Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1&2 pls Question 1 (5 pts): Calculate the B/C ratio for the following cash flow estimates at a discount rate of 10% per year. Is

1&2 pls

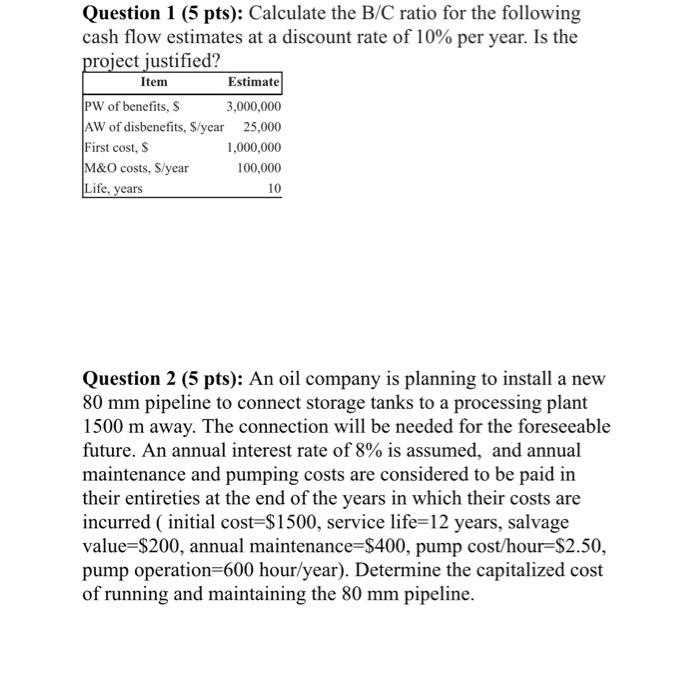

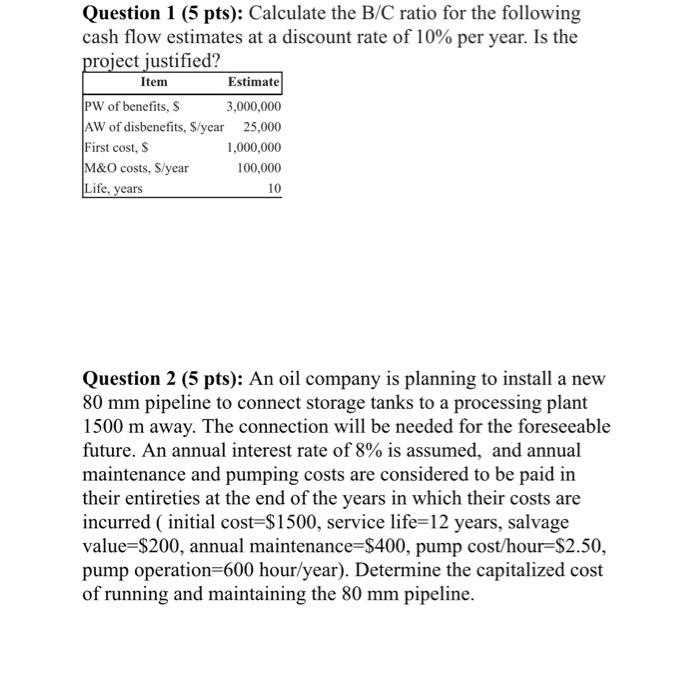

Question 1 (5 pts): Calculate the B/C ratio for the following cash flow estimates at a discount rate of 10% per year. Is the project justified? Item Estimate PW of benefits, s 3,000,000 AW of disbenefits, S/year 25,000 First cost, 1,000,000 M&O costs, S/year 100,000 Life, years 10 Question 2 (5 pts): An oil company is planning to install a new 80 mm pipeline to connect storage tanks to a processing plant 1500 m away. The connection will be needed for the foreseeable future. An annual interest rate of 8% is assumed, and annual maintenance and pumping costs are considered to be paid in their entireties at the end of the years in which their costs are incurred ( initial cost=$1500, service life=12 years, salvage value=$200, annual maintenance=$400, pump cost/hour=$2.50, pump operation=600 hour/year). Determine the capitalized cost of running and maintaining the 80 mm pipeline

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started