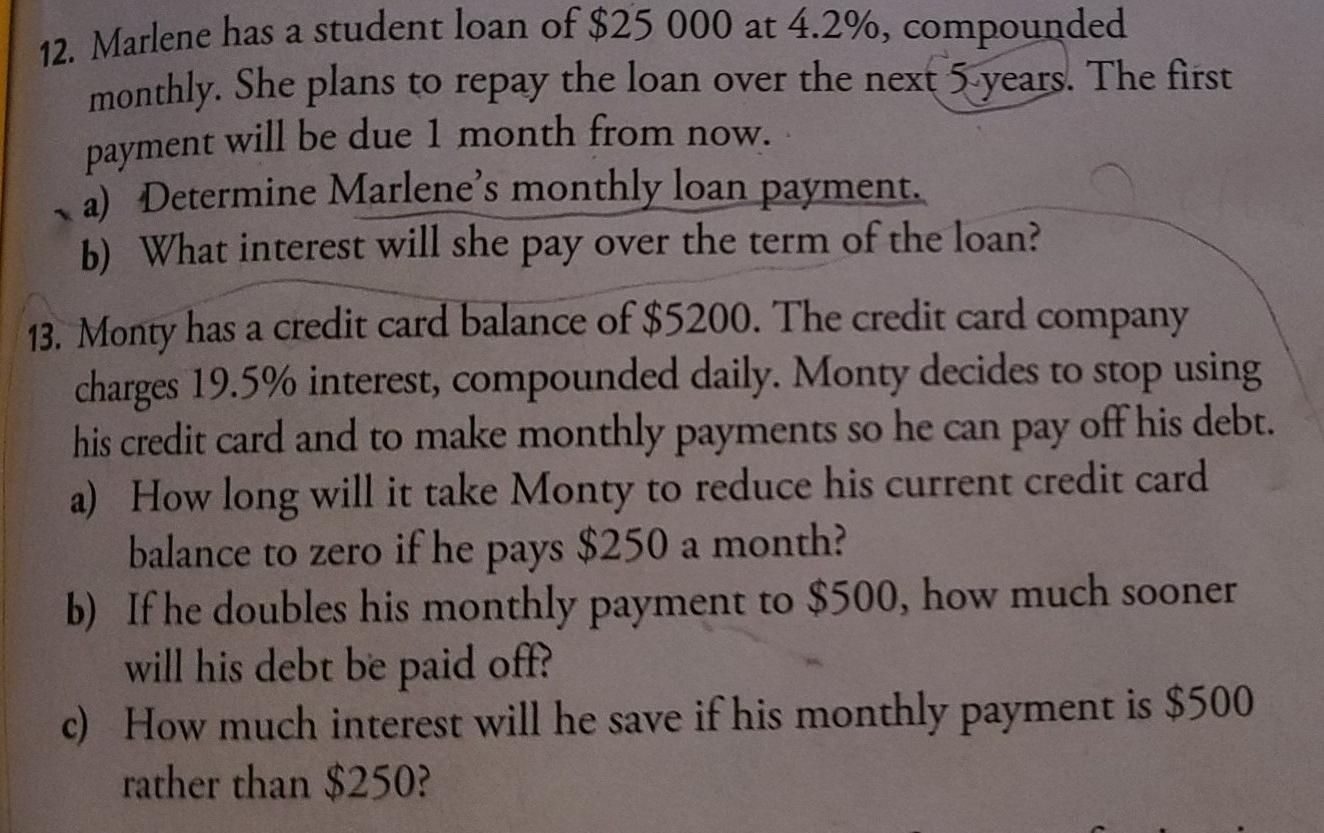

12. Marlene has a student loan of $25 000 at 4.2%, compounded monthly. She plans to repay the loan over the next 5 years. The

12. Marlene has a student loan of $25 000 at 4.2%, compounded monthly. She plans to repay the loan over the next 5 years. The first payment will be due 1 month from now. a) Determine Marlene's monthly loan payment. b) What interest will she pay over the term of the loan? 13. Monty has a credit card balance of $5200. The credit card company charges 19.5% interest, compounded daily. Monty decides to stop using his credit card and to make monthly payments so he can pay off his debt. a) How long will it take Monty to reduce his current credit card balance to zero if he pays $250 a month? b) If he doubles his monthly payment to $500, how much sooner will his debt be paid off? c) How much interest will he save if his monthly payment is $500 rather than $250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started