Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(12 points) The records for Ross Mississippi Tanning show this data for 2020: Insurance proceeds to the firm (due to the death of an insured

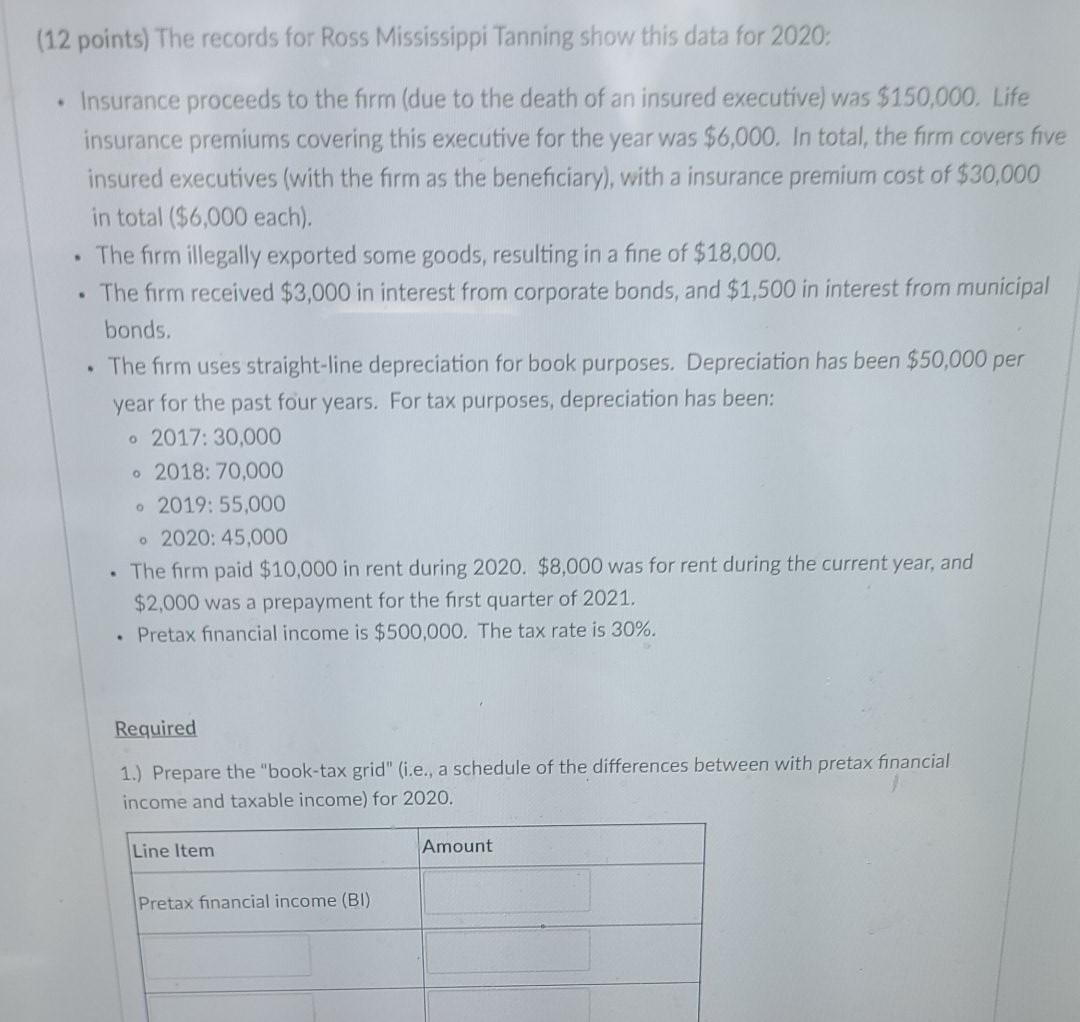

(12 points) The records for Ross Mississippi Tanning show this data for 2020: Insurance proceeds to the firm (due to the death of an insured executive) was $150,000. Life insurance premiums covering this executive for the year was $6,000. In total, the firm covers five insured executives (with the firm as the beneficiary), with a insurance premium cost of $30,000 in total ($6,000 each). The firm illegally exported some goods, resulting in a fine of $18,000, The firm received $3,000 in interest from corporate bonds, and $1,500 in interest from municipal bonds. The firm uses straight-line depreciation for book purposes. Depreciation has been $50,000 per year for the past four years. For tax purposes, depreciation has been: o 2017: 30,000 o 2018: 70,000 2019: 55,000 o 2020: 45,000 The firm paid $10,000 in rent during 2020. $8,000 was for rent during the current year, and $2,000 was a prepayment for the first quarter of 2021, Pretax financial income is $500,000. The tax rate is 30%. Required 1.) Prepare the "book-tax grid" (.e., a schedule of the differences between with pretax financial income and taxable income) for 2020. Line Item Amount Pretax financial income (BI) 1.) Prepare the "book-tax grid" i.e., a schedule of the differences between with pr income and taxable income) for 2020. Line Item Amount Pretax financial income (BI) Taxable income (TU)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started