Answered step by step

Verified Expert Solution

Question

1 Approved Answer

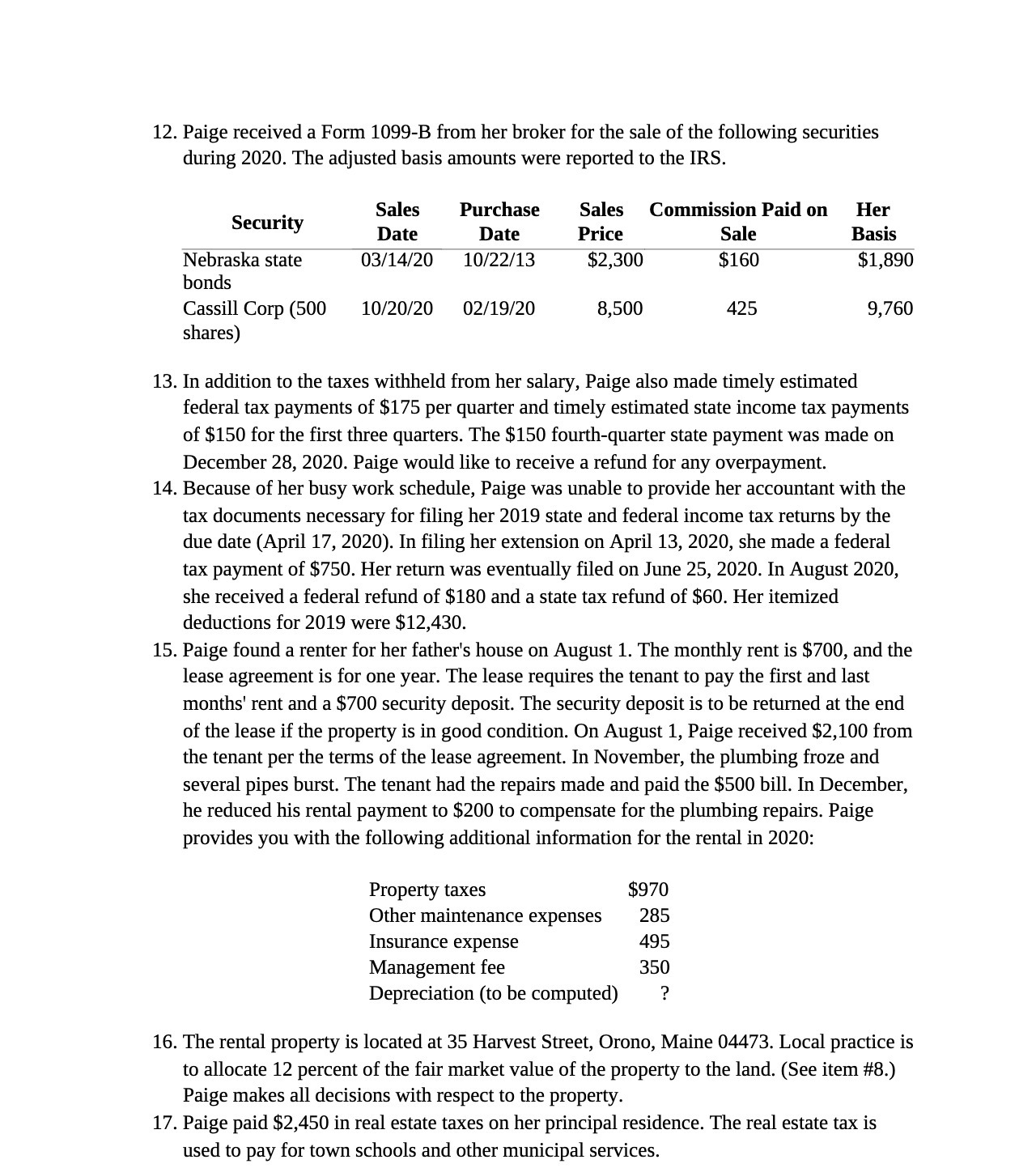

12. Paige received a Form 1099-B from her broker for the sale of the following securities during 2020. The adjusted basis amounts were reported

12. Paige received a Form 1099-B from her broker for the sale of the following securities during 2020. The adjusted basis amounts were reported to the IRS. Sales Date 03/14/20 Purchase Date 10/22/13 Security Nebraska state bonds Cassill Corp (500 10/20/20 02/19/20 shares) Sales Commission Paid on Price $2,300 8,500 Property taxes Other maintenance expenses Sale $160 Insurance expense Management fee Depreciation (to be computed) 425 $970 285 495 350 ? Her Basis 13. In addition to the taxes withheld from her salary, Paige also made timely estimated federal tax payments of $175 per quarter and timely estimated state income tax payments of $150 for the first three quarters. The $150 fourth-quarter state payment was made on December 28, 2020. Paige would like to receive a refund for any overpayment. 14. Because of her busy work schedule, Paige was unable to provide her accountant with the tax documents necessary for filing her 2019 state and federal income tax returns by the due date (April 17, 2020). In filing her extension on April 13, 2020, she made a federal tax payment of $750. Her return was eventually filed on June 25, 2020. In August 2020, she received a federal refund of $180 and a state tax refund of $60. Her itemized deductions for 2019 were $12,430. $1,890 15. Paige found a renter for her father's house on August 1. The monthly rent is $700, and the lease agreement is for one year. The lease requires the tenant to pay the first and last months' rent and a $700 security deposit. The security deposit is to be returned at the end of the lease if the property is in good condition. On August 1, Paige received $2,100 from the tenant per the terms of the lease agreement. In November, the plumbing froze and several pipes burst. The tenant had the repairs made and paid the $500 bill. In December, he reduced his rental payment to $200 to compensate for the plumbing repairs. Paige provides you with the following additional information for the rental in 2020: 9,760 16. The rental property located at 35 Harvest Street, Orono, Maine 04473. ocal practice to allocate 12 percent of the fair market value of the property to the land. (See item #8.) Paige makes all decisions with respect to the property. 17. Paige paid $2,450 in real estate taxes on her principal residence. The real estate tax is used to pay for town schools and other municipal services.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Break down Paiges taxrelated situations and address each one Form 1099B and Securities Sales Paige r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started