Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12 Option Pricing The Pirelli & C. SpA share price is 8.895. A call option with an exercise price of 9 sells for 0.35

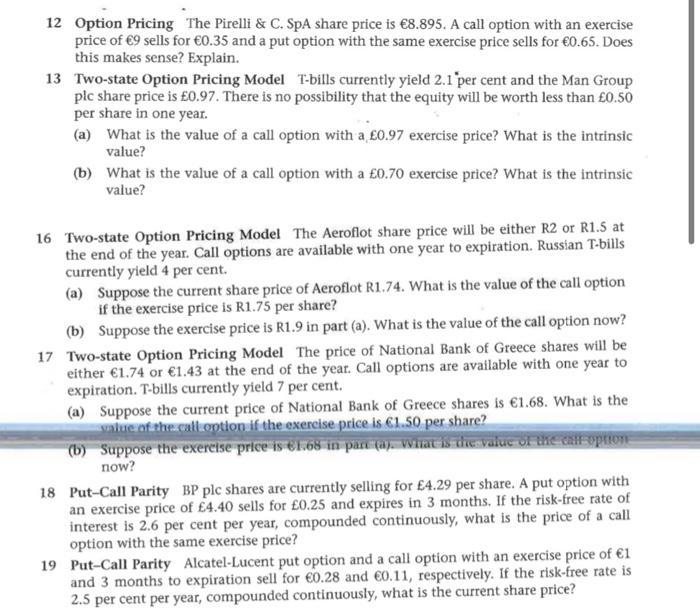

12 Option Pricing The Pirelli & C. SpA share price is 8.895. A call option with an exercise price of 9 sells for 0.35 and a put option with the same exercise price sells for 0.65. Does this makes sense? Explain. 13 Two-state Option Pricing Model T-bills currently yield 2.1 per cent and the Man Group plc share price is 0.97. There is no possibility that the equity will be worth less than 0.50 per share in one year. (a) What is the value of a call option with a 0.97 exercise price? What is the intrinsic value? (b) What is the value of a call option with a 0.70 exercise price? What is the intrinsic value? 16 Two-state Option Pricing Model The Aeroflot share price will be either R2 or R1.5 at the end of the year. Call options are available with one year to expiration. Russian T-bills currently yield 4 per cent. (a) Suppose the current share price of Aeroflot R1.74. What is the value of the call option if the exercise price is R1.75 per share? (b) Suppose the exercise price is R1.9 in part (a). What is the value of the call option now? 17 Two-state Option Pricing Model The price of National Bank of Greece shares will be either 1.74 or 1.43 at the end of the year. Call options are available with one year to expiration. T-bills currently yield 7 per cent. (a) Suppose the current price of National Bank of Greece shares is 1.68. What is the value of the call option if the exercise price is 1.50 per share? (b) Suppose the exercise price is 1.68 in pant (a). What is the value of the call option now? 18 Put-Call Parity BP plc shares are currently selling for 4.29 per share. A put option with an exercise price of 4.40 sells for 0.25 and expires in 3 months. If the risk-free rate of interest is 2.6 per cent per year, compounded continuously, what is the price of a call option with the same exercise price? 19 Put-Call Parity Alcatel-Lucent put option and a call option with an exercise price of 1 and 3 months to expiration sell for 0.28 and 0.11, respectively. If the risk-free rate is 2.5 per cent per year, compounded continuously, what is the current share price?

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

12 Option Pricing The Pirelli C SpA share price is 8895 A call option with an exercise price of 9 sells for 035 and a put option with the same exercise price sells for 065 Does this makes sense Explai...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started